The return of container shipping to the Red Sea is ramping up, but what does it mean for shippers negotiating new long term contract rates in 2026?

This blog focuses on the major fronthaul trades from Far East to North Europe and Mediterranean, which are directly impacted operationally by diversions away from Suez Canal and around Cape of Good Hope.

Where are long term rates right now compared to pre-Red Sea Crisis in 2023? What long term rates are shippers securing at the start of 2026? How could the situation play out for the remainder of the year?

Operational update:

There are signs 2026 will be the year that container shipping returns to the region at large.

For example, last week Maersk announced full loop transits via Suez Canal would return for its MECL1 service, with MAERSK DENVER completing a successful test voyage.

With Maersk being one of the more risk averse carriers this is a significant moment, not least because it also means they are seemingly pulling ahead of Gemini partner Hapag-Lloyd in returning to the Red Sea.

With other carriers including CMA CGM already announcing eastbound and westbound schedules returning to Suez Canal on services like the INDAMEX, the direction of travel is clear.

Do not take anything for granted however, especially after CMA CGM announced it is reversing its decision to return three Asia-Europe services to eastbound passages through the Suez Canal. Read more insight on that announcement here.

Xeneta data shows there is still a long way to go before ‘normality’ returns.

The monthly average offered capacity passing through the Suez Canal in 2023 on Asia-Europe services was 4.1m TEU (representing 64% of the 6.4 million total global TEU passing through Suez per month)

In 2025, that monthly average offered capacity was just 292K TEU (representing 44% of the total global 656K TEU passing through the Suez Canal).

What long term rates are being secured right now?

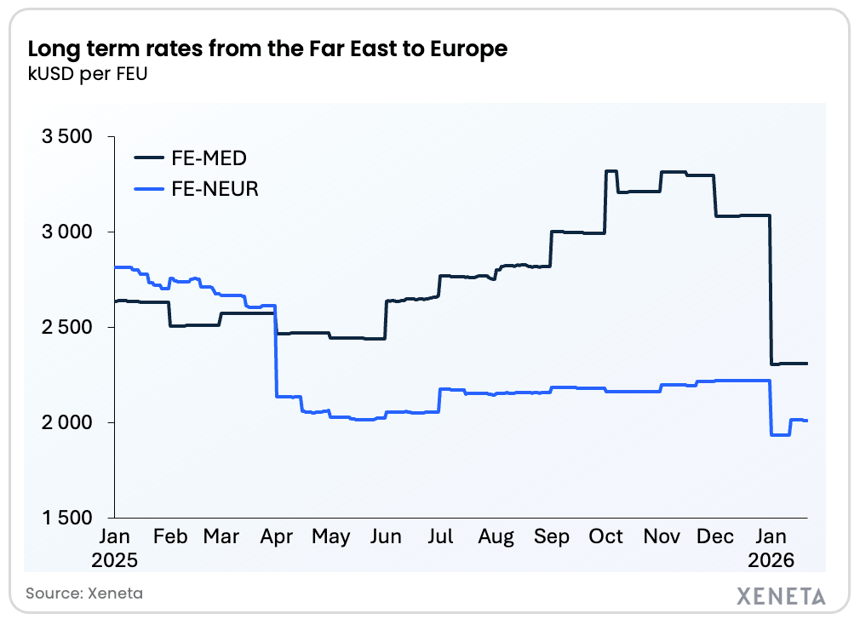

The start of 2026 has brought lower long term rates for shippers on the Europe-bound fronthauls from Far East.

Average long term rates entering validity in the last three months between the Far East and Mediterranean were down 25% on 21 January compared to the end of 2025 at USD 2 308 per FEU.

A smaller drop of 10% is found on the trade into North Europe, with average long term rates standing at USD 2 010 per FEU.

This means both trades have reached their lowest level since 2023, before the Red Sea crisis pushed rates up.

Perhaps a more powerful comparison in the minds of shippers is the development of long term rates since the beginning of 2025. This paints a different, though still positive picture for shippers, with average long term rates into North Europe down 27% compared to a year ago.

Into the Mediterranean, long term rates are down a lesser 12%.

Put comparisons across trades into context

The difference in the magnitude of decline across the two European fronthauls is a reflection of how long term rates developed on these trades in the second half of 2025.

At the start of 2025, average long term rates from the Far East to Mediterranean were USD 180 per FEU lower than into North Europe.

However, while rates into North Europe fell in April and remained low, those into the Mediterranean rose consistently between June and October.

This resulted in a reversal of the spread between these trades. By mid-October, long term rates into the Mediterranean were USD 1 160 per FEU higher than into North Europe. New 2026 contracts have seen this spread narrow to USD 300 per FEU.

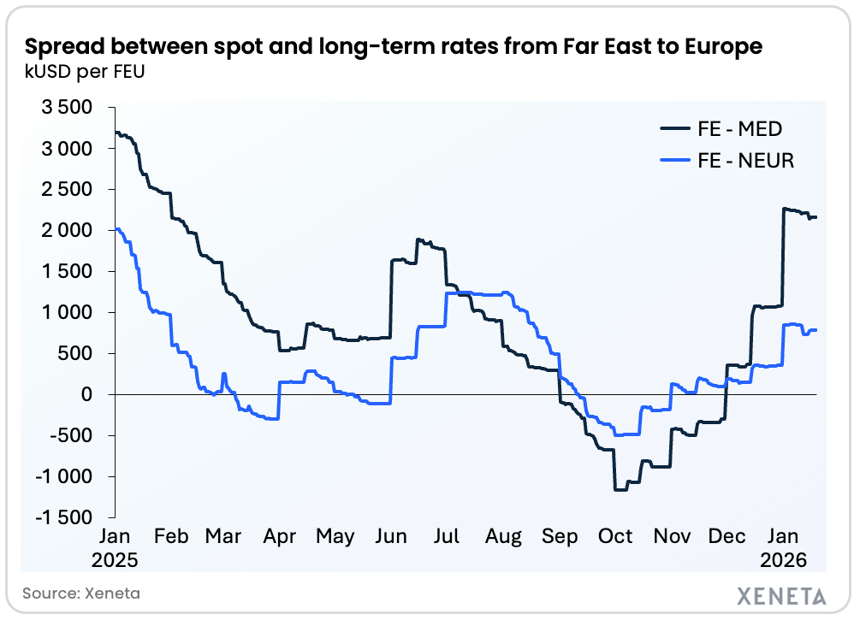

Spot-long spread

Putting long term rates into the context of the spot market is also key and, again, we see a reversal in the spread. At the end of 2025, average spot rates had fallen below long term rates. However, long term rates entering validity in Q1 2026 are coming in lower than the current spot market – particularly on the trade into Mediterranean.

On 21 January, average long term rates from the Far East to Mediterranean stood USD 2 200 per FEU lower than the average spot rate. Into North Europe, the spread is a lesser USD 770 per FEU.

Long term contracts are bellwether for market expectations

Long term contracts reflect expectations for the period they cover. A significant gap between spot and long rates on these trades clearly indicate expectations on both sides of the negotiating table for a weakening market in 2026.

It is therefore no surprise long term rates entering validity in Q1 are down compared the end of last year. If falling freight rates feels almost inevitable, carriers will be even hungrier to make up for it through market share and will offer shippers discounted long term rates to secure their volumes.

Shippers will, of course, be pleased to get these discounts, but it should come with a word of warning because they aren’t entirely risk free.

Balancing striking a lower long term rate against supply chain resilience

A USD 2 200 per FEU spread between spot and long rates is a sizeable gap, but in the face of overcapacity (even without a largescale return to Red Sea) shippers should not be at risk of cargo getting rolled.

However, this spread is still a high starting point. If there is another major disruption or Black Swan event causing spot rates to spike, cargo being moved against long term contacts could be vulnerable.

Supply chain risk is never far away. If there is a largescale return of container ships to the Red Sea, there could be an interim period of disruption and port congestion as global supply chains adjust to new schedules. This transition could take a number of months.

The geo-political situation also remains fragile. Only this week, Trump threatened (then rescinded) further tariffs against EU nations as a lever in efforts to gain control over Greenland.

Unpredictability and uncertainty are toxic for supply chains and the greater the spread between spot and long term rates, the more nervous shippers will become.

The Xeneta Carrier Comparison Scorecard is an important tool in selecting the right supplier, balancing cost with operational considerations such as historical reliability on the selected port pairs.

Expectations for the rest of the year is for a softening of the market, in part due to a return to the Red Sea freeing up large amounts of capacity, but it will not be plain sailing for shippers.

How can shippers tender freight in this situation?

The expectation of a largescale return to the Red Sea, in the absence of another black swan event, means falling freight rates.

Shippers should be aware that rates still have a long way to fall before they reach the levels of 2023, before container ships began avoiding the Suez Canal. Average long term rates from Far East to Mediterranean on 21 January were up 45% compared to the end of 2023. Into North Europe, long term rates were up an even bigger 58%.

It would be foolish for shippers to leave money on the table during new long term contact negotiations, but they should be mindful of risk. This risk applies in a falling and rising market.

If freight rates continue to fall, shippers need to make sure surcharges related to Red Sea are clearly defined and removed/reduced as the situation develops. They can also insert trigger points to request renegotiation if a Red Sea return gathers pace and the market drops well below their contracted rate.

Similarly, they can consider mechanisms to protect supply chains and prevent cargo being rolled in the event of another black swan. This could include index-linked contracts, with the rate a shipper pays tracking market movements against agreed parameters (this is obviously also beneficial for shippers in a falling market).

Shippers could go one step further and turn to exchange-traded futures. This enables shippers, forwarders and carriers to hedge container freight rate volatility with daily price transparency and central clearing security.

It is about more than freight rates

This blog makes clear that striking the right price is only half the battle. No matter whether you opt for the tried and tested RFQ, index-linked contracts or exchange-traded futures – shippers must have solid operational data, including schedule reliability and transit times.

Shippers need to be able to select the right carrier or freight forwarder – and then hold them to account for delivering the agreed service levels.

.png)

.png?width=387&name=ocean-container-shipping%20(1).png)