Xeneta for finance teams

Protect margin, safeguard cash flow, and build credible forecasts

Trusted by the world's biggest buyers & sellers of ocean and air freight

The reality facing today’s Finance leaders

Freight is no longer a stable, operational cost, it's become a material financial risk. Finance teams are under growing pressure to:

Explain sudden freight cost increases and build credible forecasts

Provide clear data-driven answers to boards and investors

Protect margin and cash flow in uncertain trade environments

Yet freight data is often fragmented, lagging, or anecdotal, making it difficult to separate market-driven change from internal inefficiencies.

This is where Xeneta provides clarity.

What success with Xeneta looks like for Finance Teams

Freight shifts from an unpredictable cost line to a measurable financial input.

Predictable freight costs built into credible forecasts

Clear explanations for spend variance

Fewer accrual surprises at month-end and quarter-close

Confidence when answering “what changed, and why?”

Data-driven explanations for board and investor reporting

How Finance Teams Use Xeneta

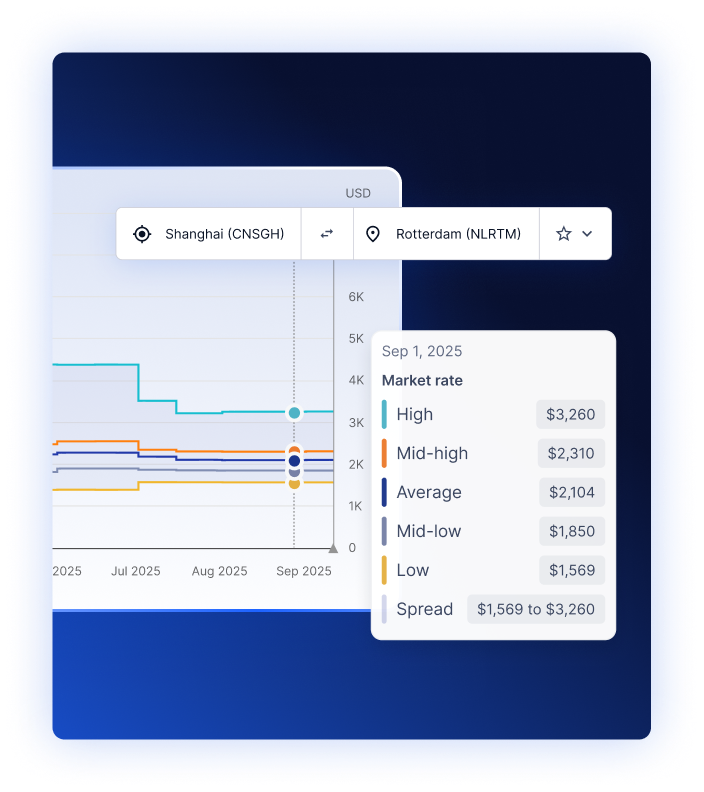

Understand why freight costs move

Xeneta provides cost and service-level market benchmarks across key trade lanes, enabling you to identify:

Effects of operational or sourcing decisions

Improve forecasting and accrual accuracy

With visibility into both historical and emerging freight rate trends, you can:

Reduce quarter-end surprises

Identify and manage financial risk

Identify, quantify, and manage freight-related risk, including:

Risk concentration by trade lane or region

Why Finance teams rely on Xeneta

Keeping your supply chain moving means constantly tracking carrier performance, securing capacity, and acting fast when reliability drops.

Real freight market data, no assumptions

Xeneta is built on anonymised, real transactional freight data, not indices, surveys, or estimates.

Independent, objective insight

Finance teams get a neutral view of the market, independent of third parties.

.png)

.jpg?width=387&name=Prospect_LIpost_WebinarAugust2025%20(6).jpg)

.png?width=387&name=Forecasting%20use%20case%20(2).png)