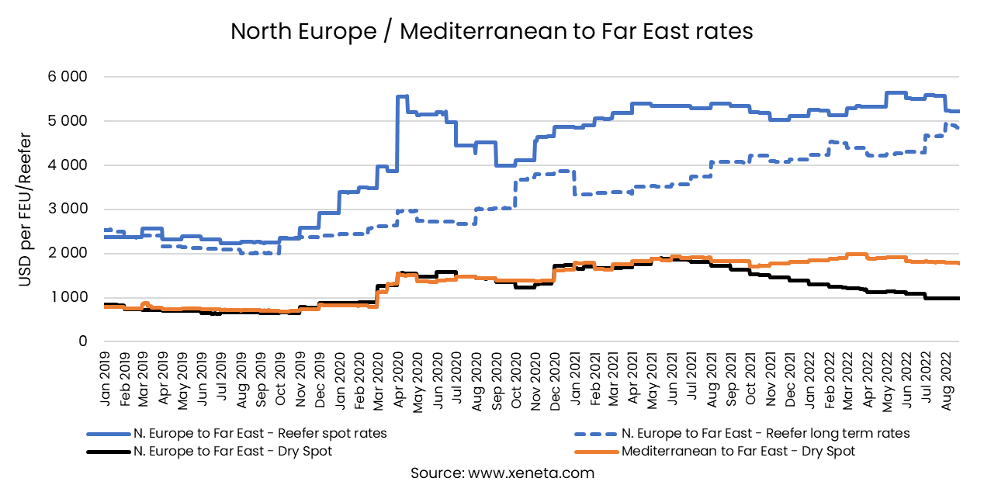

Dry standard FEU spot rates on major trade lanes are falling globally, and for the North Europe to Far East trade, it began back in June 2021. However, the long-term reefer rates are moving in the opposite direction on this trade.

On 23 August, the average spot rate for 40’ HC reefers is USD 5 230 and USD 980 per standard dry FEU on the North Europe to the Far East route. Despite the consistent fall in standard dry FEU since mid-2021 and 40’ HC reefer spot rates more recently, the long-term rates for the 40’ HC reefers are 14.5% higher than at the start of the year, standing at USD 4 850.

Read more below in Xeneta's weekly container rate update.

Reefer And Spot Rates From North Europe/Mediterranean To The Far East

With spot rates for standard dry FEUs and 40’ HC reefer containers moving in opposite directions, the spread between the two for North Europe to Far East trade lane has risen to USD 4 250 on 23 August. The average spread between these two rates in 2022 was approximately 2.5 times higher compared to the average spread in 2019.

However, long-term and spot rates for 40’ HC reefer rates are narrowing. For the first time since November 2019, the monthly average spread between the two rates is once again below USD 330 in August 2022. On 23 August, shippers could save USD 810 on the spot rate for a standard dry FEU on North Europe to Far East route compared to the USD 1 800 transport costs from the Mediterranean.

On 23 August, shippers could save USD 810 on the spot rate for a standard dry FEU on North Europe to Far East route compared to the USD 1 800 transport costs from the Mediterranean.

In the first six months of the year, 30.2% of reefer volumes exported from North Europe went to the Far East (Source: CTS). Reefer volumes on this trade route have grown by 1.5% YTD in June, whereas the total reefer exports from North Europe have dropped by -1.3% YTD in June.

Note:

The 'Weekly Container Rates Update' blog analysis is derived directly from the Xeneta platform, and in some instances, it may diverge from the public rates available on the XSI ®-C (Xeneta Shipping Index by Compass, xsi.xeneta.com. Both indices are based on the same Xeneta data set and data quality procedures; however, they differ in their aggregation methodologies.

Want to learn more?

The container market is no walk in the park. You need to have the latest rate and supply data to be able to plan and execute your freight procurement strategy quickly.

Xeneta's real-time and on-demand data is here to help you answer, "Am I paying the right freight rate to get my cargo where it needs to be?"

Sign up for our weekly 15-minute live group demo below and see Xeneta for yourself.

.png)