Christmas came early for global air cargo volumes in November with a further +5% year-on-year boost in demand adding to the seasonal cheer, but the industry’s e-commerce ‘growth engine’ of the past two years is slowing down, according to the latest market analysis from Xeneta.

While the demand outlook for the traditionally busiest time of year looked flat heading into the last four months of 2025, September and October’s demand levels were surprisingly robust at +3% and +4% year-on-year respectively. The continuation of this upward trend in November kept the market on track to deliver +4% growth for 2025 ahead of what looks set to be a more challenging year in 2026.

Capacity expansion in November broadly matched demand, although growth in supply over the year remained slower than the demand surge. This gradual rebalancing of demand and supply has still to show up significantly in lower global cargo spot rates, although November’s -5% decline year-on-year to USD 2.73 per kg was above the corresponding -3% drop recorded in October.

The disconnect suggests carriers are chasing market share at the expense of price discipline, squeezing yields in an already downbeat market. Month-on-month, global air cargo spot rates rose by +6% in November, a more subdued increase than the +9% recorded a year ago.

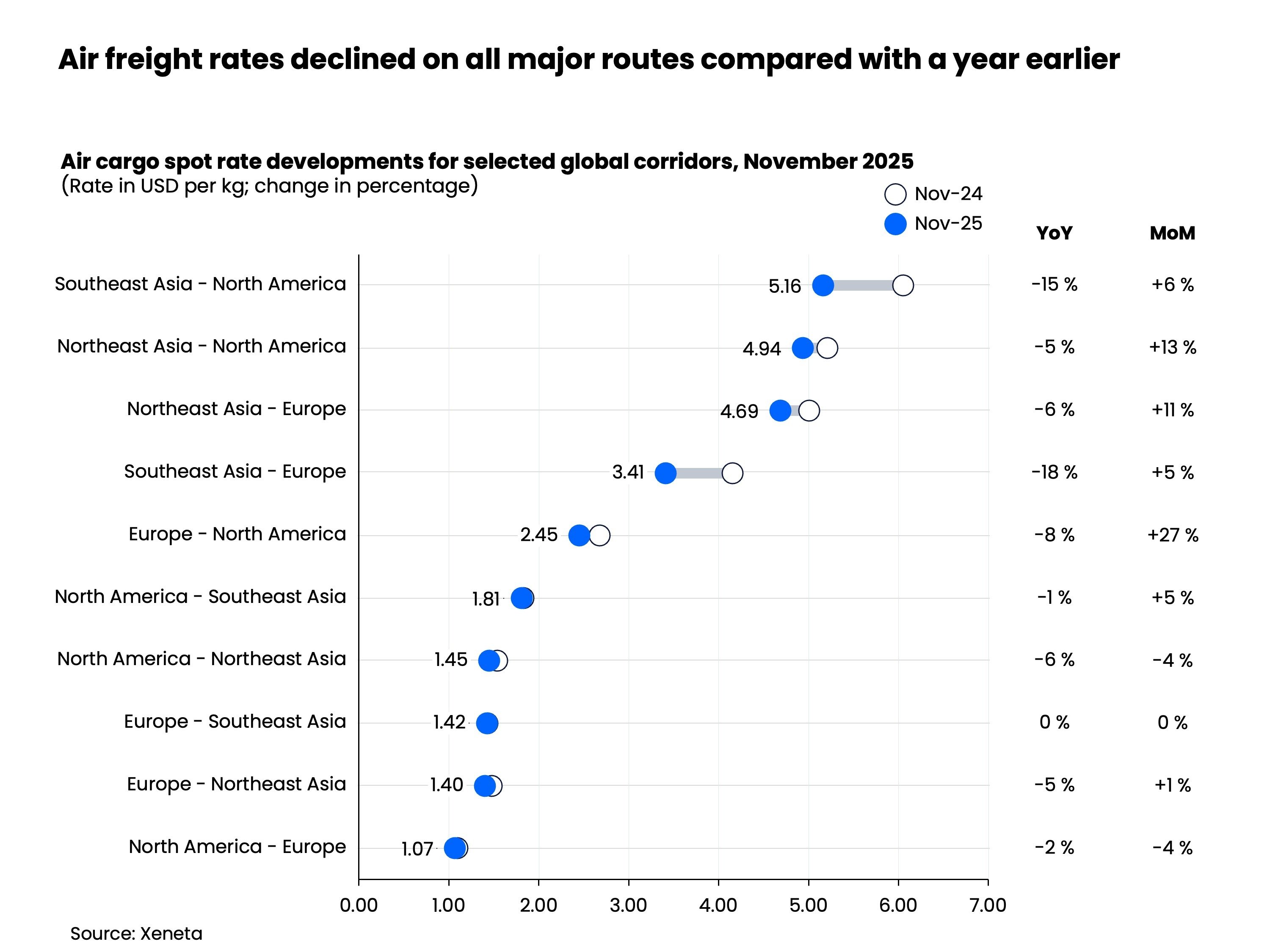

Air cargo spot rates lower across all major lanes

Across all major trade lanes, corridor-level air cargo spot rates in November were lower than a year earlier. The Europe–North America corridor registered its first year-on-year decline, with rates down -8%. This faster deceleration compares with the global average fall of -5%. Month-on-month, the corridor’s spot rate still rose a hefty +27% in November, but this was well below the +42% surge seen when carriers were shifting freighter capacity towards e-commerce-heavy corridors.

From Northeast Asia, the picture was more resilient. An agile redeployment of freighter capacity from the transpacific to the Asia–Europe market helped smooth overall air cargo yields across both trades. Inbound spot rates into North America and Europe from Northeast Asia recorded only single-digit year-on-year declines in November, while the Black Friday retail season drove double-digit month-on-month gains.

Out of Southeast Asia, by contrast, spot rates to both North America and Europe suffered double-digit declines. This likely reflects a combination of increased carrier capacity deployed to chase nearing 50% demand growth, particularly for inbound North America, and softer volumes linked to e-commerce de minimis restrictions affecting key transit hubs in Northeast Asia. All backhaul trades were subdued, with only modest rate movements, as capacity remained plentiful.

November market performance was certainly better than indicators suggested earlier in the year as many traditional shippers kept to their annual shipment cycles. Greater understanding of the realities of U.S. trade tariffs was also a factor, said Niall van de Wouw, Xeneta’s Chief Airfreight Officer.

Actual US tariffs not as bad as feared

“We are now seeing studies on the impact of actual implemented US tariffs and despite all the noise, the global average seems to be in the 10-12% range and not the 30, 40, 50 or 100% levels that were threatened in April. So, while the impact is there and it is unsettling for the airfreight market, it’s not as dramatic as was feared and is not yet hitting consumer demand to a concerning level,” he said.

This situation, however, is likely to change in 2026, van de Wouw added. “Some shippers have absorbed the increases and are yet to pass on these extra costs to consumers, but with stocks running low and inventory replenishment on the horizon, we expect to see more tariff impact on air cargo volumes next year. US consumer confidence is reportedly starting to fall, and higher prices next year are likely to exacerbate this sentiment.” he said.

While acknowledging the air cargo market is ‘busy getting through the quarter’ in Q4, latest data for the industry’s demand ‘growth engine’ of the past two years is concerning, van de Wouw said.

“For e-commerce and traditional air freight, this is by no means a peak season, but it’s a busier season than looked possible a few months ago. But after two years in which the growth of air cargo has been so reliant on e-commerce, there is now a question mark over demand for cargo capacity in the coming year. I doubt the global economic concerns will greatly impact the likes of Temu because of the ability of China’s factories to produce stuff at a very low cost for consumers willing to buy them, but the big question for the air cargo industry is whether China’s e-commerce volumes to the world can keep on growing as they have been?

“The indicators suggest it will be very difficult to maintain - and we’re already starting to pick up on flattish growth of ecommerce year-on -year, which is not something we’ve seen in the last 2 years,” he continued.

Flat growth for China’s cross-border e-commerce

Van de Wouw highlighted warning signs for e-commerce volumes heading into 2026. “After 27 straight months of near +40% year-on-year growth, China’s total cross-border e-commerce sales were flat in October, based on the latest market data from China Customs,” he said. “Even robust expansion from China to Europe - up +47% in October - was offset by declines to the rest of Asia, down -3%, and a dramatic -51% drop in e-commerce shipment volumes to the US in this new post de minis environment.”

Despite strong growth in October, e-commerce volumes into Europe could also be impacted by increasing regulation, with the EU set to introduce its own accelerated de-minimis reform in 2026 to close loopholes exploited by low-value shipments.

The EU handled around 4.6 billion such parcels in 2024, with up to 65% believed to be undervalued. 91% of all e-commerce shipments to the EU valued under EUR 150 came from China. In a similar way to the US in 2025, the EU is now aiming to curb undervaluation and level the playing field for domestic retailers.

While the rollout of an EU data hub for e-commerce will not be ready until 2028, a temporary solution is expected in 2026. Earlier proposals included a flat EUR 2 handling fee for shipments sent directly to consumers and EUR 0.5 for warehouse-handled items. Nonetheless, such measures are unlikely to materially suppress demand, considering their marginal impact on cost in comparison to alternatives for consumers.

A greater impact on air cargo demand would come from any changes that slow down the supply chain or introduce hefty extra fees, van de Wouw stated.

Modest low single-digit demand growth in 2026

The air cargo industry will head into the New Year with expectations of only modest, low single digit growth for the year ahead, van de Wouw said.

“We expect supply to grow more than demand in 2026, and that will have an impact on rates. I also do not think low, single-digit demand growth will satisfy the appetite and ambition of freight forwarders, especially the listed ones that need to grow much faster in the market. So, the only way to do that is to grab market share, which would place a further downward pressure on rates in favour of shippers.

“Shippers are asking us what we think is going to happen and, interestingly, we’re also starting to see airlines coming to Xeneta to get a better understanding of shipper rates to validate what forwarders are telling them. Right now, the consensus is the market will do well to achieve demand growth of 2-3% in 2026,” he added.

Ends

.png)

%20(1).png?width=387&name=Welcome_Bjorn_907x744px%20(1)%20(1).png)