March 3, 2016 – Oslo, Norway -- Xeneta, the leading price benchmarking and market intelligence big data platform for containerized ocean freight, today announced that its data confirms a 72% drop in the market average price of short-term contracted rates from January 1 – March 1, 2016 for the China East main ports to Northern Europe main ports and a 50% drop in the China East main ports to North America West main ports trading routes.

China East Main – Northern Europe Main Ports

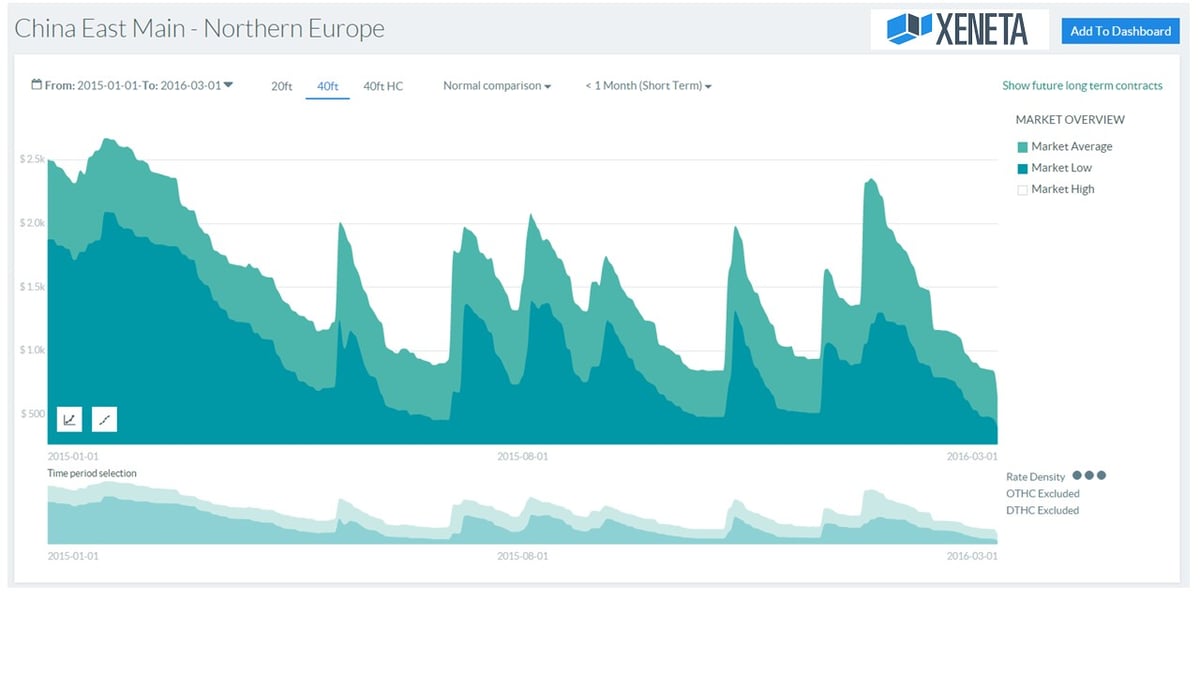

On the China East to Northern Europe ports, for a 40’ container, the Xeneta platform showed a continued steady decline in the spot market for the first two months of Q1 2016. The market average price on January 1, 2016 was at $2324 (market low = $1056); February 1, 2016, $1168 (market low = $793); March 1, 2016, $636 (market low = $398).

Figure I. Data source: Xeneta Platform. Short-term rates market average; Jan 1, 2016 – March 1, 2016; China East Main ports – Northern Europe Main Ports.

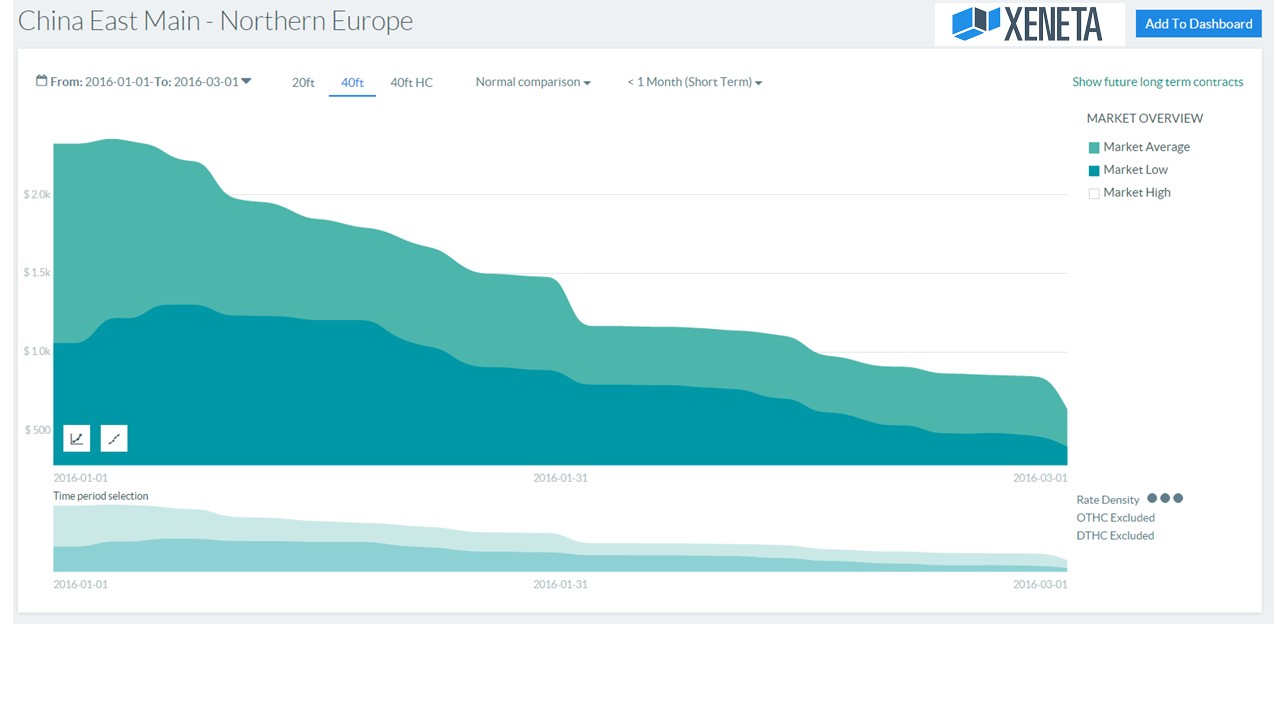

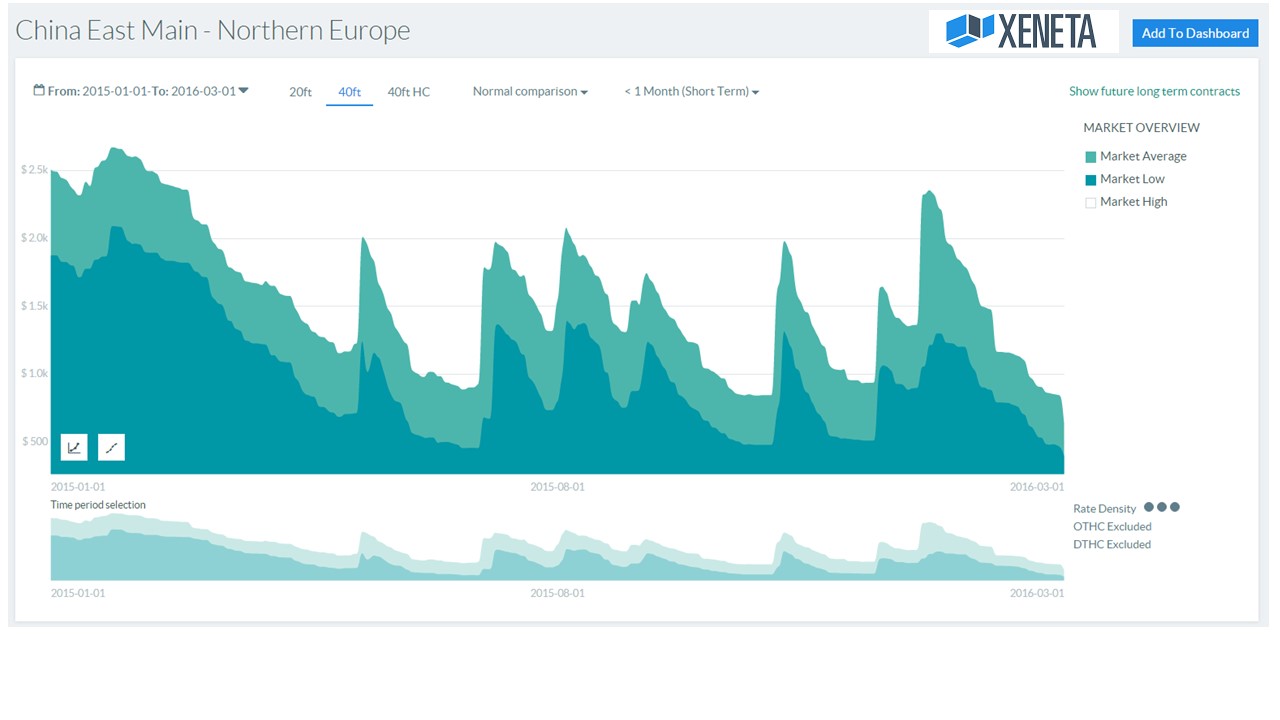

When comparing Jan 1- March 1, Q1 2015 to Jan 1- March 1, Q1 2016- the market average rate for short-term contracts was $2484 (market low price = $1879) and $1462 (market low price = $879) respectively, indicating a 41% drop in the market average price and a significant 53% drop in the market low price.

Figure II. Data source: Xeneta Platform. Short-term rates market average and market low; Jan 1, 2015 – March 1, 2016; China East Main ports – Northern Europe Main Ports

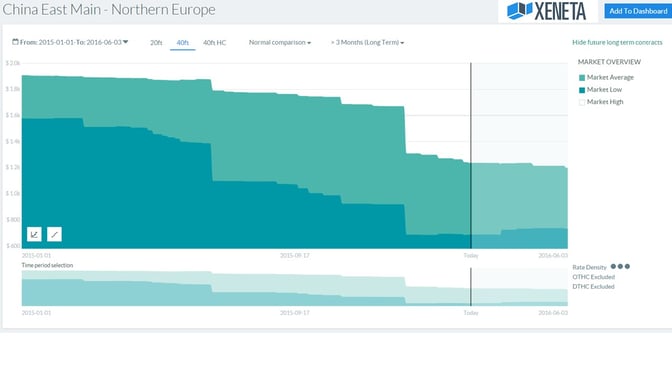

Long-term contracts on the same trade route are not seeing much of an upturn either. The Xeneta data shows market average price for long-term contracts on January 2015 – March 1, 2015 at $1903 and Jan 1 – March 1, 2016 at $1284, a 33% decline.

Further intelligence into future long-term rates provided by the Xeneta platform, clearly confirms the steady hold on the decline nearing the end of H1, with a market average price of $1199 and market low price of $733 in early June.

As new long-term rates were contracted in early 2016, the Xeneta data also shows a sharp decline of about $300 from December 2015 to January 2016, clearly indicating the negotiated long-terms contracts coming in at a much lower price than in late 2015.

Figure III. Data source: Xeneta Platform. 40’ container. Long-term rates market average; Jan 1, 2015 – June 2, 2016; China East Main ports – Northern Europe Main Ports

China East Main– North America West Ports

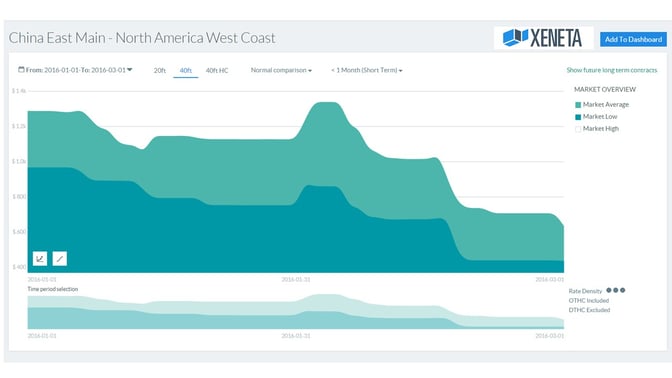

On the China East to North America West routes, for a 40’ container, the Xeneta platform showed a continued steady decline in the spot market for the first two months of Q1 2016. The market average price on January 1, 2016 was at $1288 (market low = $967); February 1, 2016, $1234 (market low = $881); March 1, 2016, $634 (market low = $436).

The average prices held pretty steady for the first part of the quarter. They then picked up pre-Chinese New Year (peak in the middle of the graph), as expected with a slight decline during the Chinese New Year and then a big slump post-CNY. Altogether, Xeneta shows a 50% decline in rates from January 1 – March 1, 2016.

Figure IV. Data source: Xeneta Platform. Short-term rates market average; Jan 1, 2016 – March 1, 2016; China East Main ports – North America West ports.

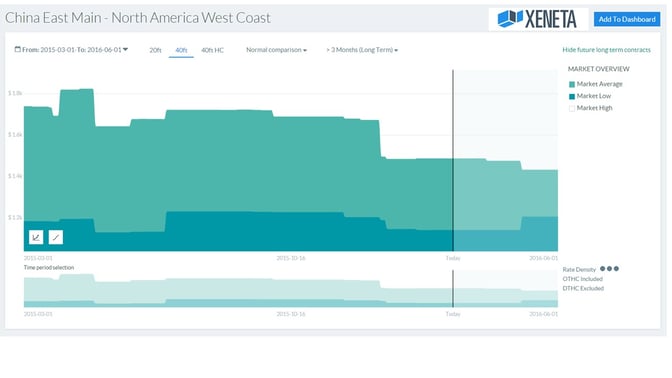

China East – North America West ports future long-term rates provided by the Xeneta platform, also confirms the steady hold on the decline nearing the end of H1 2016, with the market average price at $1487 and market low at $1187. A tiny dip will happen at the end of April, early May, bringing the market average price in early June to $1432 while the market low will be at around $1205.

Figure V. Data source: Xeneta Platform. 40’ container. Long-term rates market average; Jan 1, 2015 – June 2, 2016; China East Main ports – Los Angeles Area Ports

“As many North American-based companies enter their bidding process, it will be interesting to see how the new re-negotiated long-term data for the U.S market will impact the trend. We expect to see the same pattern for the Far East Asia – North America West routes as we have seen for the China Main East – Northern Europe routes where the short-term rate decline is later on reflected in the drop in long-term rates,” says Patrik Berglund, CEO, Xeneta.

About Xeneta

Xeneta is the leading ocean freight price comparison and shipping market watch index transforming the shipping and logistics industry. Xeneta’s easy-to-use yet powerful reporting and analytics platform provides shippers and freight forwarders the software data they need to compare their shipping prices against the world's largest database of contracted rates – reporting live on market average and low/high movements. Xeneta’s shipping indexes comprises of over 11 million contracted rates and covers over 60,000 global trade routes enabling informed decisions with actionable intelligence optimizing companies’ logistics procurement. Xeneta is a privately held company and is headquartered in Oslo, Norway. To learn more, please visit www.xeneta.com.

To see Xeneta in action have a look at our Webinar: How to Benchmark Your Container Freight Rates & Change Your Logistics Business.

Editorial Contact

Katherine Barrios

CMO

Katherine.Barrios(at)xeneta.com

+47 95 14 64 14

.png)

-1.jpg)