May came to a close and here is Xeneta's wrap up of last month's spot market and long-term ocean frieght rates for the Far East Asia Main Ports to North Europe and to U.S West Coast Main ports. May sees some declines, but overall the market is picking up as we enter Q3. A good question to ask is whether it is wise for shippers to bathe in the current low prices and risk what can happen to their cargo when the rates continue to increase.

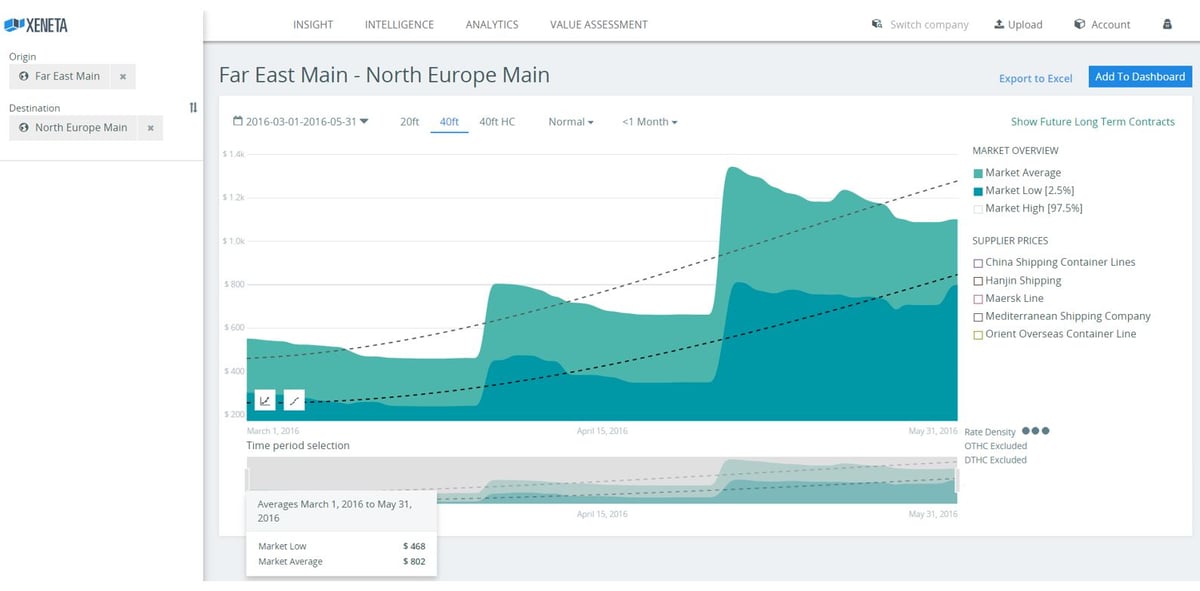

Short-Term Rates | Far East Asia Main - N.Europe Main Ports (40' container)

From May 1 - May 31, 2016 the spot market rates for the F. East Asia Main - N.Europe Main lane saw a 17% drop with May 31st's market average rate closing at $1102 for a 40' container, as recorded in the Xeneta platform. As mentioned in my post earlier in May, the May 1st GRI did cause a spike in rates. However, this was short lived where the slight drop after May 2 came just 2-3 days later.

[Click to enlarge]

Data Source: Xeneta Platform. Far East Asia Main ports - North Europe Main ports. May 1 - 31, 2016 | 40' container | Short term rates.

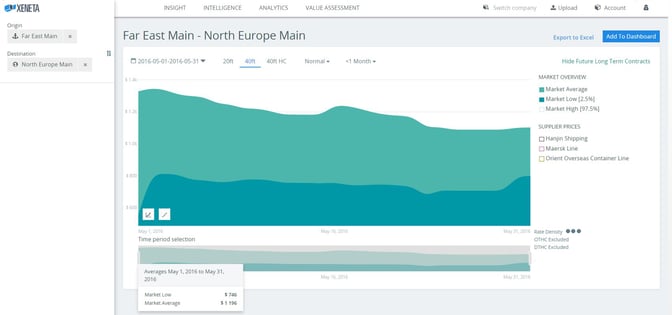

BUT, if we look back to March, when the market was down in the gutter and the market average price was $552, things have definitely improved. As of May 31st, the market average price has increased 99% since March 1. Indeed, the GRIs have had some effect and the market is getting healthier.

[Click to enlarge]

Data Source: Xeneta Platform. Far East Asia Main ports - North Europe Main ports. March 1 - May, 31, 2016 | 40' container | Short term rates.

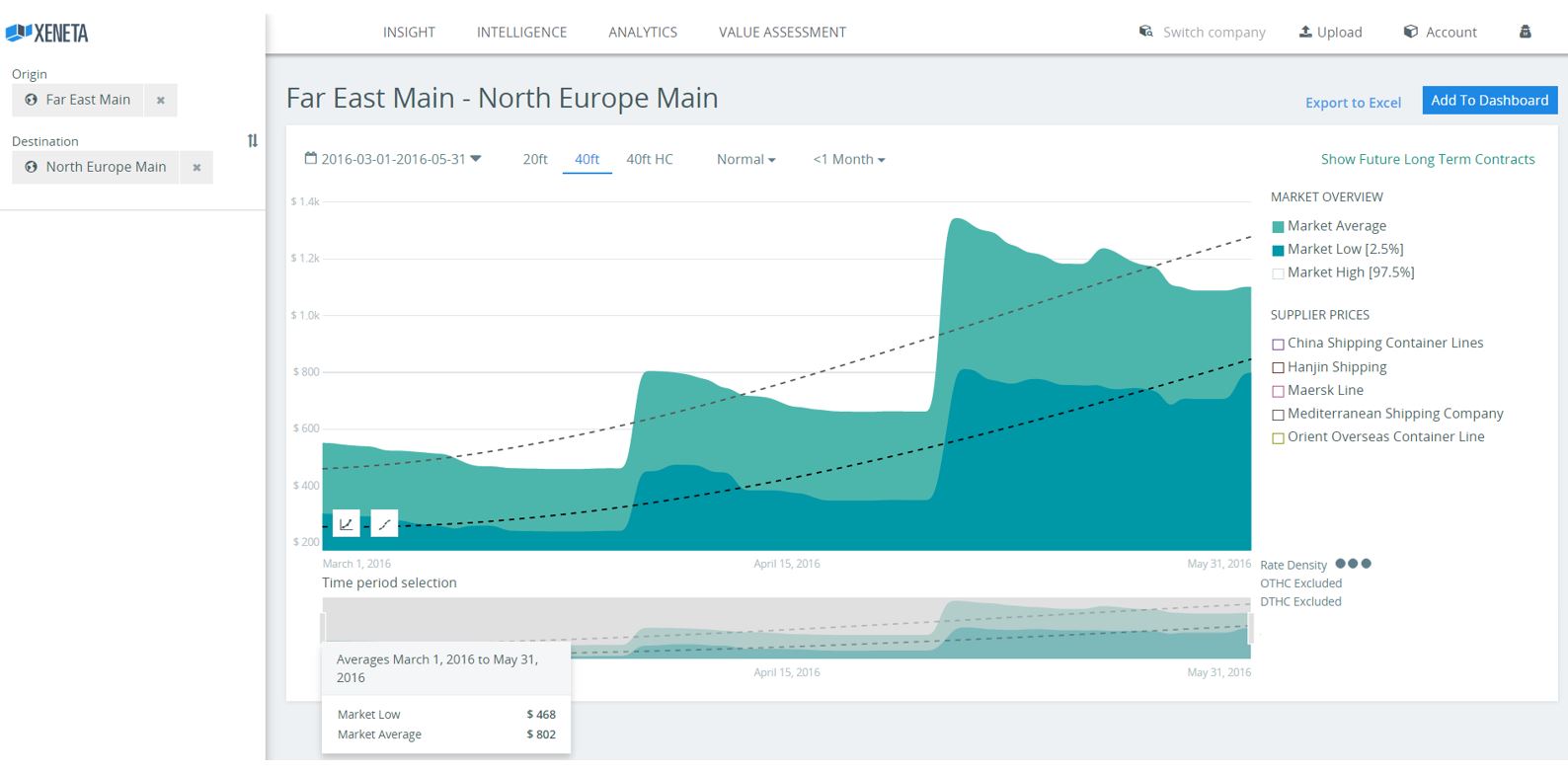

Long-term Rates | Far East Asia Main - N. Europe Main Ports (40' container)

Long term rates contracted for May held steady the entire month with a market average price of $951 and a market low of $470.

Looking further into the Xeneta data and future long-term rates, as stated earlier, early July will see a spike in long-term rates to $1014. That is an increase of about 7% from the market average seen on May 31st.

Going into the end of Q3, we can clearly see that a tiny jump in the end of July, with the market average price for long-term rates holding at $1015 until early September.

[Click to enlarge]

Data Source: Xeneta Platform. Far East Asia Main ports - North Europe Main ports. Apr 1 - Sep, 2016 | 40' container | Long term rates & future rates.

Short-term Rates | Far East Asia Main - N. America West Coast Ports (40' container)

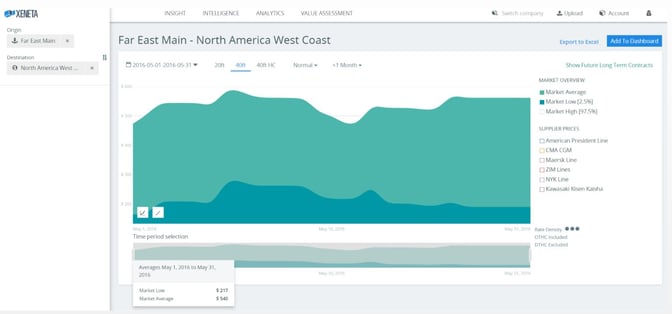

On the flip side, the second most popular lane, Far East Asia Main to U.S West Coast saw an increase of 18.5% on the market average price going from $474 (May 1) to $562 (May 31). The market low price was at $165 (May 1) and closed May at $190 (May 31).

[Click to enlarge]

Data Source: Xeneta Platform. Far East Asia Main ports - N.America West Coast Main ports. May 1 - 31, 2016 | 40' container | Short-term rates.

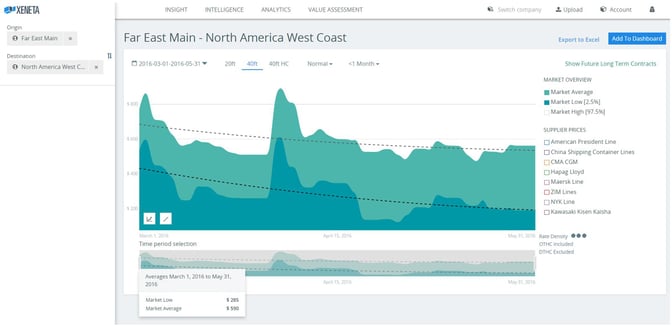

However, looking at the lane's overall performance from March to May, the market has been on a slight decline as illustrated below. The market average price has dropped 27% with March 1st at $772 and May 31st at $562.

[Click to enlarge]

Data Source: Xeneta Platform. Far East Asia Main ports - N.America West Coast Main ports. March 1 - May 31, 2016 | 40' container | Short-term rates.

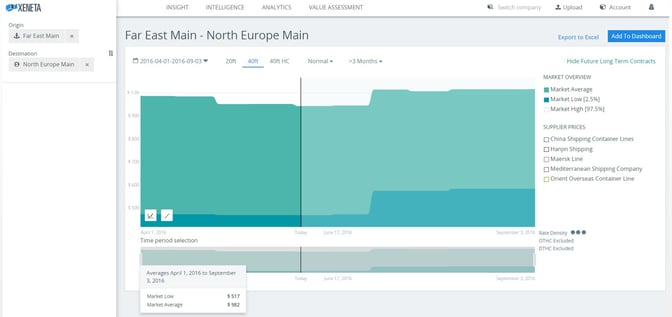

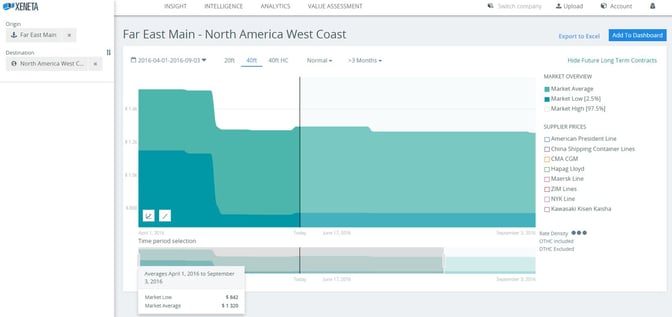

Long-term Rates | Far East Asia Main - N.America West Coast Ports (40' container)

Looking at the historical data in Xeneta for Far East Asia Main to N. America West Coast Main, long-term rates contracted for April and May dropped 14% on the market average rate going from $1519 (April 1) to $1293 (May 1). They held steady at $1272 through the rest of May, and saw a tiny jump the first few days of June bumping to $1295. While, the market low price held at $763 for all of May.

Looking at future long-term rates in Xeneta, we see the market average prices, June through early Q3, will be at $1293 and the market low at $773.

[Click to enlarge]

Data Source: Xeneta Platform. Far East Asia Main ports - N. America West Coast Main ports. April 1 - September 3, 2016 | 40' container | Long-term rates.

Short-Term Rates Reviving Before Long-Term Rates

Based on the historical data we see in the Xeneta platform, short-term rates always are the ones to go up or down first, then the long-term rates follow.

At the moment, the long-term contracts don't seem to be yet following the rally seen with the short-term rates evident in the past 2 1/2 months. This does become worrisome for some. Long-term contracts still at low levels will impose a risk for rolling cargo when the long-term rates do indeed start enjoying the current rally felt in the spot market.

Shipping lines certainly will have an incentive to take on board boxes negotiated at higher prices, which brings them the biggest return. Carriers will most likley choose the higher paying boxes, regardless.

So, how much does relationship matter here? What are your thoughts?

.png)

-1.jpg)