OSLO, Norway – 16 February 2024

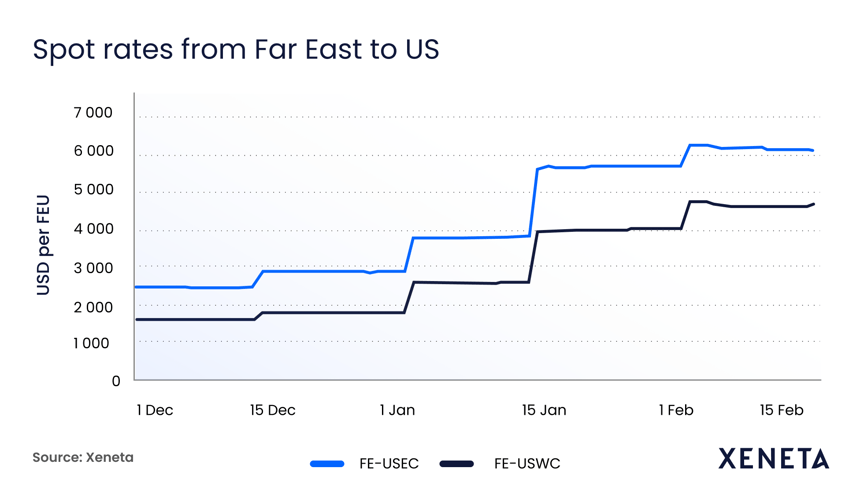

The Red Sea crisis sent ocean freight rates from the Far East to US spiralling by more than 150%, but there appears to be some relief on the horizon for shippers.

The latest data released by Xeneta indicates a peak may have been reached after spot rates from the Far East into the US declined slightly since the last round of General Rate Increases (GRIs) were implemented at the start of February.

Into the US East Coast, rates have fallen slightly from USD 6 260 per FEU (40ft container) on 1 February to USD 6 100 on 15 February. Rates into the West Coast have declined from USD 4730 per FEU to USD 4680 in the same period.

Xeneta – the leading provider of ocean and air freight rate benchmarking and intelligence – calls upon more than 400 million crowdsourced data points and early indications suggest a further softening of the market in the next 10 days.

While a weakening market will be welcomed by US importers, the impact of the crisis is far from over with spot rates remaining 145% up into the US East Coast compared to 14 December and 185% into the US West Coast.

Emily Stausbøll, Xeneta Market Analyst, said: “Unlike during Covid-19 when disruption continued to wreak havoc, shippers and carriers now know what they are dealing with in terms of ships being diverted around Africa to avoid the Suez Canal.

“Rates are still elevated so the impact of this crisis is far from over - and the situation can still change at any moment - but perhaps some semblance of order has been restored.”

Crunch time for the market ahead of contract negotiations with US shippers.

The TPM24 industry summit taking place in Long Beach California at the start of March will act as the starting gun for negotiations between ocean freight carriers and US shippers for new contracts, so the next few weeks are crunch time for the market.

Stausbøll said: “Carriers will be doing everything within their power to keep rates elevated for when they enter negotiations with US shippers for new contracts.

“However, Xeneta data suggests this will prove difficult and it is likely rates will decrease further in the next 10 days, as we have already seen happen on trades from the Far East into Europe.

“If carriers are looking for reasons for optimism, it may be found in the ending of Lunar New Year celebrations, which will see an increase in volumes out of the Far East and the potential for upward pressure on rates.

“Either way, the next few weeks is crunch time for both ocean freight carriers and shippers and could define their fortunes for the rest of 2024.”

About Xeneta

Xeneta is the leading ocean and air freight rate benchmarking and market analytics platform transforming the shipping and logistics industry. Xeneta’s powerful reporting and analytics platform provides liner-shipping stakeholders the data they need to understand current and historical market behavior – reporting live on market average and low/high movements for both short and long-term contracts.

Xeneta’s data is comprised of over 400 million contracted container and air freight rates and covers over 160,000 global ocean trade routes and over 58,000 airport-airport connections. Xeneta is a privately held company with headquarters in Oslo, Norway and regional offices in New Jersey, US and Hamburg.

To learn more, please visit www.xeneta.com

%201.png)

.png.webp?width=1053&height=629&name=Blog%20Banners%202022%20(2).png.webp)