This update uses ocean container shipping data and intelligence from Xeneta and eeSea.

Peter Sand, Xeneta Chief Analyst:

Far East to Europe

“Average departure delays on trades from Far East to Europe reached 12.5 days in the week ending 14 December 2025 – the second highest level in three years. This pushed many departures expected for last week into this week, which clearly has knock-on disruption for supply chains.

“These delays are not caused by carriers blanking sailings - it's about port congestion and operational inefficiencies. Shippers need to be on top of this and manage the risk of congestion and the potential for containers arriving later than expected.

“If shippers are looking to move back to just-in-time supply chains in 2026 after a just-in-case approach during the tariff chaos of 2025, they need to manage this risk and ask carriers to deliver on their promises.”

Far East to US West Coast

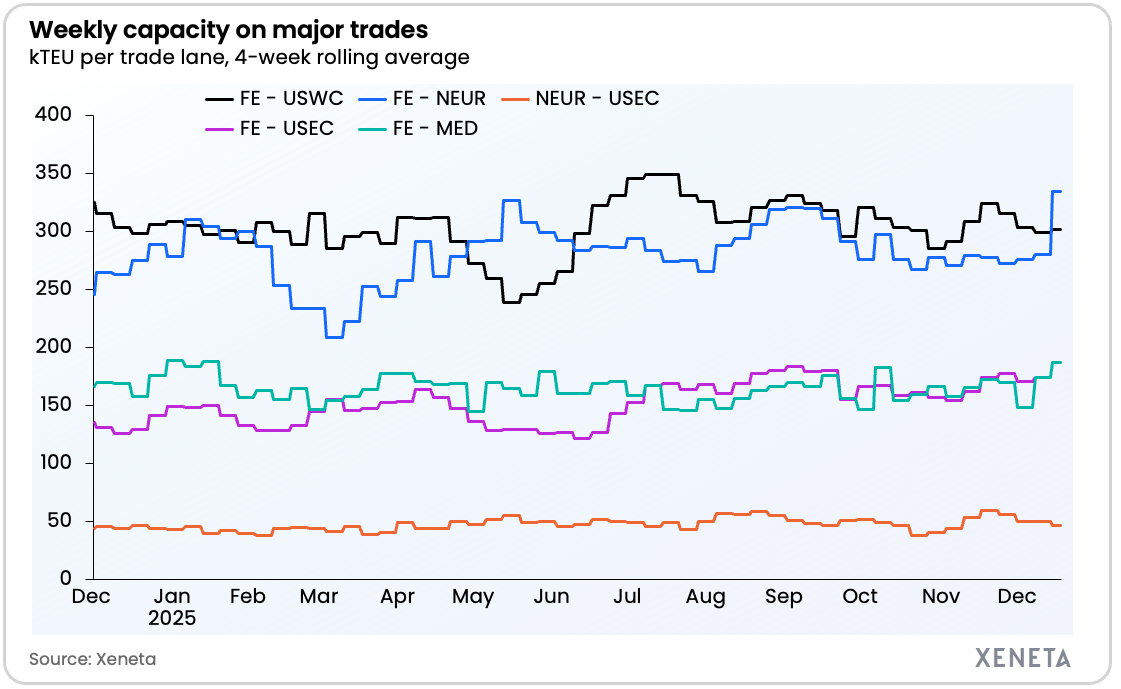

“Capacity offered from Far East to US West Coast is expected to increase 10.4% in January compared to December, with blanked capacity decreasing 48.5%.

“It’s a different story into the US East Coast with 162,219 TEU of blanked capacity announced for the next eight weeks.

“There is a distinct difference in the services offered into US East Coast and US West Coast and the way carriers are managing capacity. This is motivated by underlying stronger demand into the US East Coast, while the US West Coast being more sensitive to US-China geo-political tensions.”

Data highlights

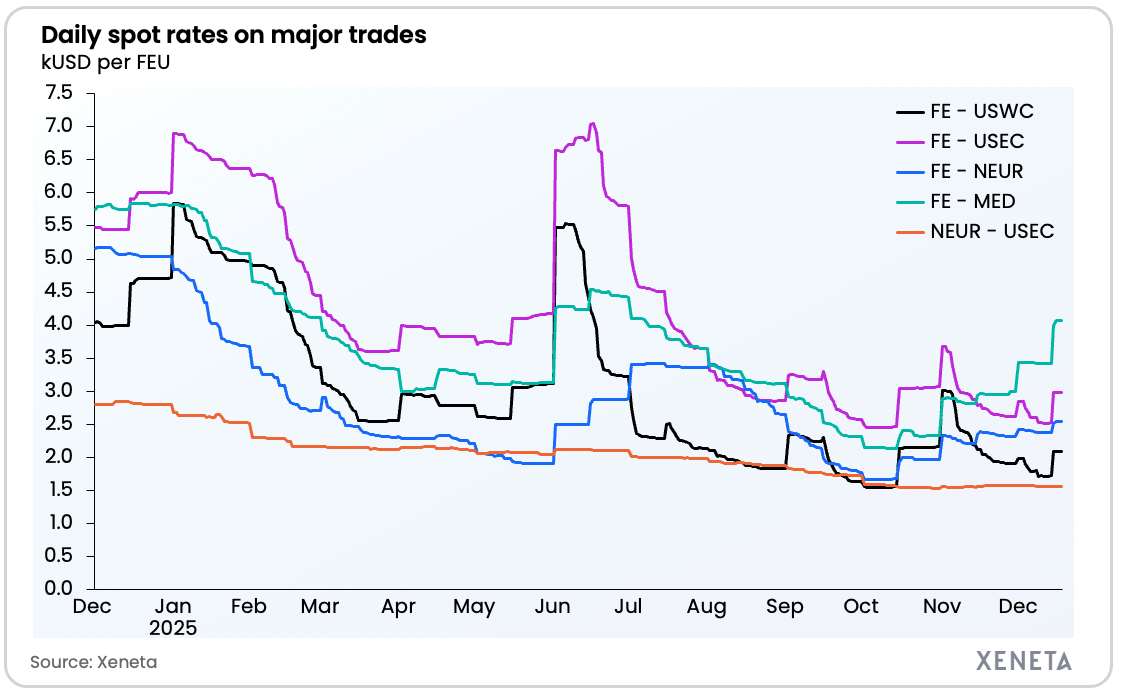

Market average spot rates – 18 December 2025

Far East to US West Coast: USD 2,086 per FEU (40ft container)

Far East to US East Coast: USD 2,982 per FEU

Far East to North Europe: USD 2,545 per FEU

Far East to Mediterranean: USD 4,072 per FEU

North Europe to US East Coast: USD 1,566 per FEU

Offered capacity (4-week rolling average) – w/c 15 December 2025

Far East to US West Coast: +0.9% from a week ago

Far East to US East Coast: +7.2% from a week ago*

Far East to North Europe: +19.2% from a week ago*

Far East to Mediterranean: +7.4% from a week ago**

North Europe to US East Coast: –6.2% from a week ago

* Many departure delays seen last week, pushed offered capacity into this week instead

** Several departure delays seen last week, pushed offered capacity into this week instead

FAR EAST to US WEST COAST

- Week-on-week:

Spot rates up +$366 (+21.3%) to $2,086.

Capacity broadly steady, up +2,594 TEU (+0.9%) to 301,668 TEU. - Month-on-month:

Rates modestly higher +$45 (+2.2%).

Capacity down -22,734 TEU (-7.0%) - Since 1 Dec 2025:

Rates up +$100 (+5.0%).

Capacity slightly down -1,296 TEU (-0.4%).

FAR EAST to US EAST COAST

Rates & capacity

- Week-on-week:

Rates up +$463 (+18.4%) to $2,982.

Capacity up +12,556 TEU (+7.2%) to 186,898 TEU. - Month-on-month:

Rates up +$236 (+8.6%).

Capacity up +12,913 TEU (+7.4%). - Since 1 Dec 2025:

Rates up +$136 (+4.8%).

Capacity up +15,792 TEU (+9.2%).

FAR EAST to NORTH EUROPE

- Week-on-week:

Rates up +$171 (+7.2%) to $2,545.

Capacity surged +53,949 TEU (+19.2%) to 334,289 TEU. - Month-on-month:

Rates up +$170 (+7.2%).

Capacity up +56,720 TEU (+20.4%). - Since 1 Dec 2025:

Rates up +$122 (+5.0%).

Capacity up +58,742 TEU (+21.3%).

FAR EAST to MEDITERRANEAN

- Week-on-week:

Rates up +$647 (+18.9%) to $4,072.

Capacity up +12,849 TEU (+7.4%) to 187,020 TEU. - Month-on-month:

Rates up sharply +$1,121 (+38.0%).

Capacity up +14,874 TEU (+8.6%). - Since 1 Dec 2025:

Rates up +$632 (+18.4%).

Capacity up +38,766 TEU (+26.1%).

NORTH EUROPE to US EAST COAST

- Week-on-week:

Rates flat ($1,566, ~0% WoW).

Capacity down -3,081 TEU (-6.2%) to 46,773 TEU. - Month-on-month:

Rates slightly lower -$19 (-1.2%).

Capacity down materially -13,047 TEU (-21.8%). - Since 1 Dec 2025:

Rates slightly lower -$18 (-1.1%).

Capacity down -3,449 TEU (-6.9%).

Ends

Journalists can be added to the distribution list for Xeneta Weekly Market Updates by emailing press@xeneta.com.

Xeneta’s Media Contacts

Philip Hennessey

Director of External Communications, Xeneta

+44 7830 021808

press@xeneta.com

%201.png)