This update uses ocean container shipping data and intelligence from Xeneta and eeSea.

Peter Sand, Xeneta Chief Analyst

“Looking at the fundamentals of supply and demand on major fronthaul trades right now and it doesn’t stack up, so something has to give. Spot rates are relatively flat even though offered capacity is going up, particularly from Far East to US East Coast, North Europe and Mediterranean.

“Carriers will try to push further rate increases in mid-December - and we may see a slight uptick - but this won’t last for too long due to the downward pressure from increasing supply. The impact of higher supply will be seen most acutely on US fronthauls where demand isn’t as strong compared to trades into Europe.

“There are increasing signs of a gradual return of container ships to the Red Sea region, highlighted most recently by CMA CGM INDAMEX service now transiting Suez Canal on fronthaul and backhauls voyages. This will only add to the downwards pressure on rates, particularly on trades from Far East to US East Coast and Europe, which transit the Suez Canal.”

Data highlights

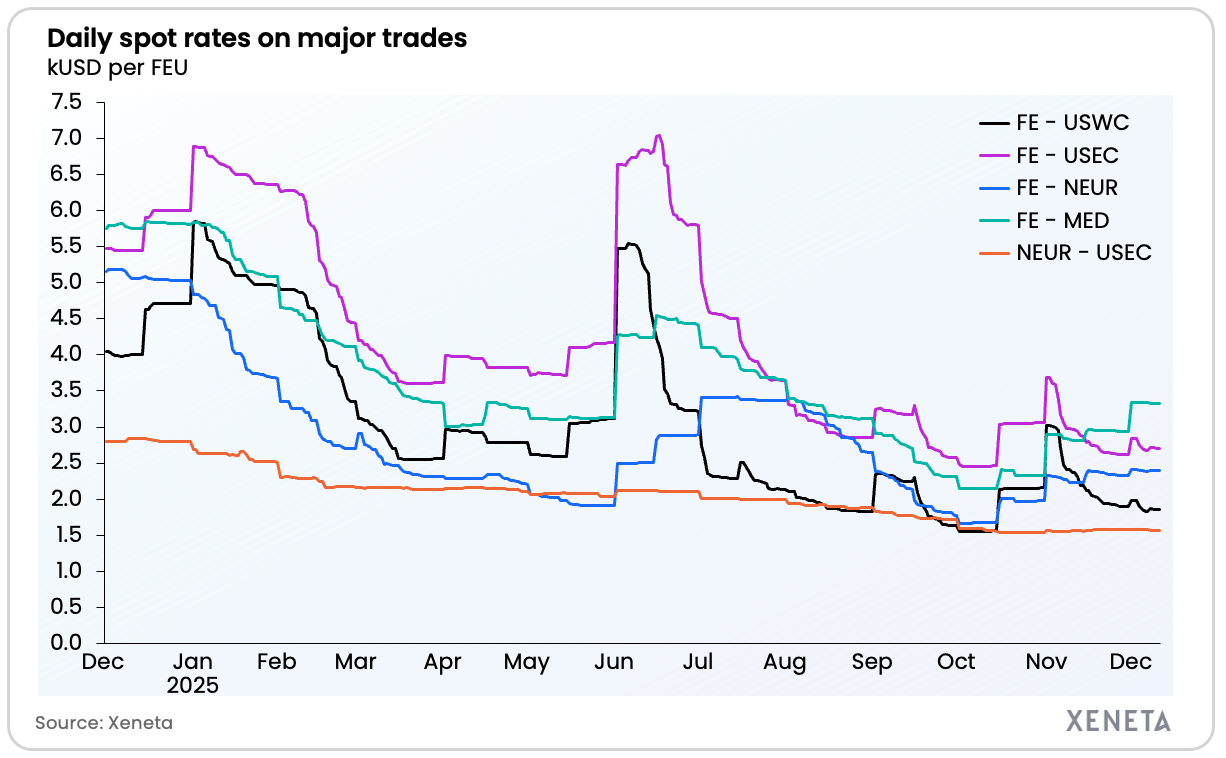

- Market average spot rates – 11 December 2025

- Far East to US West Coast: USD 1 861 per FEU (40ft container)

- Far East to US East Coast: USD 2 709 per FEU

- Far East to North Europe: USD 2 395 per FEU

- Far East to Mediterranean: USD 3 330 per FEU

- North Europe to US East Coast: USD 1 571 per FEU

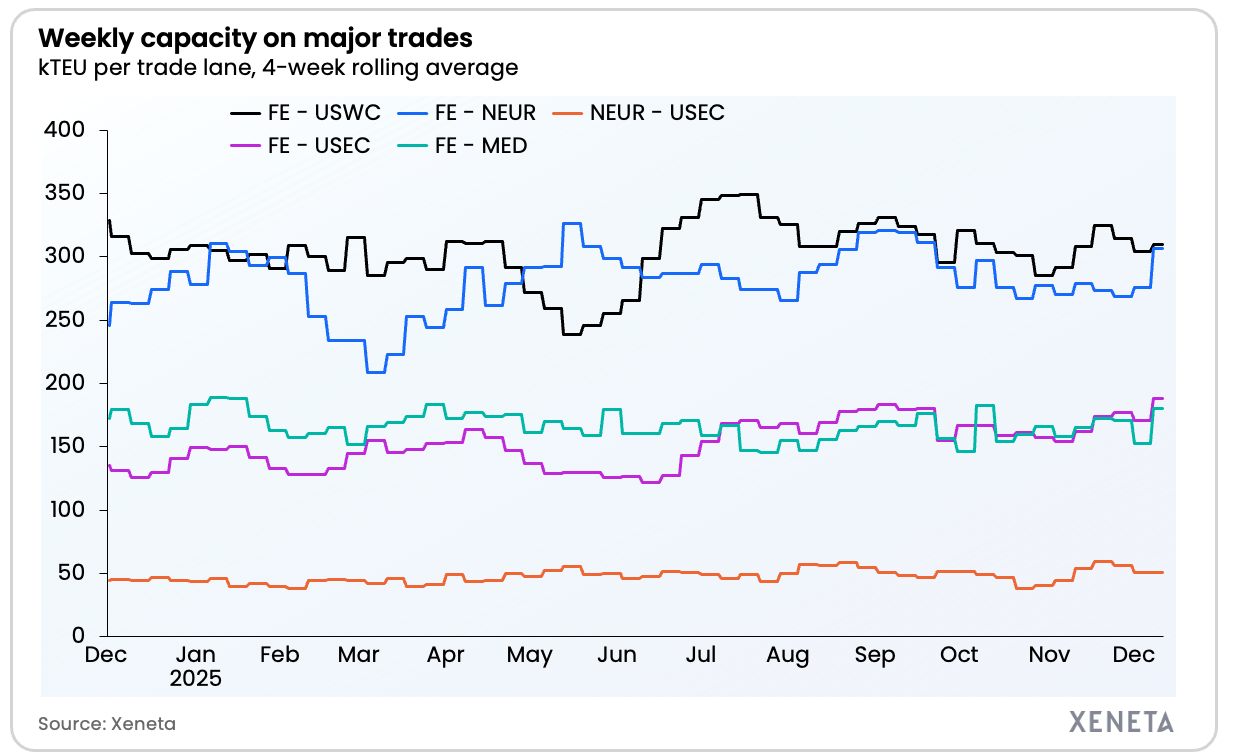

- Offered capacity (4-week rolling average) – w/c 8 December 2025

- Far East to US West Coast: +1.7% from a week ago

- Far East to US East Coast: +10.2% from a week ago

- Far East to North Europe: +11.0% from a week ago

- Far East to Mediterranean: +18.4% from a week ago

- North Europe to US East Coast: –0.7% from a week ago

Trade view: FAR EAST to US WEST COAST

Spot rates

- Week-on-week: Slipped around 2% (≈ –USD 33/FEU). After previous rebound, this latest move points back towards softer short-term pricing.

- Month-on-month: Down roughly 22% (≈ –USD 511/FEU) compared with 11 November. Remains materially cheaper than a month ago, underlining how much pricing power carriers have given up over this period.

Offered capacity

- Week-on-week: Increased about 1.7% (≈ +5.3k TEU). No sign of supply being pulled back; if anything, more space being made available.

- Month-on-month: Slightly higher than a month ago, up around 0.4% (≈ +1.3k TEU). Broader picture of stable-to-rising supply alongside sharply lower rates, keeping the market firmly in shippers’ favor.

Trade view: FAR EAST to US EAST COAST

Spot rates

- Week-on-week: Fell roughly 1.5% (≈ –USD 41/FEU). Modest pullback, suggesting tentative firming of rates seen earlier has stalled.

- Month-on-month: Against 11 November, rates are down close to 9% (≈ –USD 257/FEU). Clear month-on-month correction, even if the weekly moves now look relatively small.

Offered capacity

- Week-on-week: Climbed about 10% (≈ +17.4k TEU). Points to a decisive supply build-up into the US East Coast.

- Month-on-month: Up around 16% (≈ +26.3k TEU). Broader story is more ships chasing softer demand, which helps explain why spot levels are under downward pressure despite only modest weekly rate changes.

Trade view: FAR EAST to NORTH EUROPE

Spot rates

- Week-on-week: Essentially unchanged, flat week-on-week (≈ +USD 1/FEU). Market appears to be consolidating at current levels.

- Month-on-month: Versus 11 November, rates are about 7–8% higher (≈ +USD 165/FEU). Far East to North Europe one of the lanes where month-on-month pricing is clearly higher, not lower.

Offered capacity

- Week-on-week: Jumped roughly 11% (≈ +30.4k TEU). Carriers adding a significant amount of space into this trade.

- Month-on-month: Almost 10% higher than a month ago (≈ +27.3k TEU). Demand has been strong enough – or carrier discipline firm enough – to keep rates from softening despite heavy capacity inflow.

Trade view: FAR EAST to MEDITERRANEAN

Spot rates

- Week-on-week: Edged down about 0.4% (≈ –USD 13/FEU), essentially flat in the very short term after recent strong gains.

- Month-on-month: Compared with 11 November, rates up around 18% (≈ +USD 515/FEU). Far East to Mediterranean a clear outperformer, with sustained upward pressure on spot levels over the month.

Capacity

- Week-on-week: Surged about 18% (≈ +28.1k TEU). Rather than tightening, the lane has seen a substantial weekly increase in available space.

- Month-on-month: Up a little over 9% (≈ +15.2k TEU). Combination of rising capacity and sharply higher rates signals a very strong underlying market, with demand and risk premia more than offsetting additional supply.

Trade view: NORTH EUROPE to US EAST COAST

Spot rates

- Week-on-week: Almost unchanged, slipping around 0.1% (≈ –USD 2/FEU). Pricing remarkably steady over past seven days.

- Month-on-month: Up a modest 0.3% (≈ +USD 5/FEU). Remains stable to slightly firmer on a monthly view, with none of the sharp swings seen on the Transpacific.

Capacity

- Week-on-week: Declined about 0.7% (≈ –0.4k TEU). Small weekly reduction suggests a touch of short-term supply discipline.

- Month-on-month: Capacity down roughly 6–7% (≈ –3.6k TEU). Carriers have trimmed back space compared with mid-November, which has helped keep this trade balanced and prevented rates from sliding.

Ends

Journalists can be added to the distribution list for Xeneta Weekly Market Updates by emailing press@xeneta.com.

Xeneta’s Media Contacts

Philip Hennessey

Director of External Communications, Xeneta

+44 7830 021808

press@xeneta.com

.png)