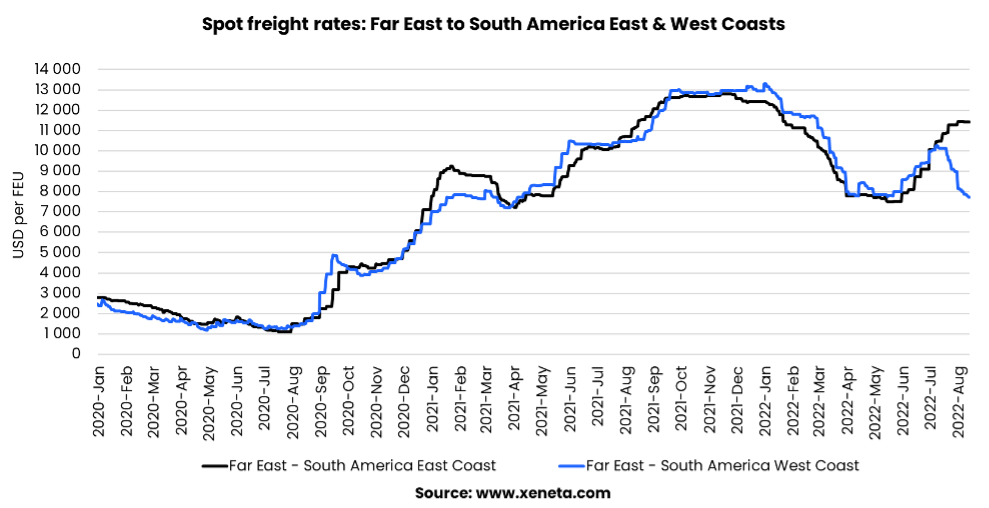

The large gap between spot freight rates on the Far East to South America East Coast and West Coast, which has widened since 1 July, is set to narrow in August and September for the Far East to South America East Coast route.

Spot freight rate on the Far East to South America East Coast (EC) trade lane has fallen by USD 990 per FEU (- 7.9%) since the start of the year, compared to the South America West Coast (WC) corridor, which has declined by USD 5 580 per FEU (-41.9%) by 14 August.

Read more below in Xeneta's weekly container rate update.

Far-East to South America East Coast & West Coast Freight Rate Trends

Historically, spot freight rates for the two had followed each other closely, making the route Far East to South America EC (Brazil, in essence) on average USD 55 per FEU more expensive compared to South America WC (Chile, Peru and Columbia, in essence).

The rates followed the same upward trend when the spread in the spot rates started widening from 1 July 2022. Rates to South America EC rose to a higher level, while those to the South America WC took the opposite direction.

An increase in spot rates occurred from the Far East to South America EC, with rates up USD 1 360 from the beginning of July. Compared to an increase in spot freight rates for exports of FEUs from the Far East, there was a decrease in spot freight rates of USD 2 270 for these FEUs en route to South America WC.

Therefore, the spread between the spot rates on the Far East to South America WC and EC presents an opportunity for shippers eager to benefit from the sharp decrease in spot rates to the South America WC route.

By end of June and mid-July, some major carriers launched new services on the route between the Far East to South America WC, which is likely to have opened up the gap in the spot freight rates. As of 14 August, shippers could save USD 3 700 on the spot freight rate for an FEU on the Far East to South America EC route compared to an FEU en route to South America WC.

In the first six months of 2022, 1.5% of loaded container volumes exported from the Far East went to the South America EC and 1.4% to South America WC (Source: CTS). Container volumes from the Far East have fallen 7.1% to South America EC and 4.3% to South America WC, respectively.

The spot rate from the Far East to the South America EC stood at USD 11 430 per FEU on 14 August, whereas the spot rate to South America WC stood at USD 7 724 per FEU. This, in return, means that it is now USD 3 700 more expensive to get a 40’ Container to the South America EC compared to South America WC when importing it from the Far East. At the start of the year, exporting to South America EC was USD 890 per FEU less expensive.

Note:

The 'Weekly Container Rates Update' blog analysis is derived directly from the Xeneta platform, and in some instances, it may diverge from the public rates available on the XSI ®-C (Xeneta Shipping Index by Compass, xsi.xeneta.com. Both indices are based on the same Xeneta data set and data quality procedures; however, they differ in their aggregation methodologies.

Want to learn more?

The container market is no walk in the park. You need to have the latest rate and supply data to be able to plan and execute your freight procurement strategy quickly.

Xeneta's real-time and on-demand data is here to help you answer, "Am I paying the right freight rate to get my cargo where it needs to be?"

Sign up for our weekly 15-minute live group demo below and see Xeneta for yourself.

.png)