TPM24 has taken place in Long Beach, California, with Xeneta taking to the stage to share expert insights on ocean freight container shipping and preview the next generation of our data and intelligence platform.

At Xeneta, our mission is to provide customer with marketing-leading ocean and air freight data along with powerful insights and personalization.

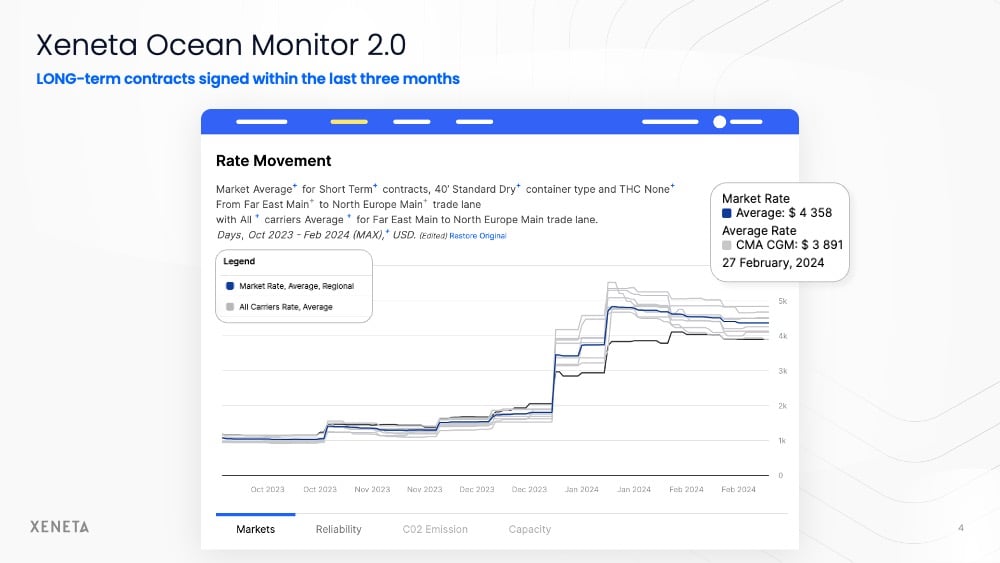

The next step in this journey is Ocean Monitor 2.0, which was available in preview mode on the Xeneta stand at TPM24. Delegates were given the opportunity to witness the power of Ocean Monitor 2.0 first hand, including comparing multiple datasets such as rates and service reliability to identify correlations and make better, faster decisions.

One US-based importer who was given a demonstration by a member of the Xeneta team told us: "Monitor 2.0 is so fast on every level-from how you zoom in on timelines, selecting new geo-hierarchies, everything is faster. This is so important because I need to be able to make fast decisions."

While the Xeneta team was busy showcasing Ocean Monitor 2.0, there were important sessions taking place on the TPM24 stage.

Peter Sand, Xeneta Chief Analyst, presented data and insights during a session titled Trade Lane Focus: Surplus Capacity and Weak Demand Will Extend Asia-Europe's “Transition to Normalization”.

Sand was joined by Greg Knowler, Senior Editor Europe at the Journal of Commerce; Michael Amri, Global Sea Freight Business Manager Development Manager at Hellmann Worldwide Logistics; and Antonios Rigalos, Managing Partner at XStaff.

Sand shared Xeneta data with the audience which demonstrated the immediate spike in rates following escalation in the Red Sea conflict in mid-December as well as the softening of the market as services settled into the diversion around the Cape of Good Hope.

Importantly, Sand also outlined the importance of using the Xeneta platform to understand risk – and opportunities – on a trade-by-trade and carrier level.

He told delegates: “No trade lane can hide from the disruption we see right now, which is the largest since the covid years. If you are not a flexible, agile company in the way you procure freight you are missing out.

“CMA CGM has transited Red Sea throughout the crisis, other than during the month of February. You can see in Xeneta data that CMA CGM was offering the lowest prices for a long time, and with that knowledge you could strike a short term deal potentially saving thousands of dollars per box.”

The panel also looked ahead to the remainder of 2024 and how the situation may play out.

Sand told the TPM24 audience: “Carriers have an incentive to go back to the Red Sea. They are wasting money and burning more fuel going around Africa. At the moment they are passing that cost on, but rates from the Far East to North Europe peaked in mid-January and we’re now in March – it’s only coming down and going one way.”

Sand also suggested shippers should always challenge surcharges, whether it is related to the Red Sea or the introduction of environmental regulations such as EU-ETS.

He said: “Meet the data before you meet your supplier. Red Sea surcharges are coming down and they’re coming down pretty fast.

“It’s part of the negotiation and you get what you deserve - there is no simple formula to put on this.”

Sand’s enlightening discussion was just one of many taking place over the three days at TPM.

In particular, a keynote address by Robert M Gates, US Secretary of Defense between 2008 and 2011, underlined the current heightened risk to ocean freight shipping globally.

Gates told delegates that it is imperative to stay close to the market and updated on the latest data and intelligence, especially with ongoing political tensions such as those in the South China Sea which could impact ocean freight shipping.

TPM24 was also an opportunity to meet with our customers and discuss how our platform is supporting their business – particularly during negotiations for new long term contracts.

One shipper told us that some carriers are attempting to introduce ‘crazy’ Red Sea surcharges but that they are pushing back strongly.

However, many of our customers who are entering tender negotiations told us initial discussions are going better than they anticipated. There is a general acceptance prices will increase but customers are using Xeneta data to push for the best deals and build in mechanisms such as quarterly adjustments.

As one shipper put it, ‘Xeneta data is helping negotiations 100%’.

Thank you to all delegates, customers and partners who joined the Xeneta team at TPM24 this week.

If you'd like more information on how the Xeneta platform can help your business navigate the ocean and air freight shipping market, book at demo.

.png)