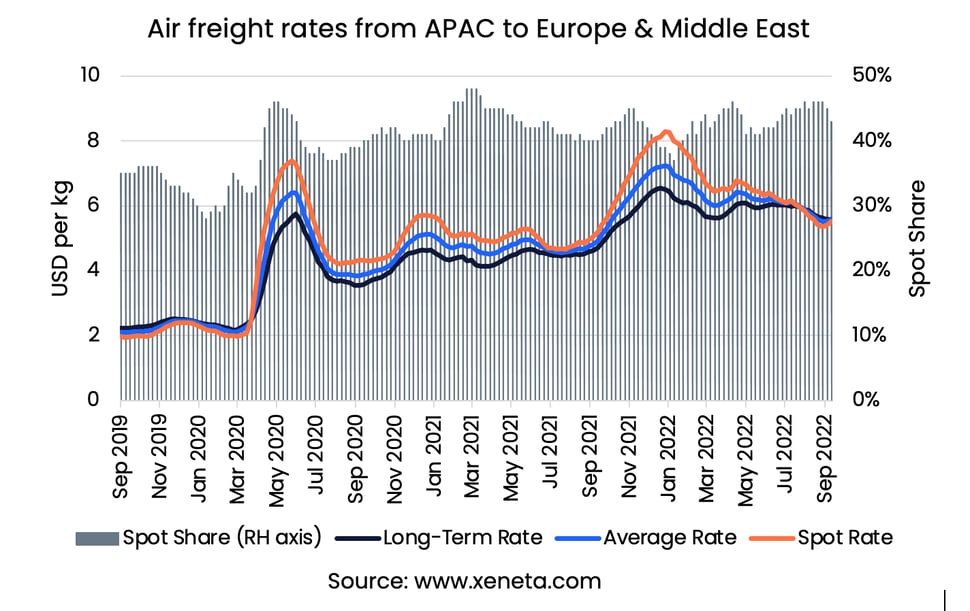

In mid-September, average air freight rates from the Asia Pacific to Europe and the Middle East stood at USD 5.59 per kg, witnessing a 21% fall from the peak at the start of this year.

As air cargo demand fell, the spot rate for shipping capacity, which freight forwarders procure from the carriers, also fell below long-term rates for the first time in over two years. At the same time, the gap between spot and long-term rates narrowed.

Read more below in Xeneta's monthly air freight rates update.

Latest trends in air freight rates and volume share between spot and long-term markets

In the first weeks of September, the air cargo spot rate from the Asia Pacific ticked up slightly to reach USD 5.52 per kg from its recent dip of USD 5.34 per kg in the last week of August. Still, it remained below long-term rates (USD 5.58 per kg) during the first two weeks of September.

The load factor on this corridor stood at 85% in mid-September, down seven percentage points year over year. However, air freight rates rose 2.8% year over year due to a surge in jet fuel prices, ground handling chaos as well as rerouted flights due to the Russia-Ukraine conflicts. The high volatility in recent load factor movements points out increased uncertainty from both the demand and supply sides of the air cargo market.

The load factor on this corridor stood at 85% in mid-September, down seven percentage points year over year. However, air freight rates rose 2.8% year over year due to a surge in jet fuel prices, ground handling chaos as well as rerouted flights due to the Russia-Ukraine conflicts. The high volatility in recent load factor movements points out increased uncertainty from both the demand and supply sides of the air cargo market.

Considering the current market, the average air freight rate today on this corridor sits 166% above the pre-Covid level.

Because of continuous market disruption and general uncertainty since the beginning of the pandemic, carriers have fixed more cargo in the spot market compared to the long-term market. By mid-September 2022, the share of cargo weight sold in the spot market was 43%, up eight percentage points from 34% three years ago.

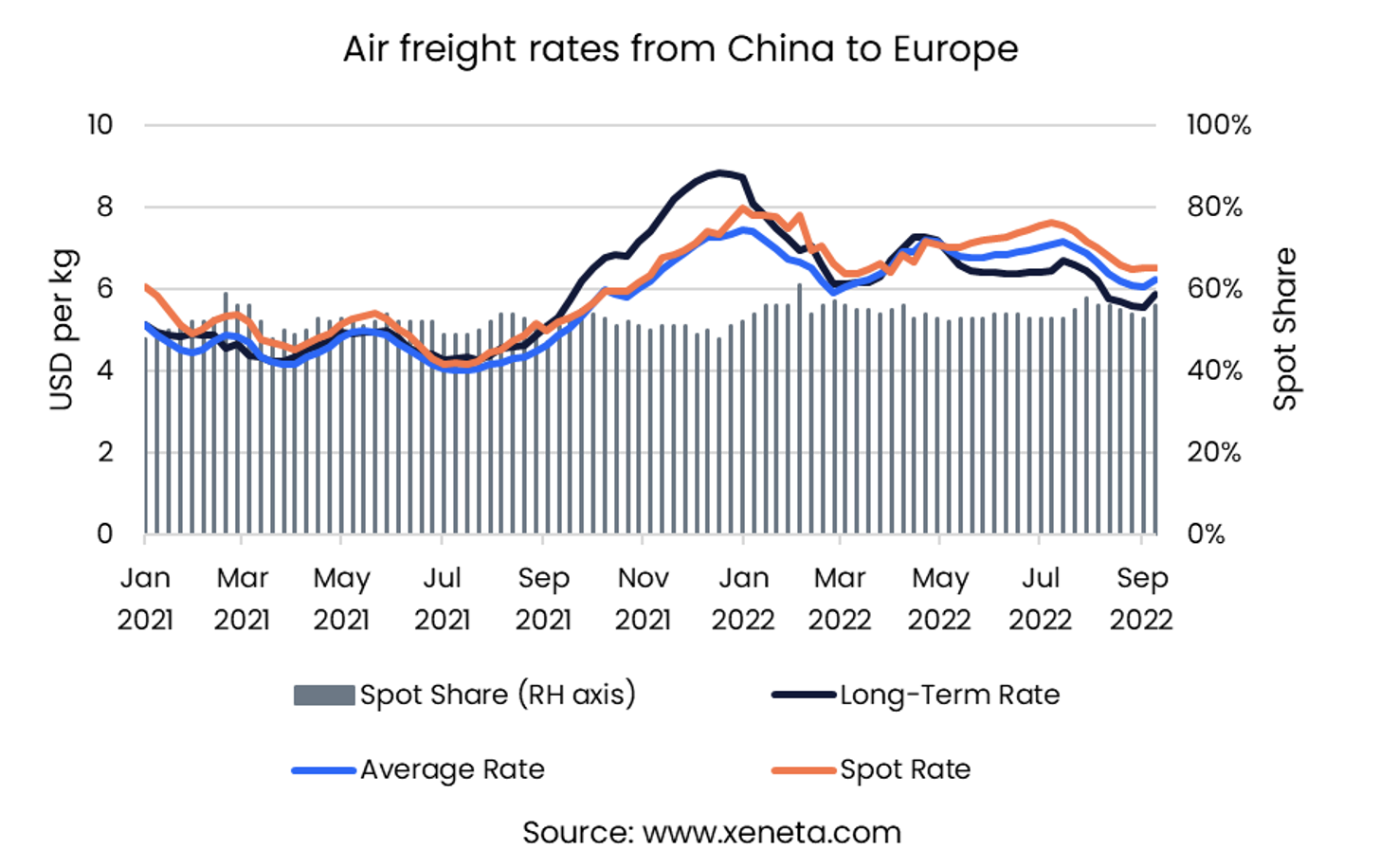

For individual high-volume corridors, the share of spot market business (between airlines and freight forwarders) is much higher than the average for the broader Asia Pacific to Europe and the Middle East market. For instance, from China to Europe, the share of the weight sold in the spot market represents roughly 56% of the market in mid-September.

For individual high-volume corridors, the share of spot market business (between airlines and freight forwarders) is much higher than the average for the broader Asia Pacific to Europe and the Middle East market. For instance, from China to Europe, the share of the weight sold in the spot market represents roughly 56% of the market in mid-September.

Thanks to some pent-up air freight demand from frequent regional lockdowns, it is then not surprising to see that the air freight spot rate out of China remains higher than long-term rates throughout the summer period, while outbound Asia Pacific spot rates dropped below long-term rates.

Taking a closer look at the rate difference between the level at which freight forwarders procure from airlines and what they sell to shippers reveals an interesting change.

Since the beginning of 2022, freight forwarders' margins have increased. Xeneta data shows that the spread between freight forwarders 'sell' and 'buy' rates has widened.

In 2021, the spread was fairly steady. One of the reasons could be that shippers are exhausted with frequent freight negotiations and have shifted their strategy to fixed rates on longer-term contracts. Moreover, it indicates that air freight spot rates for cargo out of China are likely to remain elevated in the upcoming cargo peak season.

Demand and freight rates between special and general cargo

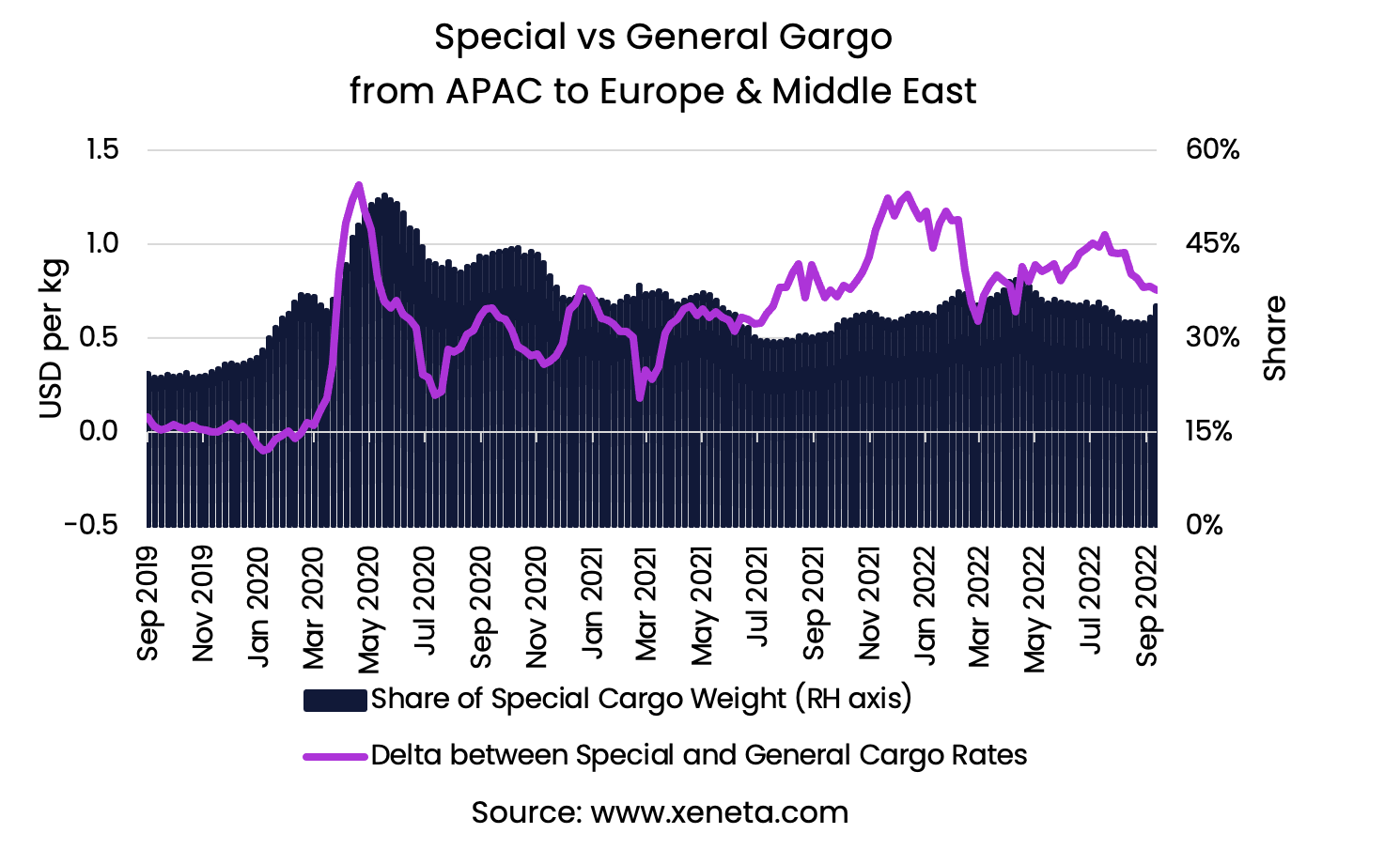

From the Asia Pacific to Europe and the Middle East, the share of special cargo demand, measured in chargeable weight, increased sharply in the pandemic period due to heightened needs for pharma goods.

From the Asia Pacific to Europe and the Middle East, the share of special cargo demand, measured in chargeable weight, increased sharply in the pandemic period due to heightened needs for pharma goods.

The onset of the pandemic (March 2020) severely pushed up the special cargo demand, especially pharma goods, to 52% of the total market share, a massive increase of 27 percentage points compared to the pre-pandemic levels.

As a result of this market twist, the spread between special and general cargo freight rates widened from a meager USD 0.02 per kg in late 2019 to USD 1.32 per kg in April 2020.

Nearly three years into the pandemic, the share of special cargo demand in September 2022 still accounts for 34% of the total market, nine percentage points above the same period in 2019.

In addition, freight rate differences between special and general cargo remain large, with the delta in September sitting at USD 0.76 per kg.

The recent global economic slowdown dampened the future of air cargo demand growth in the Asia Pacific to Europe and the Middle East corridor. So far, the special cargo seems to withstand the economic downturn, with demand still above pre-covid levels. General cargo demand solely contributed to the demand fall on this corridor, with a 26% drop from pre-covid levels, mirroring gloomier conditions for the global economy and essential markets.

Want to Learn More?

Watch the latest episode of our monthly State of the Market Webinar for the ocean and air freight rates to see where you stand in the volatile ocean & air freight markets.

If you have any questions, please send them to info@xeneta.com.

.png)