Congestion is causing fear for carriers, forwarders and shippers, as we see around the main terminals in the UK and North Europe. Things are only getting worse with dock workers on strike in Felixstowe, UK and a lack of truck drivers around Bremerhaven in the Northern part of Germany.

Low water levels in the Rhine river are slowly improving, but congestion/delays due to barge shortages and a forced decrease in volumes onboard. There's also increased pressure on other modes of preferred transportation out of Rotterdam, such as trucks and rail.

Learn more about what Xeneta experts have to say about the state of the ocean and air freight market amidst these recent events.

US strike fears produce record differences between eastern and western rates | ShippingWatch

The difference in spot rates on the east and west coasts of the US is at a record high on Far East-bound traffic at the moment, according to Xeneta. The explanation lies in increased pressure on the Eastern Seaboard due to the risk of strikes in the west.

According to Xeneta, the transfer of container traffic from west to east in the US is so great that the difference in spot rates between the coasts is at a record high on freight between the Far East and the US.

Peak freight season is underway and there’s no end in sight for congestion | CNBC

- U.S. Supply chains around the world continue to be vulnerable to interruptions or disruptions, and it’s expected to take long into next year until there is a stabilization in freight rates.

- Heading into Golden Week, the eight-day holiday in the first week of October in China, more sailings are expected to be canceled as manufacturers will be shut down, so less trade will move out of the ports.

- The next phase of the IMO program to reduce carbon emissions in maritime will take vessels out of rotation, putting more pressure on freight prices.

Read more here.

State of Ocean Freight Market | Xeneta

Congestion is causing fear for carriers, forwarders and shippers, as we see around the main terminals in the UK and North Europe. Things are only getting worse with dock workers on strike in Felixstowe, UK and a lack of truck drivers around Bremerhaven in the Northern part of Germany.

Low water levels in Rhine river are slowly improving, but congestion/delays due to barge shortages and a forced decrease in volumes onboard. So there's also increased pressure on other modes of preferred transportation out of Rotterdam, such as trucks and rail.

Tune in to the latest episode of our leading monthly 'State of the Market' webinar for ocean freight with Peter Sand, Chief Analyst at Xeneta, and Emily Stausbøll, Market Analyst at Xeneta, as they analyze the state of the ocean freight market, and review container rate movements on the main trade corridors.

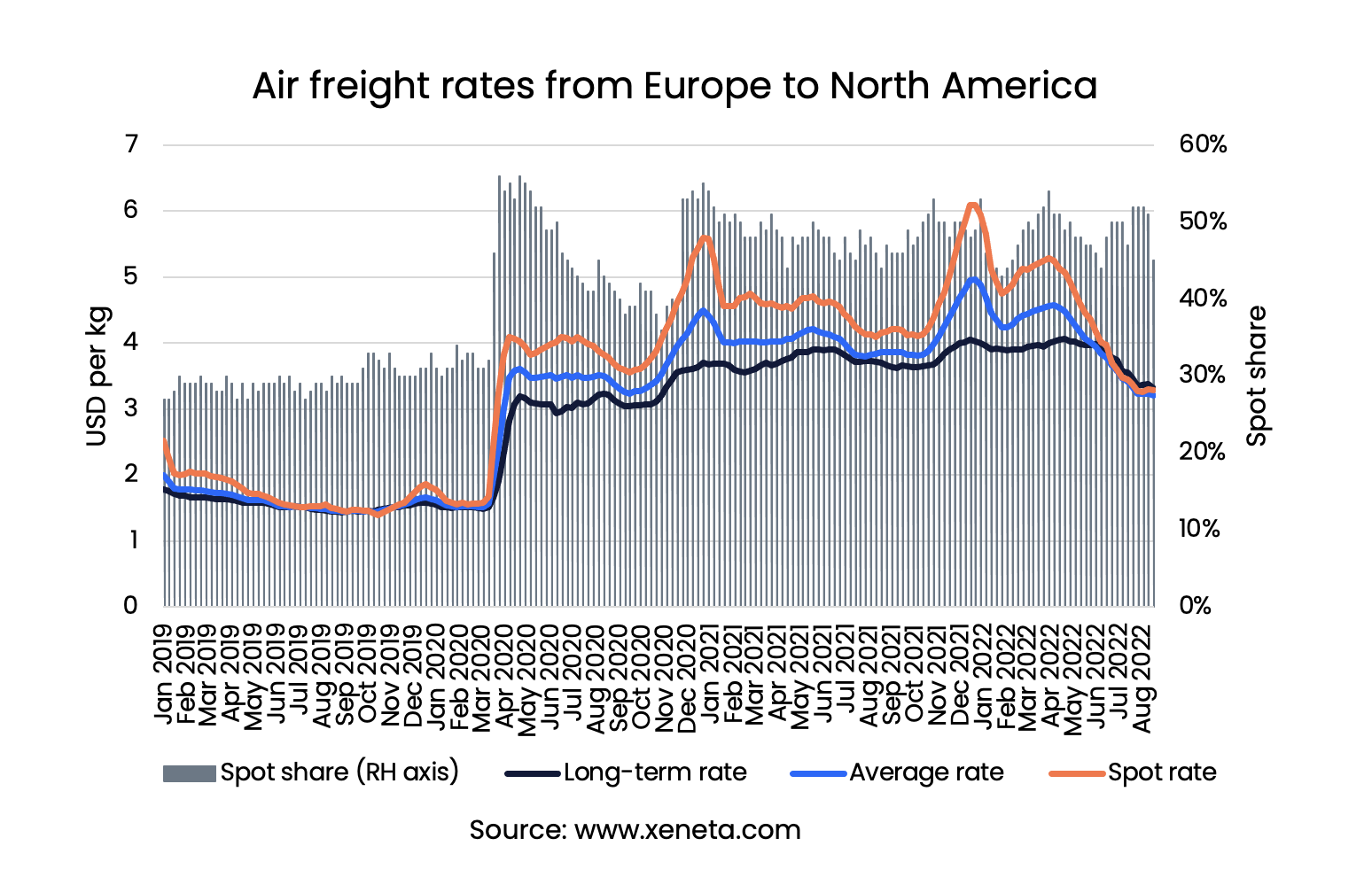

Air freight trends rates and volume share between spot and long-term markets

Zooming into the difference between the spot and long-term markets, the decline in spot rates was the main driver behind the decrease in the average freight rates - with the spot rates falling by 42% since the start of the year. In comparison, long-term rates went down by a more modest 16%.

The different magnitude of declines between the two rates on Europe to North America trades has seen spot rates fall slightly below long-term rates by mid-June.

In mid-August, long-term rates were USD 0.1 per kg higher than on the spot market, while at the start of the year, spot rates were USD 1.7 per kg higher. This is the first time long rates have fallen below the spot on this trade since the Covid-pandemic. The last time airlines earned more per kg shipped on the long-term market than on the spot market was in October 2019.

More evidence that rates have peaked | Freightnews

Freight rate benchmarking platform Xeneta has added its voice to the view that prices in the liner trade are beginning to decrease because of slowing demand. Xeneta market analyst Emily Stausbøll says despite a slew of rises in long-term contracted ocean freight rates across key global trade corridors, month-on-month growth is starting to slow – and spot rates continue to weaken – suggesting prices may have peaked.

Read more here.

Xeneta Newsroom | Interesting Freight Rate Developments Week 33, 2022

- Geopolitical tensions impacting Taiwan are affecting key trade lanes

- China's economy is slowing down. What does it mean for you as a shipper?

- High freight rates still underpin US demand. What to expect in the next few months?

Freight’s biggest disruptions: What to worry about | FreightWaves

During a recent chat with FreightWaves, Peter Sand, Chief Analyst at Xeneta, covered current supply chain and logistics issues involving congestion in North Europe that impacts the spot rate level for the Far East to US EC cargoes. Watch full episode here.

Want To Get Your Hands On More Timely Insights?

Schedule a personalized demo of the Xeneta platform tailored to match your container shipping and air cargo procurement strategy.

.png)