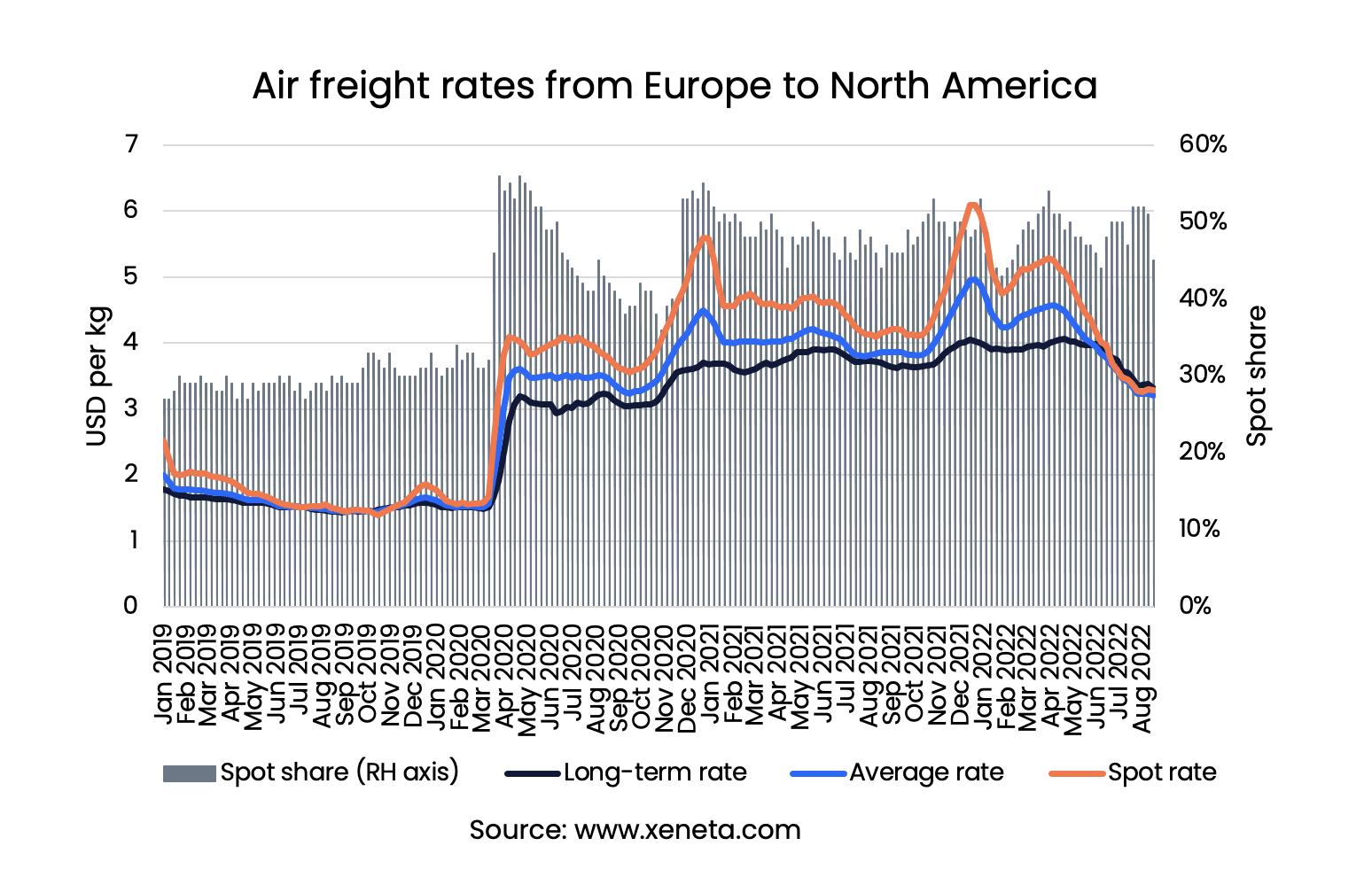

Air freight rates on the essential trans-Atlantic head haul from Europe to North America have fallen by 32% since the start of the year, sitting at USD 3.2 per kg in the week ending August 21.

This is the lowest average freight rate that airlines have reported since April 2020. However, the current level for air freight rates is still double compared to the average freight rate in pre-pandemic 2019.

Read more below in Xeneta's monthly air freight rates update.

Latest trends in air freight rates and volume share between spot and long-term markets

Zooming into the difference between the spot and long-term markets, the decline in spot rates was the main driver behind the decrease in the average freight rates - with the spot rates falling by 42% since the start of the year. In comparison, long-term rates went down by a more modest 16%.

Zooming into the difference between the spot and long-term markets, the decline in spot rates was the main driver behind the decrease in the average freight rates - with the spot rates falling by 42% since the start of the year. In comparison, long-term rates went down by a more modest 16%.

The different magnitude of declines between the two rates on Europe to North America trades has seen spot rates fall slightly below long-term rates by mid-June.

In mid-August, long-term rates were USD 0.1 per kg higher than on the spot market, while at the start of the year, spot rates were USD 1.7 per kg higher. This is the first time long rates have fallen below the spot on this trade since the Covid-pandemic. The last time airlines earned more per kg shipped on the long-term market than on the spot market was in October 2019.

The fall in the spread between spot and long-term contracts has yet to impact the share of volumes sold on both spot and long-term markets. In mid-August, 45% of air freight volumes between Europe and North America were sold on the spot market. This is in line with average levels of 47% since the start of the pandemic.

However, the average spot share has been considerably higher throughout the pandemic than pre-pandemic levels. The last time spot rates stood below long-term rates was in October 2019, and the spot market share was at 32%.

Compared to pre-pandemic times, the higher spot market share can be explained by higher market uncertainty, such as global cargo capacity constraints and increased geopolitical tensions. It makes the flexibility of spot market contracts more attractive to airlines.

Shippers can also see the benefits of the spot market under the current circumstance. Xeneta expects shippers to remain reluctant to sign long-term contracts at such high rates while the outlook remains unclear.

Given that uncertainty is coming from everywhere, Xeneta expects the spot market share for the rest of the year is unlikely to change considerably unless drastic changes to the current air freight market occur.

Dynamic load factor at a two-year low, indicating a muted peak holiday season

The volatility of air freight rates and increased volume in the spot freight market reflect the uncertainty in the aftermath of the Covid-pandemic.

The volatility of air freight rates and increased volume in the spot freight market reflect the uncertainty in the aftermath of the Covid-pandemic.

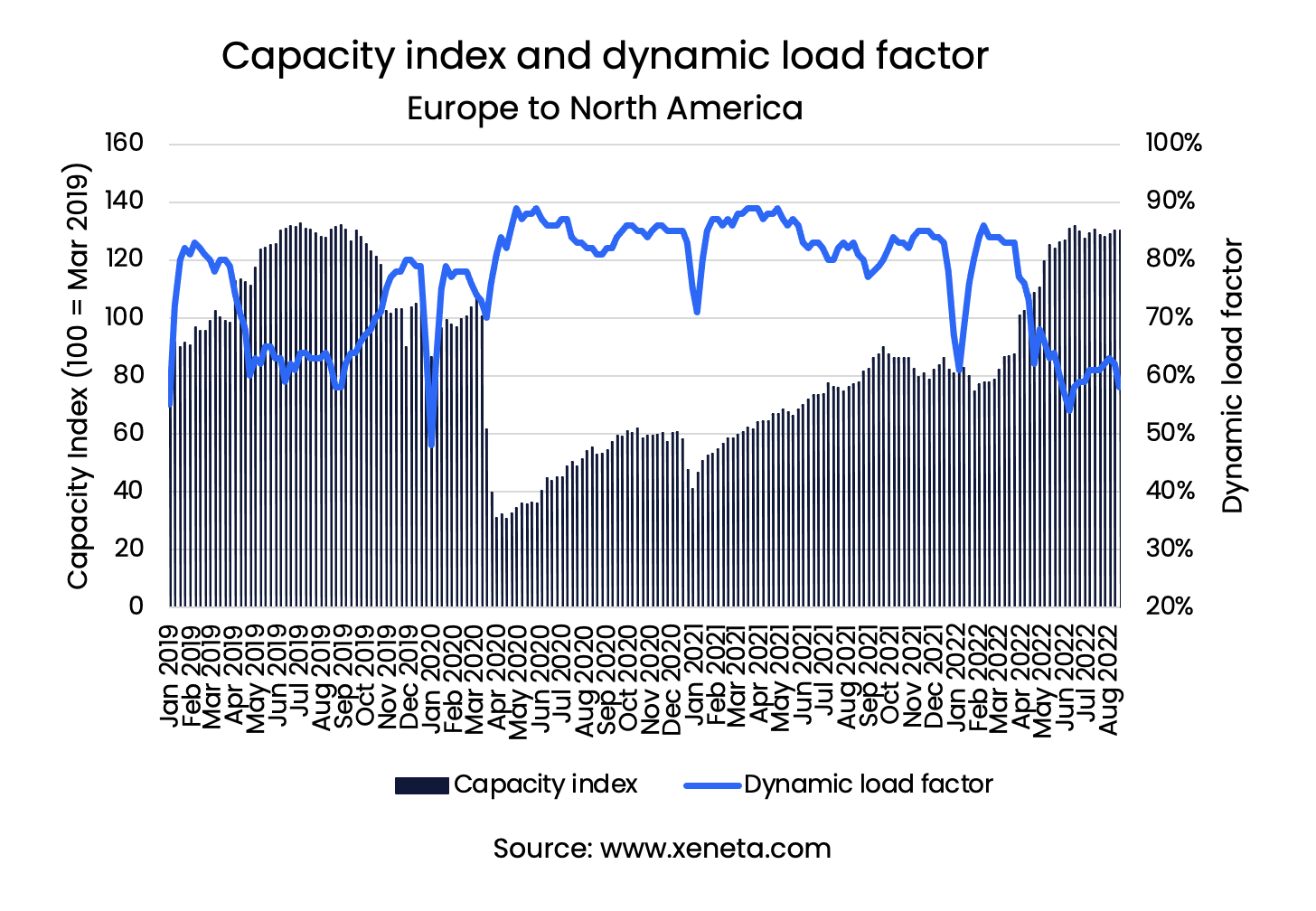

The recent decline in freight rates is partly due to the falling dynamic load factor, which measures the flight capacity utilization considering both freight volume and weight. Airlines have clearly added more capacity (as a part of their summer schedule) than was needed in the market.

The dynamic load factor in recent weeks has fallen to 61% from its 2022 peak of 86% in February, driven by the sharp increase in supply and stagnation in demand. Since the February peak in dynamic load factor, capacity has surged 67%, with demand increasing by only 1%.

The increase in capacity is mainly due to the pent-up demand for summer passenger travels in the northern hemisphere. This has also led to a full recovery of widebody belly capacity which is now back to pre-pandemic levels on Europe to North America corridor – the only major trade lane that has passed that milestone.

Looking ahead, seasonality in the air freight market suggests that the dynamic load factor on Europe to North America route will increase in the traditional peak season towards the end of the year as the supply of capacity and demand move in different directions. The overall drop in flights, due to the reduced number of passenger flights in the winter, also impacts the supply of air cargo freight capacity.

On the contrary, expect demand to increase, although to a more muted level compared to last year, under the backdrop of high inflation and global economic headwinds.

The expected uptick of the dynamic load factor is to push air freight rates up during the upcoming peak season between late September and mid-December, but they are unlikely to go back to the levels of last year as the global economies face various headwinds.

Air cargo freight rates towards early next year are likely to experience more decline in the westbound transatlantic market compared to the last two years, as there is adequate capacity but not much growth in demand.

Finally, as the first major trade with capacity back above the pre-pandemic levels, the transatlantic market might shed some light on what the recovery of outbound Asian trades might look like once passengers' belly air cargo capacity and demand return.

Want to Learn More?

Watch the latest episode of our monthly State of the Market Webinar for ocean freight rates to learn what to expect as the long-term rates just hit record highs – again!

If you have any questions, please send them to info@xeneta.com.

.png)