The ripple effects of Chinese lockdowns & U.S. port congestion on ocean freight rates, along with continuing Russia-Ukraine crisis, have contributed to a disastrous start to the 2022 second quarter. With the unpredictable global events currently creating havoc on the supply chains, learn what Xeneta experts have to say about the future of the ocean and air freight market.

Covid Lockdowns, Port Congestion, War – & A Lack of Slots & Flights | The Loadstar Podcast

The lesson of the recent Easter episode of The Loadstar podcast is - 'do not put all your freight eggs in one basket.'

Supply chain disruptions covered in this podcast with Peter Sand, Xeneta Chief Analyst, include the implications of more Covid lockdowns in China, port congestion and what war in Europe is doing to air charter markets.

"It's end-to-end logistics; that is a worry here and at stake here. We see rapidly rising congestion, also due to the fact (of course) that Shanghai is just so essential for the world of the global container business," says Peter.

Container Shipping Rates Are Going Mad Again | Financial Times

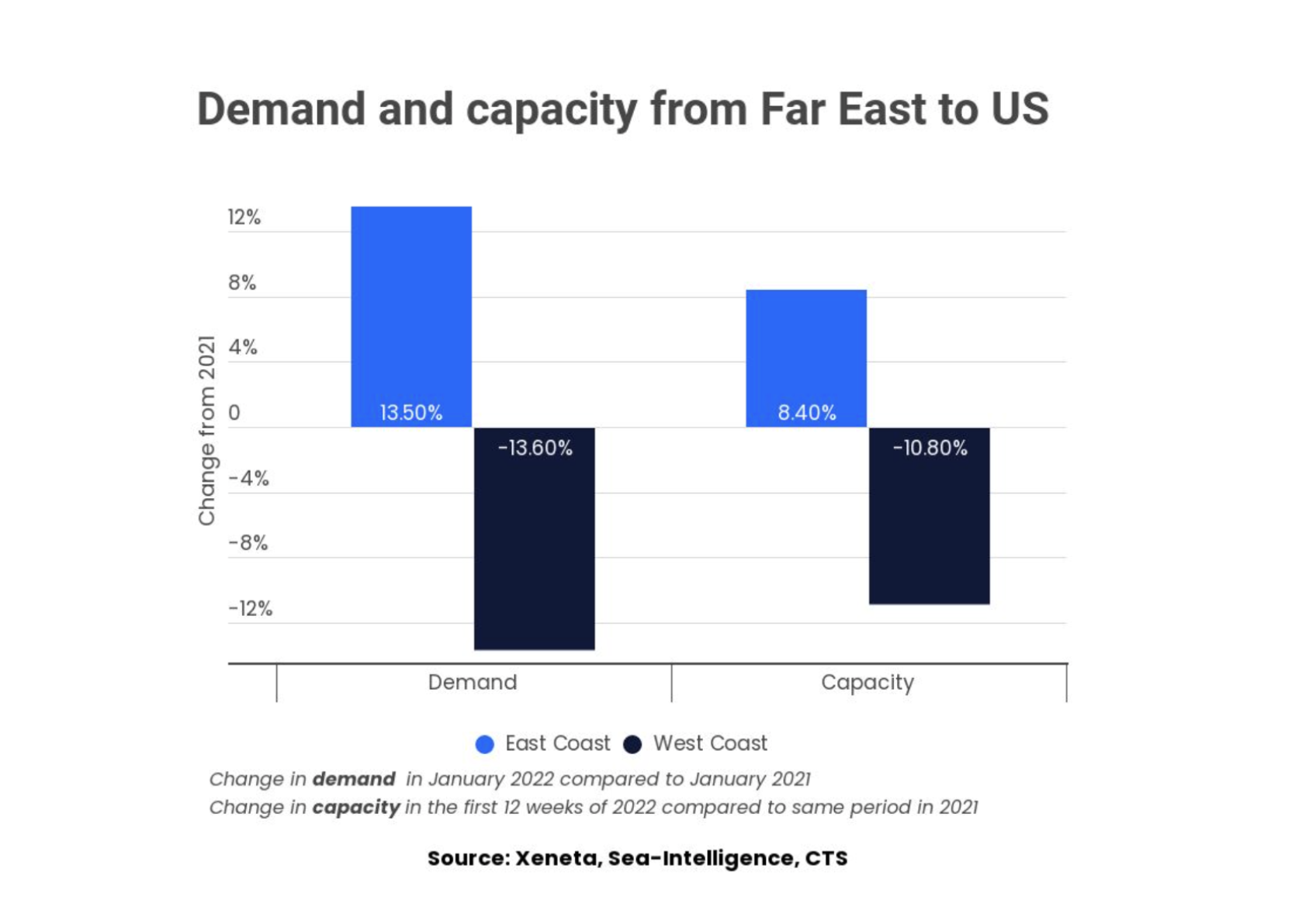

Xeneta's data shows that spot prices on the Far East to the U.S. West Coast artery remain broadly flat. But others are seeing big falls here too.

The fall in spot rates could also be down to shippers — exporters — preferring to lock in their transportation costs for the longer term.

Xeneta Chief Analyst Peter Sand told Financial Times that longer-term contract rates on the Far East to Northern Europe route had jumped by 6 percent over the past month to $9,800 per 40ft box.

Businesses were desperately seeking shelter from all the supply chain volatility and hoping that closer relations with the carriers through longer-term contracts would lift the appallingly low reliability of when their goods will leave Asia and arrive at their final destination.

Read the full report HERE.

Russia May Not Stop With Ukraine – NATO Looks To Its Weakest Link | Reuters

Learn more HERE.

Shippers & Consumers Pay The Price For Supply Chain Mess | Air Logistics International

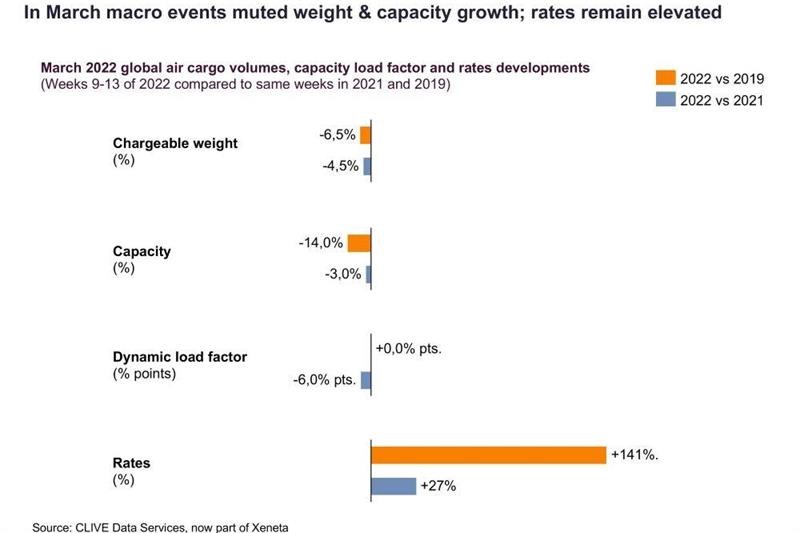

War, sanctions and lockdowns have added to the mess faced by global supply chains. Global air cargo volumes were down 4.5% in March compared to a year ago and down 6.5% in 2019 as the world deals with war in Ukraine, sanctions and the closure of Russian airspace, and Covid lockdowns in China.

Capacity was down 14% compared to March 2019, exacerbated by the closure of Russian airspace, which immediately resulted in flight cancellations and capacity between Europe and North-East Asia falling 20%. The dynamic load factor, which considers both the volume and weight of cargo flown, was 66%, six percentage points lower than March 2021.

Rates remain high, 141% above March 2019 and 27% above March 2021, and much of the capacity has been placed on short-term spot rates.

Niall van de Wouw, Chief Airfreight Officer at Xeneta, calls March a step back, saying - "We have been reminded of how the limited control the general airfreight market has over its own destiny and how it is impacted by passenger traffic trends, disruption in the ocean freight market, and geopolitical events."

Read full story HERE.

Air Cargo Demand Takes A Hit In March But Rates Stay High | Air Cargo News

While talking to Air Cargo News, Niall van de Wouw said that the ongoing disruption in ocean shipping could provide a boost to air cargo demand while higher inflation could have a negative impact.

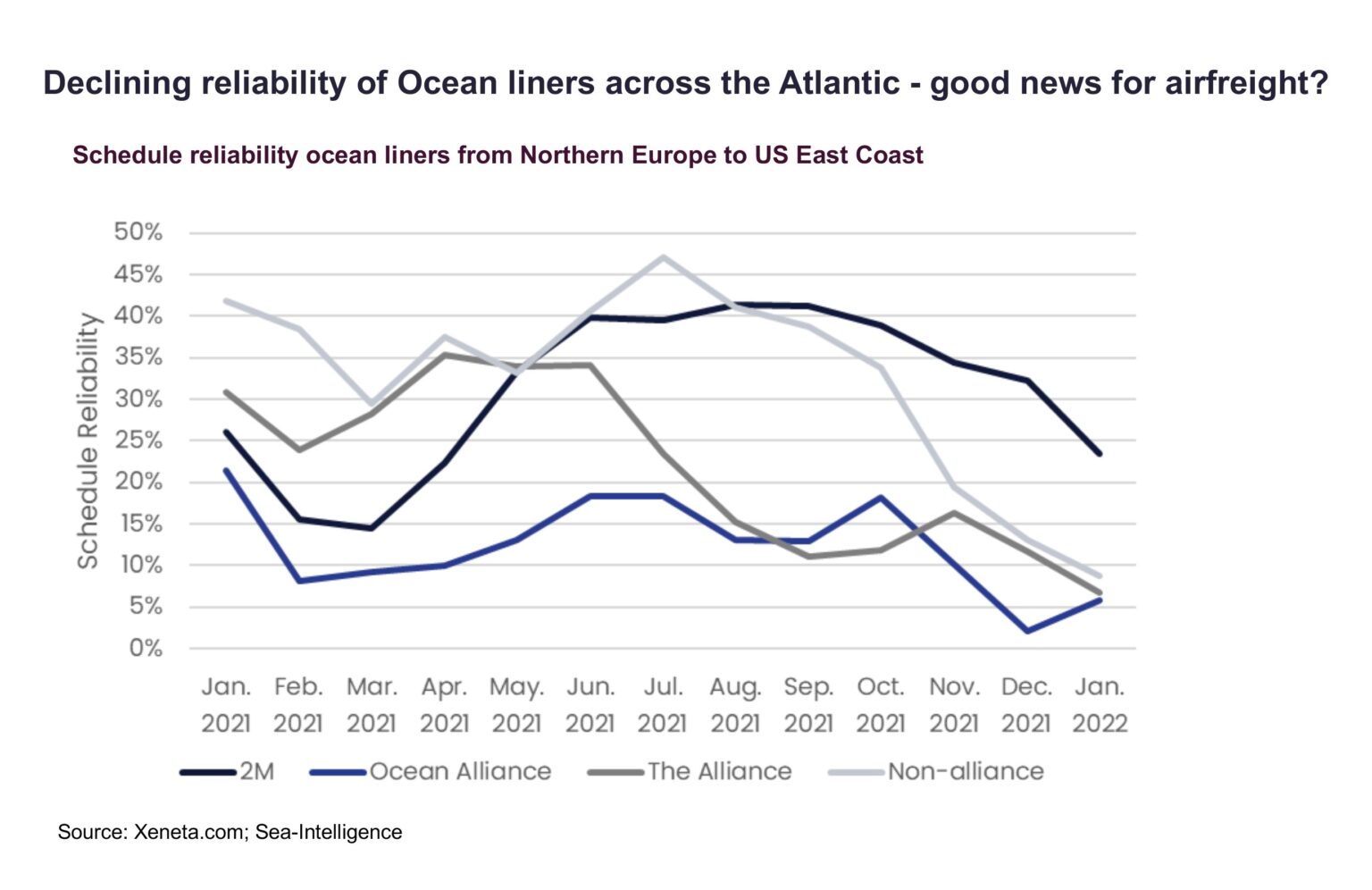

“Although it is too soon to tell what the skyrocketing inflation numbers in the US will result to, the logistical difficulties on the water between these two continents must put some wind into the sails of the air cargo market. With continuously declining schedule reliability of the ocean liners, logistical departments will likely be required to resort to airfreight because of disruptions to their supply chains caused by these record low service levels,” he added.

Read full update HERE.

Air Cargo Slumps In March As War, China Lockdowns Take Toll | Freight Waves

Air cargo volumes have been boosted for more than a year by businesses converting ocean shipments to air because of systemic inefficiencies and backlogs precipitated by the pandemic.

Much of the diversion has been on the main trade lanes of Asia to the U.S. and Europe, but the same trend appears to be happening in the trans-Atlantic. East Coast ports are experiencing extremely low vessel reliability and mounting congestion as companies try to avoid bigger logjams on the U.S. West Coast. Vessels are arriving an average of 9.5 days late, according to Xeneta.

Full report available HERE.

Long-term box freight rates up almost 100% year-on-year | Xeneta Press Room

Long-term contracted ocean freight rates climbed by 7% in March, pushing shipping prices up 96.7% year-on-year. The rise, revealed in the latest Xeneta Shipping Index (XSI®) Public Indices for the contract market, further boosts the coffers of leading carriers, with Evergreen the latest name to disclose record annual revenues of USD 17.67bn.

However, as Xeneta CEO Patrik Berglund points out, the sustainability of such developments remains to be seen.

Xeneta’s XSI®, compiled from the latest crowd-sourced ocean freight rate data aggregated worldwide, has painted a stark picture over the last 18 months, with 16 months of rates hikes against only two dips (December 21 and January 22). A combination of relentless demand, port congestion, equipment shortage and COVID disruption has driven the rates trendline to new heights – facilitating huge profits for carriers and worrying times for shippers. March 2022 proved true to form, as Berglund explains.

“Yet again we saw another bumper month for the carrier community, with climbs across all major trade corridors, for both export and import indices,” he notes. “Long-term rates are reaching all-time highs, and carriers are undoubtedly sitting pretty in contract negotiations, but there are signs that future adjustments may be edging onto the horizon.”

“Yet again we saw another bumper month for the carrier community, with climbs across all major trade corridors, for both export and import indices,” he notes. “Long-term rates are reaching all-time highs, and carriers are undoubtedly sitting pretty in contract negotiations, but there are signs that future adjustments may be edging onto the horizon.”

Read the March 2022 issue of XSI® Public Indices report for the long-term market HERE.

Xeneta Newsroom: Weekly Dose of Shipping Market Insights

In the latest episode of Xeneta Newsroom, Peter Sand talked about the congestion on the U.S. East Coast and hinted at the upcoming disaster in the coming months comparable to what we saw on the West Coast.

Watch the full episode HERE.

March ’22 Container Rates & Trends: What Xeneta Customers Are Saying

In the March 2022 edition of our customer-exclusive webinar, Xeneta experts discussed the impact of the ongoing global disruptions on the current state of the market to set reasonable tender targets this season. During the webinar, 75% of customers said the recent sanctions in Russia have impacted their supply chains. The extended lockdown in Shanghai has also left ports severely disrupted due to strengthened restrictions.

Read more insights from our latest 'Ocean Freight Market Pulse' webinar HERE.

Want To Learn More?

Join our State of the Ocean Market webinar to understand how the events below may impact your tender and procurement strategies.

.png)