Did you miss the latest news in the shipping industry? Don't worry, we have got you covered.

From growing concern over possible global recession to a drop in the stock market and European demand - learn what Xeneta experts have to say about the future of the ocean and air freight market amidst these recent events that can potentially impact your future negotiations with your suppliers.

Viewpoint: CNBC Heat Map Highlights Global Events That Can Impact The US Supply Chain

Logistics managers need to keep an eye on the U.K. as the railroad is on strike this week.

“The strike will most likely impact passengers, but surely also cargo moved on the railways,” explained Peter Sand, chief analyst at Xeneta. “It’s too early to see if ships en route would omit to call ‘North Germany,’ we’ll have to see. What is more worrying is that containers end up in the wrong place — and local feeder networks can’t work magic either bringing the boxes into the congested ports.”

“Some carriers are shying away from offering long-term contracts with the destination being the U.K.,” he added.

Read full story here.

Container Spot Rates Duck Below Long-Term Rates On The Transpacific | Splash247

Ocean contracts are notorious for not being honored during market swings. “What we’ve seen over the last year is strong growth for both sets of rates, but really spectacular gains for contracted agreements,” said Peter Sand, chief analyst at Xeneta.

“That has led the gap between the two to diminish and, with supply chains bursting at the seams and shippers looking to manage risk as much as possible, the demand for spot deals has fallen slightly on this trade, bringing prices down. This creates an opportunity for those with limber logistics strategies.”

Read more here.

The Staff Shortage Slowing Down Air Cargo And Bags | BBC News

According to the International Air Transport Association (IATA), the cargo handling industry lost thousands of workers during the pandemic. Consequently, there is now a "severe shortage" of skilled ground handlers to move goods. Niall van de Wouw, chief air freight officer at Xeneta, highlights the shortage as a key problem.

"There is enough capacity in the air but there's not the capacity on the ground," he says, saying "the present situation is something of a bottleneck. Whether it's truck drivers, or people loading ships or planes, or people in warehousing, there seems to be a global issue of finding operational people at the lower end of the pay-scale," he adds.

He suggests some of these problems for the industry are self-inflicted, caused by persistently undervaluing cargo handling as a service and perpetuating a system where staff is low-paid.

Full story available here.

Asia-US container shipping rates are flashing two bearish signals | FreightWaves

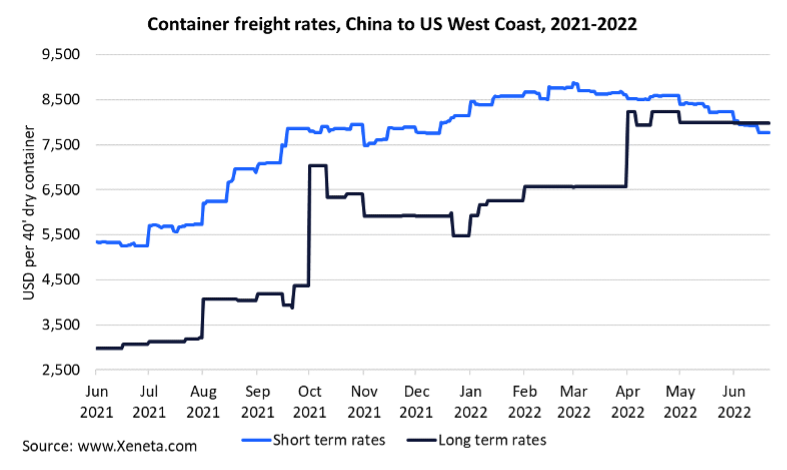

Xeneta tracks data on both contract rates and spot rates. China-U.S. West Coast spot rates have been below contract rates since June 4, according to Peter Sand, Xeneta’s chief analyst.

As of Tuesday, Xeneta assessed average short-term rates on the China-West Coast route at $7,768 per FEU, 3% below average long-term rates of $7,981 per FEU.

Different indexes continue to post different price assessments (leading to some skepticism toward indexes). Unlike Drewry, Xeneta does not see a y/y drop in the spot rates yet. It still shows a y/y increase of 46.5%. But its data shows a 160% y/y increase in long-term rates, leading to a flip in the relationship between the two.

According to Sand, “What we’ve seen over the last year is strong growth for both sets of rates, but really spectacular gains for contracted agreements.“That has led the gap between the two to diminish and, with supply chains bursting at the seams and shippers looking to manage risk as much as possible, the demand for spot deals has fallen slightly on this trade, bringing prices down.”

According to Xeneta, China-West Coast spot rates exceeded contract rates by a peak of $4,000 per FEU in September “before long-term rates hit overdrive and reeled in the difference. Long-term rates have stayed more or less stable since April, while spot rates have slowly fallen from their peak in March.”

Read full update here.

Simulated Impacts of The Container Freight Rate Surge | Xeneta's Monthly 'State of the Market' webinar for ocean freight

During our leading monthly 'State of the Market' webinar for ocean freight on June 21, 2022, Peter Sand, Chief Analyst at Xeneta, and Jan Hoffmann, Head Trade Logistics Branch at UNCTAD discussed how current global events are having huge impacts on the ocean freight market, and how data is key in navigating your procurement.

Weekly Container Rate Update: Week 25, 2022 | From China To US WC

Weekly Container Rate Update: Week 25, 2022 | From China To US WC

US West coast shippers have long endured logistic troubles as overloaded terminals have obstructed the free flow of cargo through the system. Terminal automation (more or less of it) is the central pain point to resolve this time around. Beyond that, record throughput at terminals and record freight rates for ocean shipping has long been the main challenge. Let’s have a look back at the past year.

Since end-June 2021, short-term rates have climbed 46.5%, from USD 5 304 per FEU to USD 7 768, where they sit now.

During the same period, long-term rates have rocketed 159.9%, from USD 3 070 to USD 7 981 by end-June 2022.

Read more on Xeneta's latest weekly container rate update.

Is Winter Coming? | The Loadstar Podcast

Is Winter Coming? | The Loadstar Podcast

In the latest Loadstar podcast, Xeneta's Chief analyst, Peter Sand talks to Mike King of The Loadstar about all things happening in container shipping in an exclusive interview. Peter makes some bold predictions for container shipping as the global economic picture deteriorates.

Listen to the full episode here.

TOC Europe 2022: Interview With Xeneta

"All carriers have a fistful of dollars, looking for options on how to spend it," said Peter Sand, Chief Analyst at Xeneta.

at TOC Europe on Tuesday, 14th June as part of its ‘Market Intelligence & Volatility’ session.

Peter discussed the options that carriers have - and how they can best make use of the money, for the benefit of global shippers, that rightly expect an improved service level from carriers and more resilient supply chains sooner rather than later. Watch the one-on-one interview after the event here.

The “Millennial Consumer Subsidy” & Changes to Container Shipping | Carnegie Council

Derek Thompson's "The End of the Millenial Lifestyle Subsidy," written for The Atlantic, describes how consumer costs for services like Uber, DoorDash, and Blue Apron were so low. But, with venture capital investment receding and inflation on the rise, the cost of these services is rising dramatically.

How have factors like COVID-19, increased reliance on doorstep delivery of goods, and changes to the container shipping industry impacted the economy? Hear Xeneta's Peter Sand discuss with "Doorstep" podcast co-hosts Nikolas Gvosdev and Tatiana Serafin.

Listen to the full episode here.

Navigate by Zencargo | With Xeneta CEO, Patrik Berglund

Visibility is a valuable asset when the unexpected happens. It can help you to identify which products will be affected and at what stage of their journey, prepare for increased costs and lead times and communicate internally and externally when plans change.

To gain practical insights and tips on how your team can work towards freight excellence, join Patrik Berglund, CEO and co-founder of Xeneta, and Zencargo experts at Navigate.

Want To Learn More?

Schedule a personalized demo of the Xeneta platform and learn how on-demand freight rate and market insight data will help you navigate through the current climate and identify potential savings in your freight spend.

.png)