Since the escalation in the Red Sea crisis in mid-December last year, focus has been on the main fronthaul trades out of Asia into the Mediterranean, North Europe and US East Coast – but, as is always the case with ocean freight shipping, there is more to consider.

It isn’t surprising the fronthauls grab the limelight given these services take goods from the manufacturing hubs in Asia to the consumers and businesses in Europe and the US. Another reason these fronthaul trades grab all the headlines is because they are the first to display symptoms of black swan events such as the Red Sea crisis, with rates increasing even faster than the early months of the pandemic.

However, let’s not forget about the backhauls. Freight rates may react a little slower than their fronthaul counterparts, but they still demand our attention, not least due to the huge volumes of goods shipped on these trades.

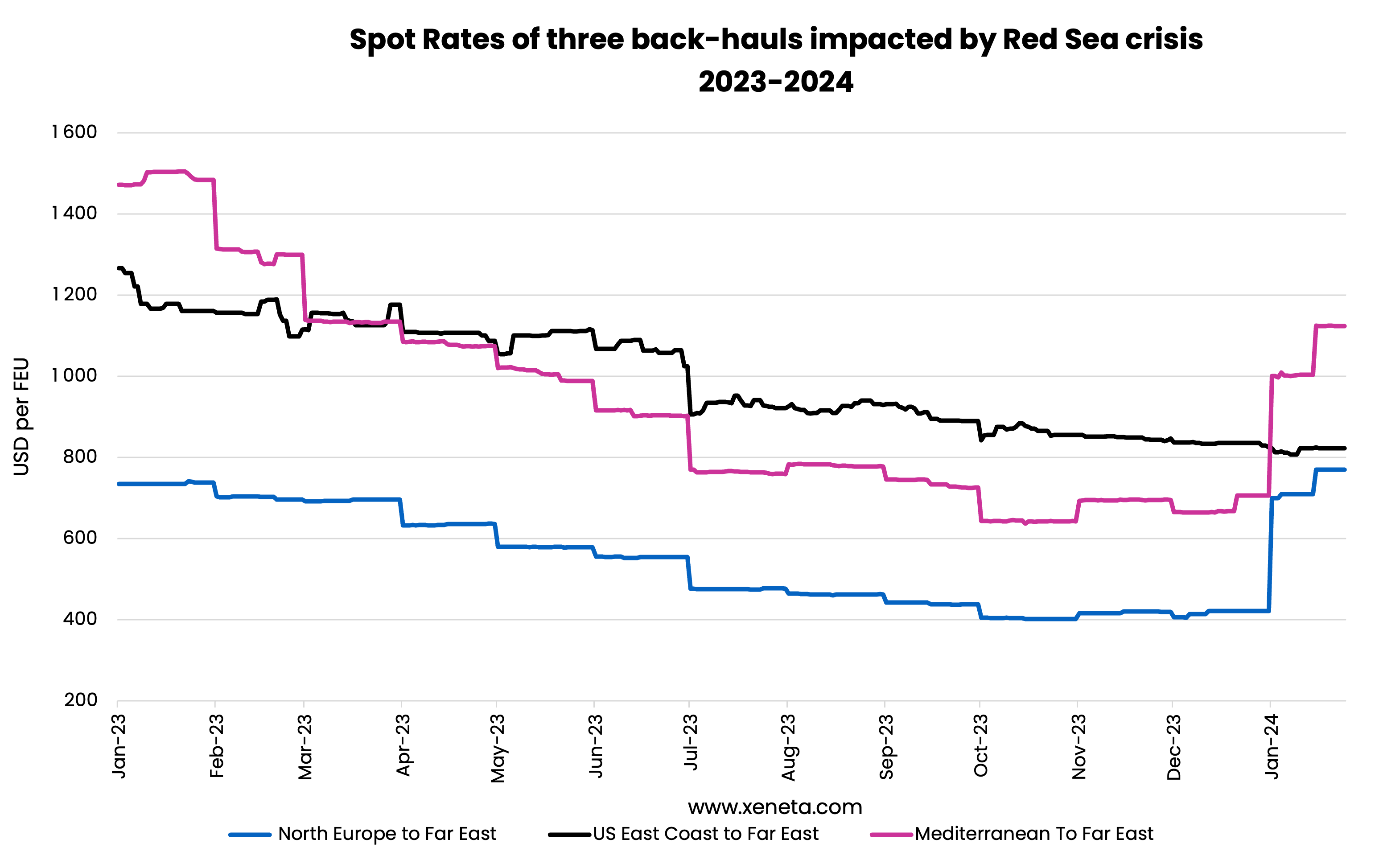

The graph below demonstrates the delayed reaction to the Red Sea crisis on backhaul trades from North Europe and Mediterranean into the Far East with spot rates not spiking until the turn of the New Year.

In the case of the US East Coast to Far East backhaul, we are yet to see any reaction to the Red Sea crisis in the spot rates.

Putting some numbers behind the narrative, as Xeneta always do, spot rates out of North Europe have jumped from USD 422 per FEU on 31 December 2023 to USD 709 on 4 January (+68%). Since then, they have increased a further 9% to stand at USD 770.

From the Mediterranean to the Far East, spot rates increased from USD 706 per FEU on 31 December to 1022 on 4 January (+45%), before jumping a further 12% to today’s level of USD 1146.

Should we expect spot rates on these backhaul trades to continue to rise?

The Xeneta ocean freight rate benchmarking platform calls upon more than 450 million crowdsourced data points, meaning we can make projections based on future rates already received from customers. While the situation remains volatile and subject to change, this data is the best indication on the extent to which rates will rise.

Looking at Mediterranean to Far East, this early data suggests spot rates will increase between 10-20% by early February, adding around USD 170 per FEU. While from North Europe rates will increase by 25-35% by early February, adding around USD 250 per FEU.

This would be the first time spot rates between North Europe and Far East have breached USD 1 000 per FEU since June 2022. It would also be a reversal of a trend which has seen rates steadily decreasing since the peak of the Covid years in May 2021.

If the February projection for the North Europe to Far East trade does become reality (we must stress there are many factors which could influence this between now and then), it would see rates increase to more than half of their Covid peak.

This is helpful perspective, given that if the February projection for the fronthaul materialises and rates hit USD 5 012 per FEU, this would only be one third of the pandemic peak.

Capacity is key to Red Sea rates increases

Remember, the Red Sea crisis is causing an issue with available capacity rather than increases in demand, which was the main driver for disruption during the pandemic.

The question is whether increases in rates on the backhaul really are a consequence of lack of capacity due to ships being delayed on the fronthaul sailing around the Cape of Good Hope…

With carriers now reportedly no longer offering expensive premium services to guarantee containers will be shipped during severe capacity shortages, perhaps the capacity is there after all - and has always been there - and the rate spikes during this crisis are a consequence of widespread uncertainty in the market.

The increase in rates expected in early February could mark the peak in this crisis, with rates potentially beginning to fall back again towards the end of the month.

One thing is for sure, regardless of backhaul rates, carriers will be looking to get vessels back to the Far East ahead of the Lunar New Year demand spike.

As we regularly say at Xeneta, no two trades are alike, and the seeming immunity to rate increases between US East Coast and Far East during this crisis is testament to that. The projected rates for February also does not indicate any significant change.

Finally, let’s not forget reefer trades, where the fronthaul from North Europe to Far East have increased from USD 2 000 per 40’ reefer to USD 2 500 since the turn of the year. The Red Sea crisis must be a factor in this along with long term rates on this trade increasing from USD 1 825 at the end of October 2023 to USD 3 021 in 2024.

Stay on top of the latest data and insight on the Xeneta Red Sea Crisis Newsfeed here. You can also join the LIVE webinar on January 30 to get the most up to date information on how ocean freight rates are impacted due to the Red Sea Crisis here.

Want more?

Download the 4 Steps Shippers Can Take Now’ providing a range of advice and insight to help navigate the ongoing crisis, such as support for internal meetings with CFOs, preparing to use more air freight and understanding the risks to your supply chain here.

.png)