Please note: this newsfeed is now closed. Ongoing updates and information on the evolving situation in the Red Sea and Gulf of Aden will be provided in the Xeneta blog and press area.

The Xeneta Red Sea Crisis Newsfeed – your trusted source of regular news updates and insights based on Xeneta data and verifiable market intelligence.

This crisis has brought widespread disruption to ocean freight shipping, with surging rates and increasing service unreliability. It is now more important than ever to have access to neutral insight and the most comprehensive data available anywhere in the market.

UPDATE: Friday, 23 February 2024

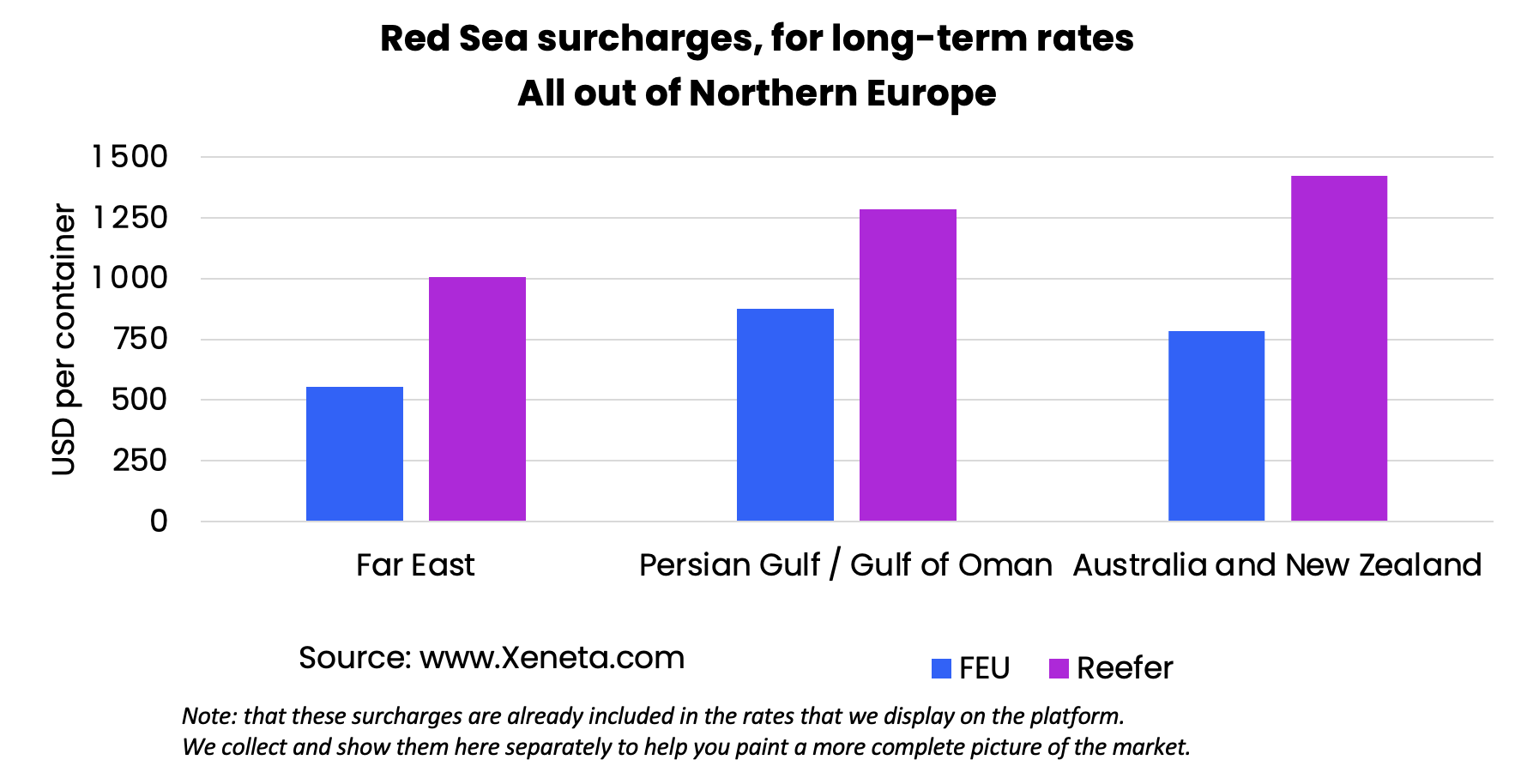

Surcharges relating to the Red Sea crisis are now included on the Xeneta platform, giving customers even greater insight on its impact on ocean freight shipping.

And don't forget, these surcharges are impacting the cost of ocean freight shipping across the world's major trades on both the short and long term markets.

Learn more on our latest blog update here.

UPDATE: Friday, 16 February 2024

Is there relief on the horizon for US importers from the Far East? Will spot rates from the Far East to US continue to weaken in the coming days? And why could the next few weeks define the fortunes of carriers and shippers for rest of 2024?

Xeneta Market Analyst Emily Stausbøll discusses all this and more with CNBCs Lori Ann LaRocco.

UPDATE: Thursday, 15 February 2024

You don’t need a crystal ball to know where US freight rates are headed – just look at Europe.

Two weeks after Xeneta reported that ocean freight shipping spot rates from the Far East into Europe may have peaked during the Red Sea crisis it now appears trades into the US have followed suit.

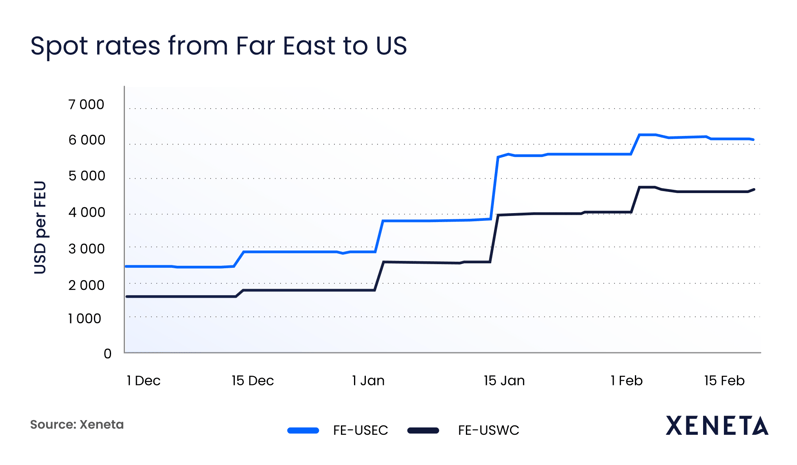

Spot rates from the Far East into the US have softened since the last round of GRIs were implemented at the start of February. Into the US East Coast, rates have fallen slightly from USD 6 260 per FEU on 1 February to USD 6 100 on 15 February. Rates into the West Coast have declined from USD 4730 per FEU to USD 4680 in the same period.

Read more on the softening of the market from the Far East to US here.

UPDATE: Wednesday, 14 February 2024

The Red Sea crisis is yet another reminder of the importance – and fragility – of global supply networks. But what will be its legacy and will it lead to changes in the way goods are transported around the world in the future?

Xeneta Chief Analyst Peter Sand joined the latest edition of Maersk’s ‘Beyond the Box’ podcast this week to share his thoughts.

He said: “This is a watershed moment for the general public and citizens of the world because they have been accustomed to globalisation and getting goods from everywhere at any given time.“One lesson for sure is that safeguarding global and maritime is of paramount importance.”

To listen to the full podcast, click here.

UPDATE: Tuesday, 13 February 2024

Earlier this month, Xeneta’s Emily Stausbøll told CNBC that rates into Europe from the Far East may have already peaked during the Red Sea crisis – and that this trend may be replicated on trades into the US, albeit with a slight delay.

This suggestion is supported by the latest data, with trades into Europe continuing their slight decline from the peak in mid January while trades into the US are now also starting to level off.

The graph below indicates the movement in rates on major trades during the Red Sea Crisis by applying an index with a baseline set at 100 on 1 December.

-2.png?width=3430&height=2400&name=image%20(2)-2.png)

On 1 January, rates from the Far East into Europe increased by more than 100% in what was the biggest single increase during the crisis. We then saw trades into the US experience their biggest rise 15 days later.

In mid February, European trades saw another sharp increase to reach their crisis peak – something which again appears to have been replicated on the US trades 15 days later. This second spike in US trades was not quite as severe as the European trades however, suggesting the market was already beginning to soften.

The question now is whether rates on the US trades will follow the same trajectory as European trades and begin their decline in the second half of February and early March.

Emily Stausbøll said: “The Red Sea crisis impacted rates on trades into Europe first and these were also the first to begin to fall again last month.

“We should expect this pattern to continue with US trades now also beginning to decline. But with TPM24 taking place in early March and acting as the starting gun for negotiations for new contracts with US shippers, carriers will be doing everything they possibly can to keep rates elevated.”

UPDATE: Wednesday, 7 February 2024

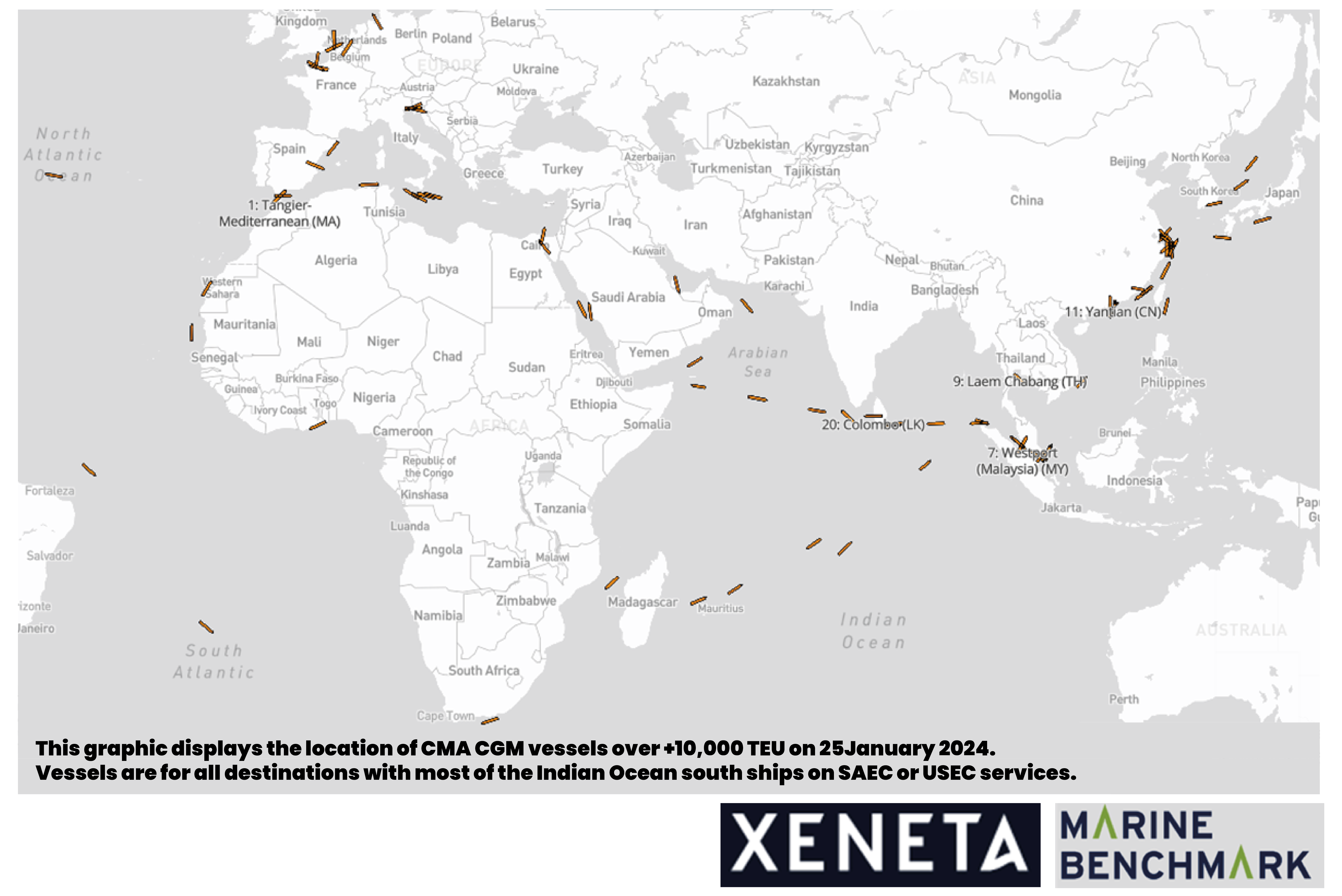

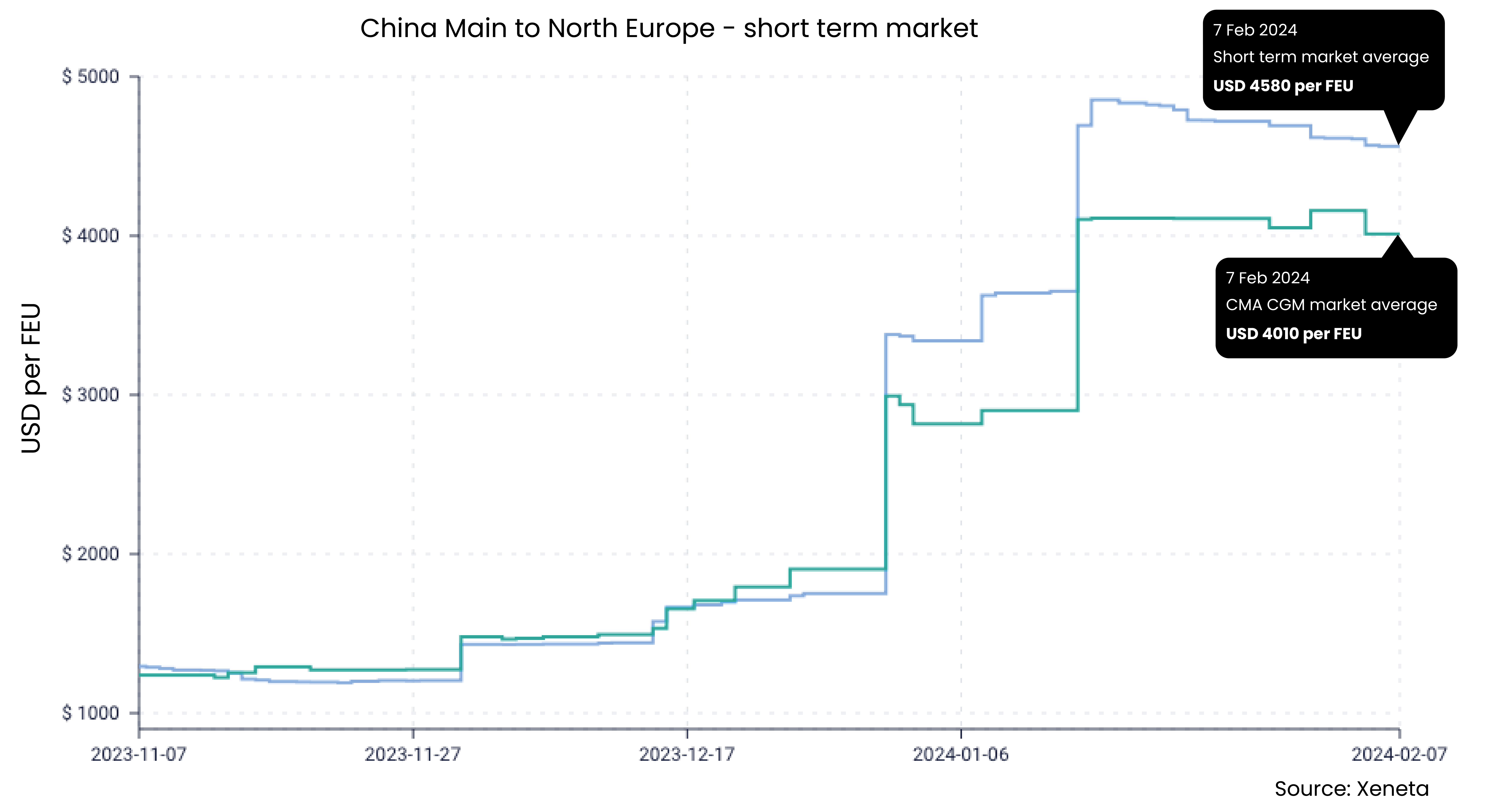

French carrier CMA CGM has this week announced it will stop sailing through Red Sea ‘until further notice’ after one of its ships was the target of a Houthi missile attack - meaning CMA CGM spot rates could be set to rise.

CMA CGM’s previous stance of continuing sailing through the region (partly due to its ships being escorted by the French Navy) was in contrast to other major carriers which had already suspended transits.

The graphic below shows the position of all CMA CGM ships over 10 000 TEU on 25 January with vessels still transiting the Suez Canal.

Because CMA CGM had continued to transit the Suez Canal its spot rates had remained below the market average. The graph below shows CMA CGM spot rates were USD 4010 per FEU on 7 February, which is USD 550 below the market average.

Peter Sand, Xeneta Chief Analyst, said: “CMA CGM have been able to offer lower prices to their customers throughout this crisis because they continued to transit the Suez Canal. The question now is whether they will hike prices to match the market average.

“Shippers choosing CMA CGM during the crisis could have been saving anywhere between USD 500 to USD 1000 per container – so it could have significant financial implications if prices are set to rise.

"We must also consider that, as well as CMA CGM prices going up, the market average could come down, which would also cause a narrowing between these rates.

“This demonstrates the importance of shippers using the Xeneta platform to not only monitor market averages but to also look at the spread of rates between different carriers.”

UPDATE: Friday, 2 February 2024

On Wednesday, Xeneta data revealed ocean freight rates from the Far East to Europe may have already peaked during the Red Sea crisis.

What could cause rates to fall earlier than anticipated in February? And what about trades from the Far East to US?

Chief Analyst Peter Sand and Market Analyst Emily Stausbøll have spoken to CNBC to dive a little deeper into the latest market movements and provide their insight.

Emily Stausbøll: “Based on the fact February general rate increases are below anticipated levels suggests carriers have been forced to negotiate down with shippers.”

Peter Sand: “We see differences between how freight forwarders and ocean carriers treat their biggest customers because the power has never really been out of the hands of these extremely large volume shippers.”

Read the full interview with CNBC’s Lori Ann LaRocco here.

UPDATE: Wednesday, 31 January 2024

Have ocean freight shipping rates already peaked during the Red Sea crisis?

Shippers have become increasingly suspicious of carriers seeking to keep rates elevated for as long as possible during the Red Sea crisis and the latest Xeneta data suggests they are now pushing back.

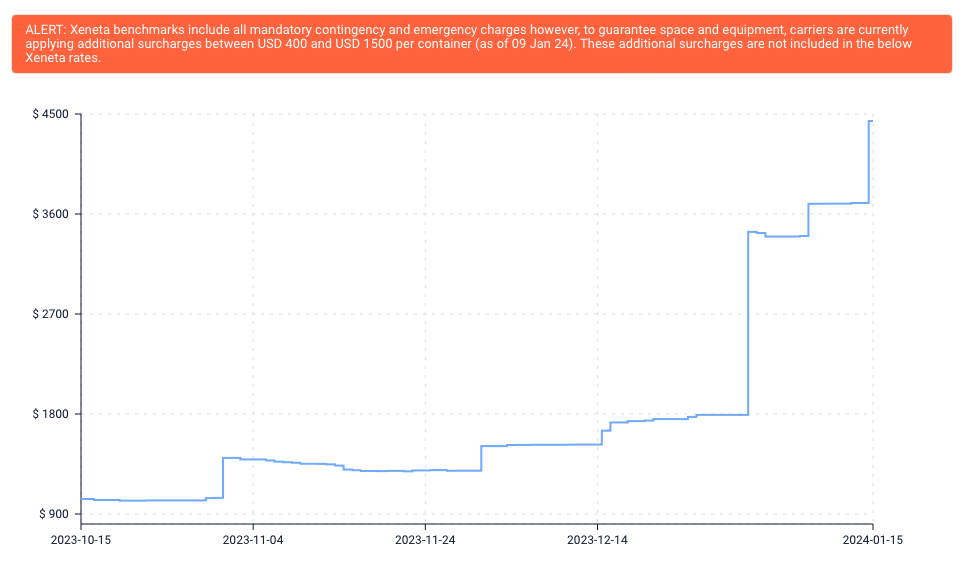

Data released today, Wednesday, indicates the average short term rates from Far East to Mediterranean are set to increase from the current level of USD 5750 per FEU to USD 5950 under February’s GRIs.

However, that rate, even if it sticks, is still below the peak of USD 6050 on 16 January.

.png?width=7795&height=4252&name=rates%20flatlining%20in%20Feb%20(2).png)

It is a similar situation on the trade from Far East to North Europe with rates expected to increase from today’s level of USD 4730 per FEU to USD 4820 at the start of February - again this is below the peak of USD 4850 on 16 January.

Peter Sand: Xeneta Chief Analyst, said: “Everyone is accusing everyone at the moment, which is normal during situations when there is so much uncertainty in the market.

"Ocean freight carriers did not invent this crisis and it takes time for them to put in new shipping networks to deal with the disruption caused by diverting away from the Suez Canal.

"However, you can also see this from the shippers’ perspective who may view the rate increases as carriers acting opportunistically to maximise the money they can make.”

While the situation remains volatile and subject to change, the newly-released data is the best indication of where the market is headed. This is demonstrated in the fact the February GRIs are below the level previously anticipated, suggesting carriers have been forced to negotiate down.

Emily Stausbøll, Xeneta Market Analyst, added: "Shippers have generally accepted the carriers’ argument that it takes time to react to such an unexpected crisis, but it now appears some shippers are pushing back and managing to agree lower rates. So, we may see rates begin to flatten or decline sooner than many anticipated in February.

“However, the market low – the cheapest rates shippers are paying - is set to increase from USD 2940 per FEU today to USD 4840 in February. With the bigger, large volume shippers tending to occupy the lower end of the market, this is good news for carriers and may even increase the amount of money they make overall."

UPDATE: Friday, 26 January 2024

A poll of Xeneta customers has revealed nearly two thirds of shippers are no longer having their containers moved on the terms of previously agreed contracts as a result of the Red Sea crisis.

A poll of Xeneta customers has revealed nearly two thirds of shippers are no longer having their containers moved on the terms of previously agreed contracts as a result of the Red Sea crisis.

Hundreds of shippers, freight forwarders and carriers joined the Xeneta customer-exclusive Freight Market Pulse webinar yesterday, Thursday, to discuss the ongoing impact of the Red Sea crisis.

During the webinar, Xeneta CEO Patrik Berglund conducted a live, anonymous poll to ask shippers if their existing contracts were being honoured – with the majority confirming they are not.

Berglund told the webcast: “The situation is changing on a daily basis. Just one week ago, shippers were confirming their containers were being moved on MCQs at the contracted price. Today I have been told these same carriers are now insisting they want to add surcharges.

"Other shippers have been facing surcharges from the early days of this crisis and some have been told their contracts are completely invalid.

"I see differences between how freight forwarders treat customers and how carriers treat their biggest customers. I also see differences if the shipper is buying additional services from the carrier beyond the ocean freight leg.

"This is what creates so much uncertainty in the market and every shipper is impacted in a different way to the next. There is absolutely no broad brushstroke here that you can say is applicable to all shippers."

UPDATE: Wednesday, 24 January 2024

Xeneta data reveals the Red Sea crisis has had a more sudden and rapid impact on ocean freight shipping rates than the early months of the Covid-19 pandemic.

A capacity crunch is caused in the Far East due to ships not returning on time for their next scheduled departure. In turn, shippers are willing to pay higher rates to secure their cargo on board the next available ship. This situation is heightened by the fast-approaching Lunar New Year.

The graph below shows growth in ocean freight rates 52 days after the start of both the COVID-19 outbreak and the Red Sea crisis.

Emily Stausbøll. Xeneta Data Analyst, said: "Rates have not yet hit anywhere near the levels we saw during Covid-19, but the sudden nature of the Red Sea crisis has seen a more rapid increase in rates which is arguably creating even more disruption than during the early months of the pandemic."

UPDATE: Tuesday, 23 January 2024

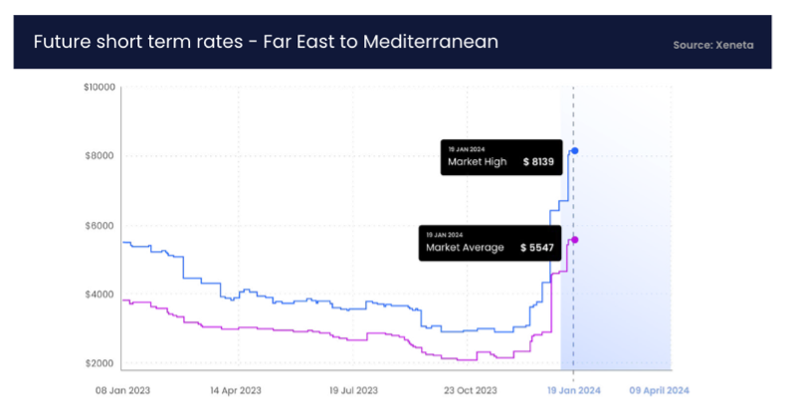

Early indications suggest ocean freight shipping rates are set to increase further in early February, according to data released by Xeneta today, Tuesday.

The Xeneta ocean freight rate benchmarking platform calls upon more than 400 million crowdsourced data points and the latest projection is based on rates already received from customers for the first week in February. While the situation remains volatile and subject to change, the newly-released data is the best indication of where the market is headed.

Far East to Mediterranean market average short term rates are set to increase 11% by 2 February to stand at USD 6507 per FEU. This is an increase of 243% since the Red Sea crisis escalated in mid December.

Far East to North Europe are set to rise 8% by 2 February to USD 5106 per FEU. This is an increase of 235% since mid December.

Far East into US East Coast is set to increase 17% by 2 February to USD 6119 per FEU. This is an increase of 146% since mid December.

For more information on the latest freight rate data projection and insight from Chief Analyst Peter Sand click here.

UPDATE: Monday, 22 January 2024

With shippers increasingly looking to switch more cargo from ocean to air freight amid the Red Sea crisis, we look at potential options and put some numbers behind them.

Read more here

UPDATE: Friday, 19 January 2024

Retailers are turning to air freight to protect supply chains and keep their products on shelves amid the ongoing crisis in the Red Sea and Suez Canal.

The latest data released by Xeneta today, Friday, shows air cargo volumes from Vietnam to Europe – a major trade route for apparel – spiked 62% in the week ending 14 January. This is also 6% higher than 2023’s peak week in October and a 16% increase on the volumes recorded in the same week 12 months ago.

Niall van de Wouw, Xeneta Chief Airfreight Officer, said: “This is the first signal in Xeneta data that the Red Sea crisis is impacting air freight. This is typically a quieter time of year for air freight so to see increases of this magnitude, with higher volumes than at any point in 2023, is significant."

To read the full update on the spike in air freight volumes and further insight from Niall van de Wouw, click here.

UPDATE: Tuesday, 16 January 2024

Ocean freight shipping rates spiked even further in the four days following air strikes by the US and UK on Houthi militia in Yemen.

Between the Far East and Mediterranean, average market rates have increased by 26% since Friday, while the increases from the Far East to North Europe and US East Coast stand at 21% and 20% respectively. If we compare today's average rates to the escalation in the Red Sea crisis back in mid December, the increases in trades from the Far East stand at 188% into the Mediterranean, 195% into North Europe and 79% into the US East Coast.

The market spread between the lowest and highest rates being paid by shippers and freight forwarders has also increased during the Red Sea crisis. This spread is most severe between Far East and US East Coast with today's market high being USD 7100 per FEU and a market low of USD 2380.

Peter Sand, Xeneta Chief Analyst said: "Since the beginning of the Red Sea crisis and following the air strikes by the UK and US overnight last Thursday and Friday we have consistently stated the situation would get worse before it gets better.

“This has certainly been the case with ocean freight shipping rates now hitting the 200% increase mark and a further spike following the air strikes last week.

"The market spread seen in the Xeneta data is also something shippers must be aware of because it places increased risk on their supply chains and uncertainty on how much they should be paying to transport their goods by ocean."

Far East to North Europe market average per FEU (source: Xeneta)

UPDATE: Friday, 12 January 2024

-

At approximately 2.30am (Sanaa/Red Sea time) today, Friday, the US and UK military carried out air strikes on targets in Yemen in response to Houthi militia attacks on merchant ships in the Red Sea.

Peter Sand, Xeneta Chief Analyst, said: “There is never a straight line to a resolution and perhaps the missile strikes in Yemen by the US and UK is the beginning of the endgame in this crisis, but, short term, things will get worse before they get better for ocean freight supply chains."

Read Xeneta's full update on the US and UK missile strikes as well as further insight from Peter Sand here.

- Peter Sand is interviewed by BBC News on the US and UK missile attacks on Houthi militia in Yemen.

UPDATE: Thursday, 11 January 2024

-

Data on Xeneta's platform indicates spot market ocean freight shipping rates are set to breach $8,000 per FEU from Far East Asia to Mediterranean and North Europe in less than a week’s time.

Peter Sand, Xeneta Chief Analyst: “There has already been a doubling of freight rates between the Far East and Mediterranean and North Europe but this latest data really does indicate the magnitude of the impact this crisis is yet to have on ocean freight shipping during 2024.”

-

At approximately 21:15 (sanaa / Red Sea time) Houthi militia carried out a large and complex missile attack. Vessels continue to avoid the area and divert around the Cape of Good Hope in Africa (see map).

-

Shippers now know disruption caused by the Red Sea crisis will not be easing any time soon and will be taking decisive action amid surging ocean freight shipping rates. Read the thoughts of Xeneta Chief Analyst Peter Sand in our latest blog update here.

UPDATE: Wednesday, 10 January 2024

-

Xeneta has released ‘Red Sea Crisis – 4 Steps Shippers Can Take Now’ providing a range of advice and insight to help navigate the ongoing crisis, such as support for internal meetings with CFOs, preparing to use more air freight and understanding the risks to your supply chain.

Download the report here.

UPDATE: Thursday, 4 January 2024

-

“No one comes away free from a supply chain disaster like the one we are watching right now”.

Peter Sand, Xeneta Chief Analyst, joins the Loadstar to discuss the latest developments in the Red Sea Crisis. Listen to the podcast here.

UPDATE: Wednesday, 3 January 2024

-

Peter Sand, Xeneta Chief Analyst talks to BBC News to give his insight on the unfolding crisis in the Red Sea and its potential impact.

-

You can watch the coverage below:

UPDATE: Tuesday, 2 January 204

-

Following another attempted attack on one of its vessels, AP Moller Maersk has announced it is pausing all transits through the region ‘for the foreseeable future’. This replaces the carriers previous position of ‘until further notice’.

Peter Sand, Xeneta Chief Analyst: “This is a very significant development because it is one of the clearest indications yet that carriers are expecting disruption from this crisis to be over a prolonged period. Shippers have been watching and waiting because they don’t want to make changes to their supply chains unnecessarily. This could be the point at which they say ‘enough’ and start to take decisive, more longer-term action.”

UPDATE: Friday, 22 December 2023

-

“The Suez Canal is a critical artery for global trade so disruption caused by the missile attacks will not be solved quickly or easily and ocean freight shipping rates will continue to rise.”

Read the thoughts of Xeneta Chief Analyst Peter Sand in our latest blog on the Red Sea crisis here.

UPDATE: Tuesday, 19 December 2023

Join the Xeneta team of expert analysts in our Red Sea crisis webinar below as they provide the latest summary on the situation as well as how it could impact the ocean and air freight shipping sector both now and in the coming weeks and months.

Our panel is:

-

-

-

Peter Sand – Chief Analyst

-

Niall van de Wouw – Chief Air Freight Officer

-

Michael Braun - VP of Customer Success & Solutions

-

Philip Hennessey - Director of External Communications

-

-

UPDATE: Friday, 15 December 2023

-

There has been an escalation in attacks on merchant ships passing through the Red Sea and Gulf of Aden. Xeneta Chief Analyst Peter Sand shares his views on this rapidly escalating situation and the potential consequences for ocean freight shipping.

-

Read our latest blog here.

.png)