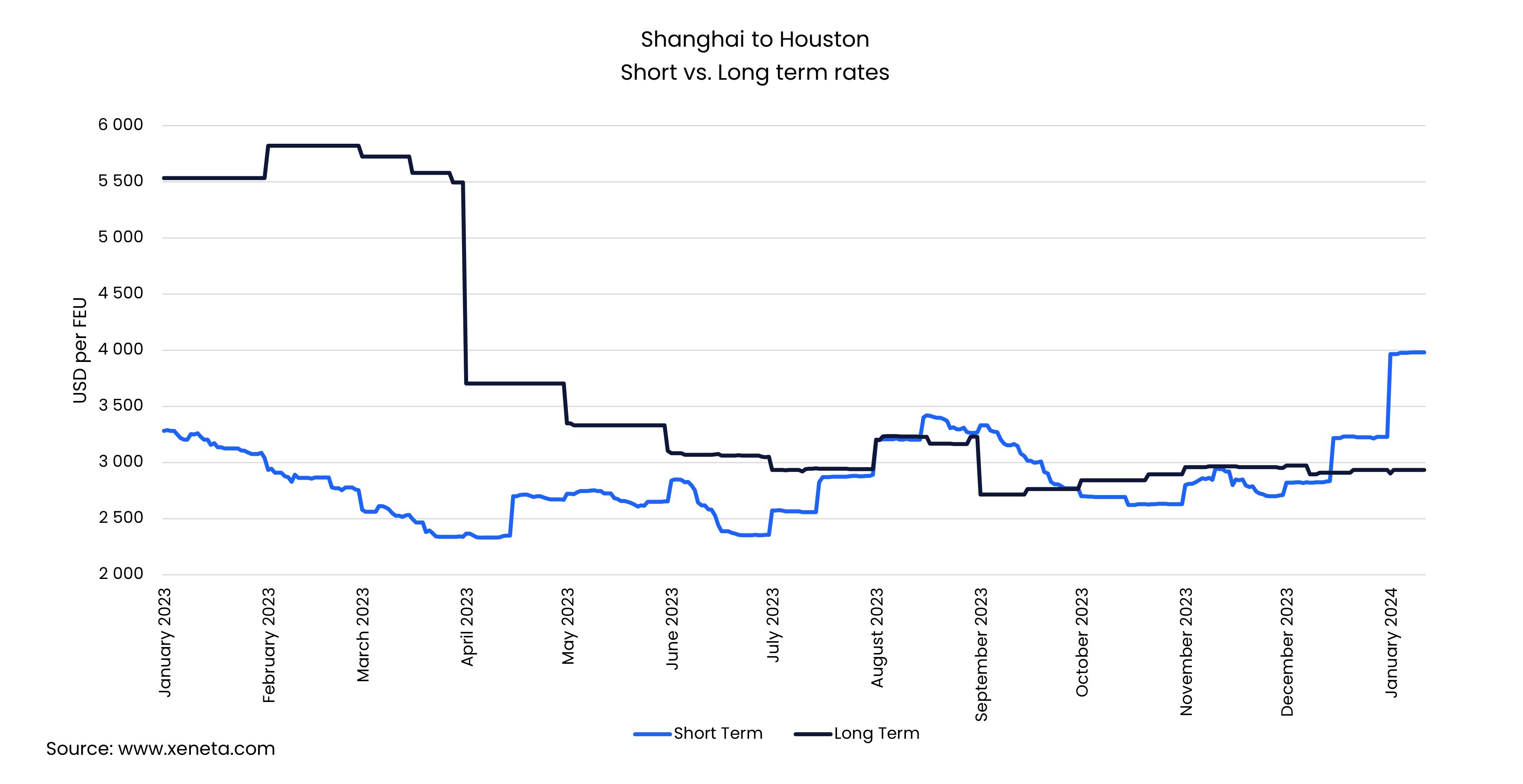

On 11 January 2024, spot rates between Shanghai and Houston reached USD 3 979 per FEU, the highest they have been for more than a year and a consequence of major incidents in the Suez and Panama canals.

This rate is 71% higher than the start of April 2023 when they plummeted to an all-time low. The highest rates got in 2023 was in mid-August when they reached USD 3 418 per FEU, which is still comfortably below today’s level.

The lower rates witnessed in 2023 were despite carriers’ concerted efforts through GRIs and capacity management to counter falling volumes and over-supply of ocean freight shipping.

Then something changed.

In December 2023 there was a sea change in the market as carrier rates began to surge. By mid-December, spot rates had increased by 19% when compared to 30 November, reaching USD 3 219 per FEU. This increase brought spot rates above the price of long term contracts in the market.

The backdrop to these rate increases is, of course, ongoing concerns on the Asia to US Gulf and East Coast trade lanes, many of which transit the Panama Canal. With this vital waterway being impacted by transit and capacity cuts due to drought, it has given rise to a heightened focus on supply chain resilience.

This has now been compounded by the crisis in the Red Sea region, but more on that later…

The lack of rainfall in Panama has impacted the water level in the Gatun Lake, and subsequently operations through the canal, with authorities announcing measures to reduce daily transits. These restrictions, first introduced back in March 2023, began at 49.5ft for Neopanamax ships, with the normal limit being 50ft. Currently the limit stands at 44ft.

Xeneta expects capacity through the Panama Canal in terms of cargo throughput and number of transits to remain reduced throughout 2024.

These restrictions have the biggest impact on the cargo-carrying ability of the largest ships due to the resulting reduction in payloads and longer waiting times to transit.

According to the Panama Canal Authority, under normal conditions, there would be daily availability for a total of 36 ships (10 Neopanamax and 26 smaller vessels) to transit the canal. In November 2023 this reduced to 24 (seven Neopanamax, half of which are containerships) and then down to 22 in December.

To avoid the bottlenecks and extended transit times at the Panama Canal, carriers opted to re-route services from the Far East to US Gulf and East Coast. Yang Ming and Hapag-Lloyd were among the first to announce these changes with the former re-routing all Asia to US East Coast services via the Suez Canal and the latter sailing ships around the Cape of Good Hope in Africa.

2024 was due to begin with further restrictions in the number of ships transiting the canal, reducing to 20 in January and 18 from February onwards.

However, on 15 December, the Panama Canal Authority made a further announcement – and this time it was for the better. Following weeks of heavy rainfall in November and December, the number of available slots in January would return to 24 – the same level as November 2023.

Another Black Swan appears on the horizon.

As the crisis in the Red Sea unfolded during December with vessels coming under attack from Houthi Militia, carriers came under pressure to reconsider re-routing services away from the Panama Canal in favor of the Suez Canal.

Hapag-Lloyd decided to send services back to the Panama Canal, a decision strengthened by the number of available transits beginning to increase earlier than expected.

The Red Sea crisis is a localized event with global implications and we can see this clearly in the climbing spot rate from Shanghai to Houston.

Shippers must consider their options carefully, understand where the risks lie and use data and intelligence to take decisive action. Is their choice of service provider the right one in the current landscape? How do you balance priorities of cost, transit times and reliability? Should you consider alternative corridors and modes of transport such as air freight and rail?

The crises in the Panama Canal and Red Sea is a powerful example of the importance of basing supply chain decisions on data and intelligence across ocean freight shipping trades.

Want more?

Download the 4 Steps Shippers Can Take Now’ providing a range of advice and insight to help navigate the ongoing crisis, such as support for internal meetings with CFOs, preparing to use more air freight and understanding the risks to your supply chain here.

.png)