Meltdown as reefer rates from North Europe to the Far East hit their lowest point on record

North Europe to Far East is one of the world’s busiest reefer trade lanes, but it has experienced a rates meltdown in 2023.

As global disruptions due to Covid began to disappear, freight rates on many key trade lanes plummeted amid evaporating demand growth and easing of congestion at main importing regions.

Many of these trade lanes have failed to transition out of the covid era and return to a ‘new normal’ – or even reach the same level of the pre-pandemic freight rates of 2019. North Europe to Far East reefer lane is one such trade.

Of course, ‘new normal’ is a fairly intangible description, but it is clear that this is a trade lane which is struggling to find its place in the world’s ocean freight shipping network.

October data typifies trade lane demise

Following tepid growth in demand for the full year of 2020, volumes have been consistently falling at high single digit rates. The demise of this trade lane is perfectly illustrated when looking at the data for October – traditionally the month which delivers the annual demand peak.

Back in 2019, a total of 60k TEU reefers were transported during October, half of which were headed to China. Fast forward to October 2023 and a total of 43k TEU were transported during the month, with only 16k destined for China.

While all sub-regions in the Far East have seen reefer imports decline, Chinese imports have halved (source CTS).

Record low filling factor on backhaul

When we are considering rates on dry container backhauls such as North Europe to Far East, we must also look to the capacity deployed by carriers on the fronthaul.

To illustrate the point, the filling factor on the North Europe to Far East trade (all containers moved, including dry and reefer) stands at 69.3%, which is the lowest ever recorded for this trade. In comparison, the filling factor out of the Far East into North Europe has averaged 91% in 2023.

The truth is brutal – yet easy to grasp

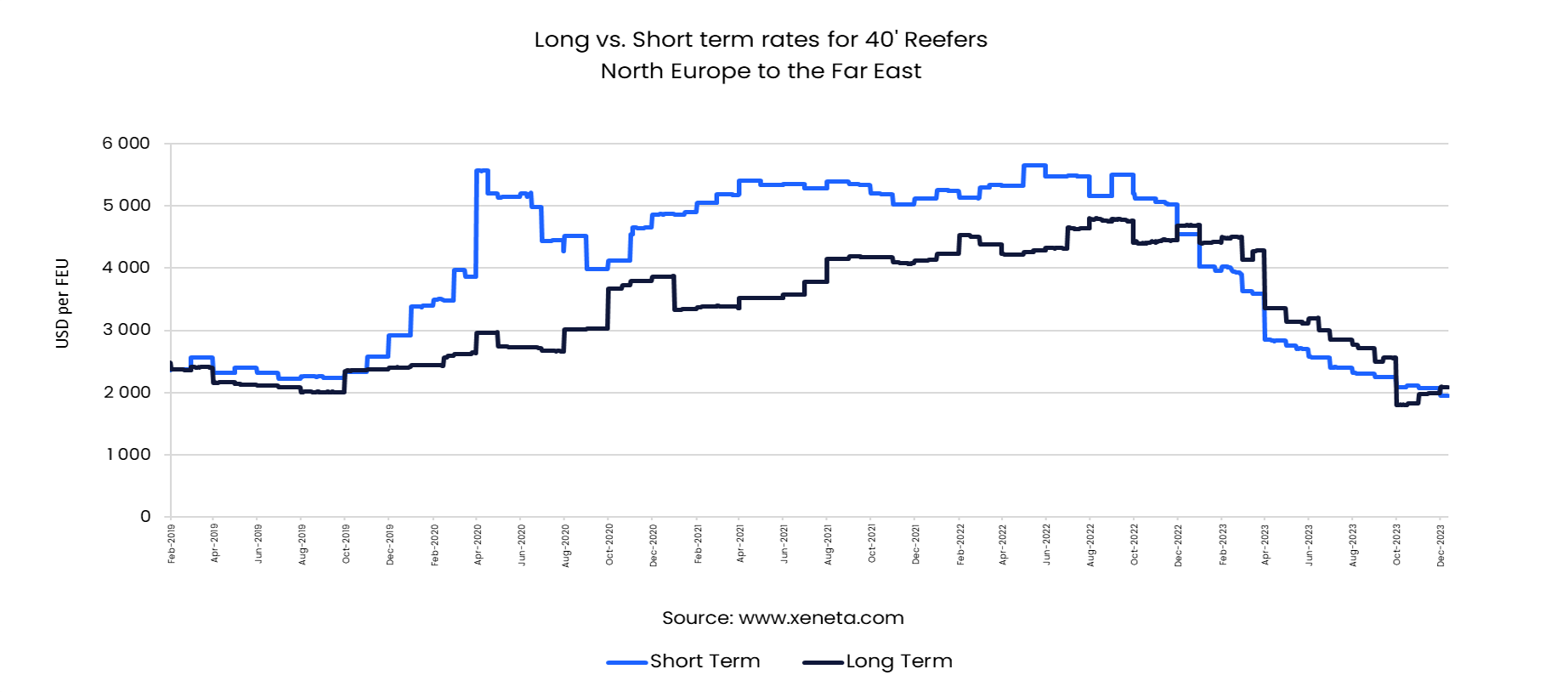

The effect all this has on freight rates, both long and short, in a market which is no longer buoyed by the disruptions of the Covid years is almost mind-blowing.

The truth is also quite simple. Despite falling volumes in 2021 and 2022, rates stayed around all-time high levels, due to the disruptions we have discussed at great length previously, such as port congestion.

When these disruptions began to unwind at an increasingly fast rate towards the end of 2022, the freight rates began to head south.

Record low in short term rates on backhaul

Looking at the market today and short term rates for reefers from North Europe to the Far East are at an all-time low according to Xeneta data. On 13 December, the spot rate was USD 1 952 per FEU reefer, which is a year-to-date (YTD) decline of 57.1% since they stood at USD 4 550 on 31 December 2022.

Long term rates have followed a similar path with a YTD decline of 55.4% to currently stand at USD 2 094 per FEU reefer. While it is nothing to shout too loudly about just yet, long term rates have inched up slightly since they hit the lowest level on record in mid-October.

Xeneta data reveals dry freight rates have also reached an all-time record low to complete the total meltdown on this trade. Long and short term rates currently sit below USD 500 per FEU, which represents a loss-making level for ocean carriers.

2024 unlikely to see rates resurgence

While the recent, albeit very slight, upturn in long term reefer rates could give carriers a glimmer of optimism, there is nothing but gloom in long term rates for dry containers where contracts signed in the most recent three months fell to just USD 341 per FEU.

2023 is closing on a negative note on this trade (from a carrier perspective certainly) and there is absolutely nothing to suggest we are likely to see any kind of resurgence in rates during 2024.

Even from the perspective of a European exporter of refrigerated cargoes, there are few reasons to be cheerful. They may find comfort in there no longer being an equipment shortage and it may be easy to secure space on a ship at record low freight rates.

But with volumes of North European refrigerated exports declining to all destinations, shippers may still be looking towards 2024 with trepidation.

Read more about Xeneta 2024 Ocean Shipping Outlook

Want to learn more?

Contact us to learn how Xeneta can help you prepare for this upcoming tender season and supplier/buyer negotiations. Gain the upper hand with actionable real-time ocean and air freight rate and capacity data.

.png)