Data highlights

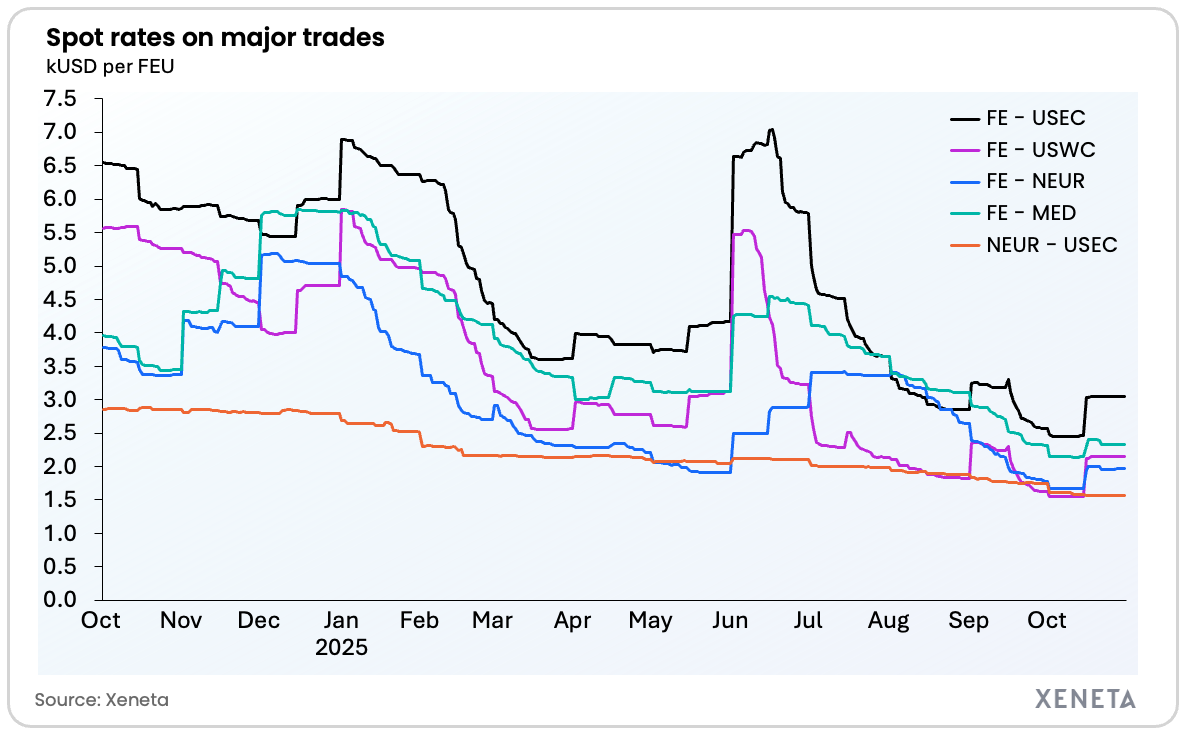

- Market average spot rates – 30 October 2025:

- Far East to US West Coast: USD 2145 per FEU (40ft container)

- Far East to US East Coast: USD 3046 per FEU

- Far East to North Europe: USD 1964 per FEU

- Far East to Mediterranean: USD 2326 per FEU

- North Europe to US East Coast: USD 1565 per FEU

- The average spot rates on all five main fronthauls moved sideways in the past week and remain almost flat against levels seen in mid-October.

- Compared to one month ago, average spot rates from Far East to US West Coast and US East Coast have increased the most out of the fronthaul trades. The highest volatility is seen into the US West Coast, rising 31.4%, while average spot rates into US East Coast are up 18.2%.

- Year-to-date, average spot rates from Far East are down 49% to US East Coast and 55% into US West Coast compared to 31 December 2024.

- Average spot rates from Far East to North Europe are up 10.4% from 30 September. However, taking a longer view, Far East to North Europe spot rates register the largest drop across the major fronthauls since the end of last year – declining 61% from USD 5037 per FEU to USD 1964 per FEU.

- Into the Mediterranean, spot rates are almost unchanged, sitting USD 9 per FEU higher (+0.4%) on 30 October when compared to one month ago.

- Average spot rate from North Europe to US East Coast is down 10.1% compared to one month ago and by 44% compared to 1 January.

- Far East into the Mediterranean is down by 60% compared to 31 December 2024.

Xeneta analyst insight – Far East to North Europe

Peter Sand, Xeneta Chief Analyst:

“Another uptick in spot rates from Far East to North Europe is expected on 1 November, bringing it on par with the average long term rate on this trade. We also saw spikes on this trade on 1 November 2024 and 1 November 2023 following periods of decline – it could be a coincidence we are seeing that again 2025, but it is more likely carriers using smart capacity management and pushing hard to keep rates up at a critical time of year ahead of tenders for new contracts.

“Shippers must stay on top of these market developments day-in day-out because the recent uptick in short term rates does not necessarily mean long term rates entering validity in 2026 must also rise.”

Xeneta analyst insight – Far East to US

Peter Sand, Xeneta Chief Analyst:

“Average spot rates have increased on Transpacific trades in October and are expected to increase again on 1 November, but this goes against the underlying fundamentals of subdued demand into the US.

“The 12-month trade truce between the US and China announced this week, including the lowering of tariffs and removal of port fees, could prompt some shippers into action but it is unlikely to spark a surge in imports. Many shippers did their work earlier in the year frontloading goods, now inventories are high they will be in no rush to take advantage of lower tariffs.

“Market sentiment is a powerful force, so while the US-China truce may not spark a rush of cargo and further uptick in rates, it could apply some upward pressure to stop rates falling quite so hard in the remainder of 2025.

“Once again, the container shipping industry is having to react to chaotic and unpredictable geo-political games. Removal of port fees is positive news for carriers, but they have already carried out the disruptive work to rearrange services to reduce the financial impact of these new levies – in that sense the damage has already been done.”

Ends

Journalists can be added to the distribution list for Xeneta Weekly Market Updates by emailing press@xeneta.com.

Xeneta’s Media Contacts:

Philip Hennessey

Director of External Communications

Xeneta

+44 7830 021808

press@xeneta.com