Data highlights

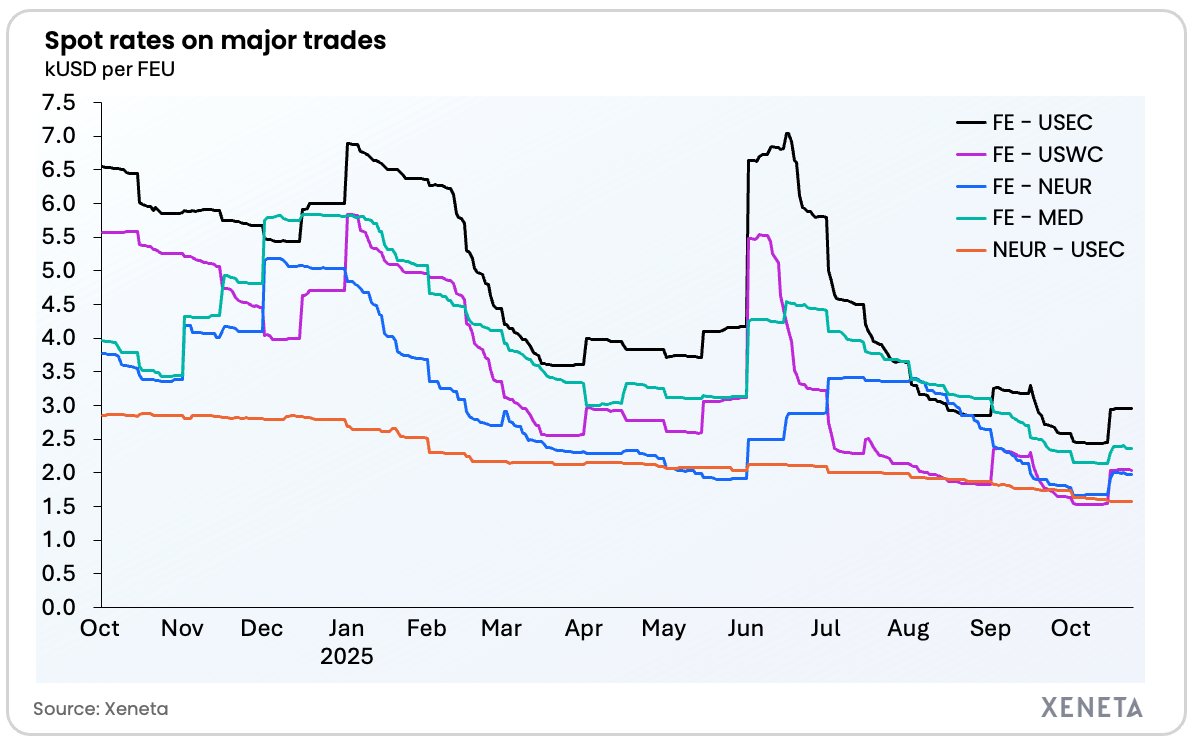

- Market average spot rates – 23 October 2025:

- Far East to US West Coast: USD 2044 per FEU (40ft container)

- Far East to US East Coast: USD 2953 per FEU

- Far East to North Europe: USD 1976 per FEU

- Far East to Mediterranean: USD 2367 per FEU

- North Europe to US East Coast: USD 1581 per FEU

- The average spot rates of the four main fronthauls out of the Far East rose markedly in mid-October and have maintained those levels in the past week. This increase follows a consistent decline in rates since Mid-September.

- Rising the most from two weeks ago is the Far East to US West Coast average spot rate. The rate is up 33.4% since 9 October, reaching levels last seen in mid-September.

- Carriers have increased blanked sailings on Transpacific throughout October, to keep offered capacity slightly below the September level.

- Similar development is seen into the US East Coast from the Far East, with the spot rate back at the mid-September level and up by 20.9% from two weeks ago.

- Rates seem to have stabilized after the initial mid-October uptick into both US Coasts.

- The spread between the two US coasts has been consistent at around 909 USD over the past two weeks indicating similar conditions impacting spot rates on both trades.

- Spot rate from Far East to US West Coast (USD 2044 per FEU) is almost on par with the average long term rate (USD 2013 per FEU). Similar situation into the US East Coast with average spot rate of USD 2953 and average long term rate of USD 3070 per FEU.

- Average spot rates are up 9.8% Far East to Mediterranean and 18% into North Europe from two weeks ago. However, there has been a slight decline of -1.4% and -1.3% respectively from a week ago.

- The spread between the two Europe-bound fronthauls from the Far East has been narrowing since mid-September to now reach 391 USD. This is a return to end-August levels.

- The drop of 5.7% into the Mediterranean since 16 September is the main contributor to this narrowing spread, rather than the rate into North Europe which has increased 3% in the same period. The spread was USD 605 on 16th September.

- Average spot rate from Far East to North Europe (USD 1976 per FEU) is now below the average long term rate (USD 2168 per FEU). Similar situation into the Mediterranean with average spot rate of USD 2367 per FEU and long term rate of USD 3237 per FEU.

- Finally, on the Transatlantic, the short-term rate plateaued from a week ago. Down by 2.6% from two weeks ago, and 44.6% from a year ago today.

Xeneta analyst insight - EUROPE

Peter Sand, Xeneta Chief Analyst:

“The spot rate spike in mid-October on European-bound fronthauls should be good news for carriers, but they won’t be celebrating too much because it is not enough to bring it above the long term rates.

“This plays into the hands of shippers who must be considering pushing contract negotiations back into Q1 next year. A long term market higher than a short term market is an extremely powerful negotiating position for shippers – why would they lock into a new 12 month contract at those levels?”

Xeneta analyst insight - US

“The average long term rate is almost on par with spot rates on Transpacific trades, which in isolation should be a good position for shippers. We do not live in normal times though and shippers are braced for further geo-political turmoil. In addition to USTR port fees coming into effect this month, China has announced retaliatory port fees of its own and Trump has threatened a further 100% tariff on imports from China.

“This uncertainty is deeply unhelpful for shippers. Some people may say Trump’s 100% tariff threat is a negotiating tactic and will not become reality – but what if it does? It has the potential to cause further chaos for shippers who have already experienced so much tariff pain.”

Ends

Journalists can be added to the distribution list for Xeneta Weekly Market Updates by emailing press@xeneta.com.

Xeneta’s Media Contacts:

Philip Hennessey

Director of External Communications

Xeneta

+44 7830 021808

press@xeneta.com