Cause and effect.

A well-known phrase, defined as ‘the principle of causality, establishing one event or action as the direct result of another’.

If an example were needed to sit underneath this dictionary definition, you could easily reference the introduction of surcharges in ocean freight shipping due to the ongoing situation in the Red Sea and Gulf of Aden.

That is why Xeneta has this week added Red Sea surcharges to the platform.

Why does it matter? Well, because at Xeneta we continuously stress the importance of using data to inform decision-making and for a long time our customers have been able to monitor and analyse surcharges relating to fuel, congestion and peak season.

Now, they can add Red Sea surcharges to the list along with EU Emissions Trading Scheme (EU-ETS) surcharges, which are also now on the platform.

After all, there’s little point knowing about the cause unless you also understand the effect.

Effects are felt most acutely on spot market backhauls.

When it comes to the Red Sea crisis, the ‘cause’ has been well documented over the past few months. So, let’s take a closer look at the ‘effect’.

Diversions away from the Suez Canal have hit ocean freight trades hard from Asia to the Mediterranean, North Europe and US East Coast. However, it could be argued cargoes moving in the opposite direction on the backhauls have been hit even harder by these surcharges.

Effect – North Europe to Far East.

Moving from USD 400 per FEU by the end of 2023 to more than USD 1 000 per FEU by mid February, market average spot freight rates have gone up by 150% in six weeks.

Within these market average spot rates, some shippers have been paying upwards of USD 1 000 in additional costs while others have managed to avoid surcharges altogether, with an average of USD 591 per FEU

Effect – Mediterranean to Far East

Surcharges are spread in the range of USD 400 (mid-low) and USD 1 100 (mid-high) per FEU, with an average of USD 639.

Effect – North Europe to Australia and New Zealand

Shippers and BCOs are paying average surcharges of USD 854 per FEU within a total spot rate of USD 2 400 per FEU. This positions the trade slightly above a classic backhaul and slightly below a classic fronthaul in terms of the total spot rate and percentage of surcharges to overall cost.

Effects are wide-ranging

The effects of the crisis are highly individual, and therefore it is very much a case of every business looking after its own individual interests. Shippers, carriers and freight forwarders are fighting as hard as they can and entering negotiations with the single aim of reducing the effect of the crisis on their business as much as possible – whether that is through surcharges or service reliability.

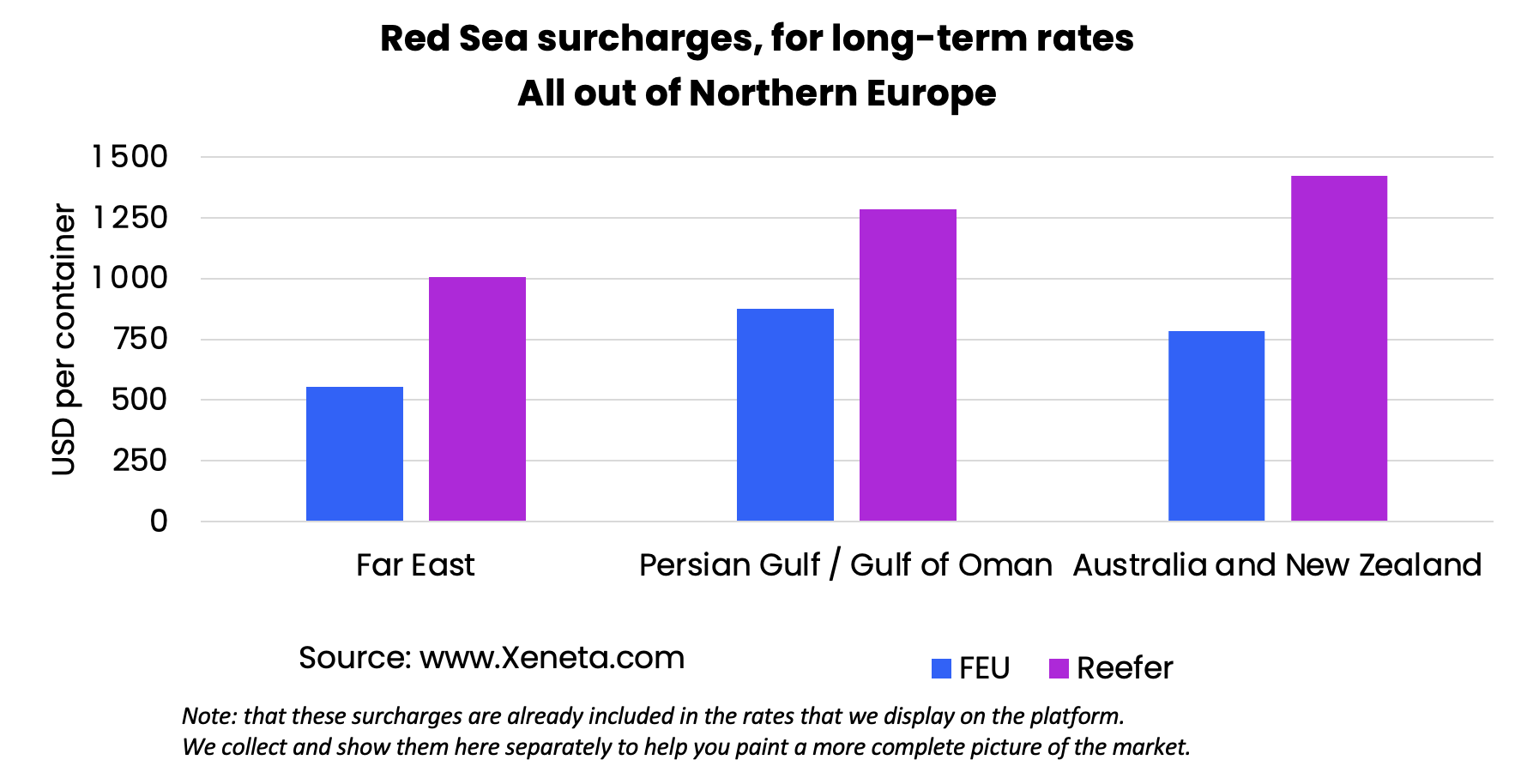

Surcharges are more significant on long-term rates.

For a standard FEU, the Red Sea surcharge for exports out of the Mediterranean on long term contracts sits higher than North European exports, with a spread of USD 162. However, while the market low for both of these trades sits at USD 400, the market high sits at USD 1 295 for the Mediterranean and USD 750 for North Europe.

Bringing a reefer out of North Europe heading for Far East, the average surcharge sits at USD 1007 per box.

EU Emissions Trading Scheme (EU ETS) surcharges revealed.

Some 50 days after coming into force, the much talked about EU ETS surcharges, which were introduced on 1 January, are now showing up consistently in Xeneta crowdsourced data and are included on the platform.

If you want to know a little more about the cause of EU ETS then you can read more here, but for now we’ll concentrate on some effects.

It’s of little surprise that the highest average EU ETS surcharge is paid for a reefer from a main port in the Mediterranean to a main port on the US East Coast, with USD 132 added to the cost of transportation.

A similar non-surprise comes from the fact the EU ETS surcharge for the fronthaul Transatlantic is averaging USD 71 per FEU, whereas the backhaul from the US East Coast to North Europe is USD 49 per FEU.

At the other end of the spectrum, EU ETS surcharges for exports out of the Mediterranean going to the Far East adds only USD 16 per TEU, with no discount received for moving more cargo since the same surcharge for a FEU sits at USD 33.

Cause and effect – how to make sense of it all.

Many more trades and surcharge benchmarks in addition to the above can be found on the Xeneta platform. If you are a Xeneta customer, then you will already have received an update on the Red Sea surcharges added to the platform.

If you understand the cause, but maybe aren’t too sure about how it is affecting your business then the Xeneta platform can help you to make sense of it all.

Want more?

Download the 4 Steps Shippers Can Take Now’ providing a range of advice and insight to help navigate the ongoing crisis, such as support for internal meetings with CFOs, preparing to use more air freight and understanding the risks to your supply chain here.

.png)