Impact on Asia to Europe trades

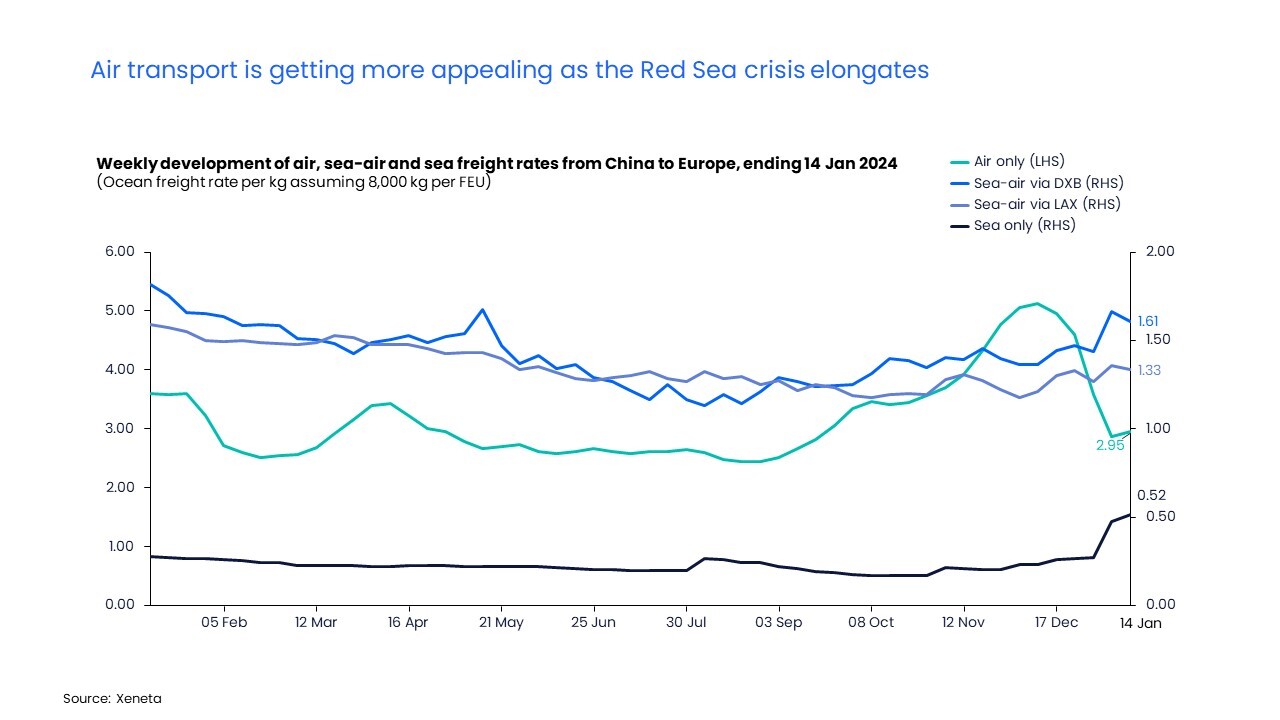

By the week ending 14 January, China to Europe air freight spot rate for general cargo stood at USD 2.95 per kg, which was down 43% from its peak in early December.

This is in stark contrast to the ocean freight market where the spot rate from China to Europe on 14 January climbed to USD 4138 per FEU dry container (or USD 0.52 per kg if converted to a per kg basis assuming 8000 kg per FEU). This is more than double (+121%) its level from early December.

Due to the ongoing Red Sea crisis, Maersk and several other carriers have been diverting their container ships from the Red Sea around South Africa’s Cape of Good Hope. This has led to disruptions around shipping schedules and container availability as well as increased operating costs due to the added transit time for rerouting.

Approaching two months into the crisis, the impact is being felt by manufacturers, with businesses including Tesla and IKEA reported to have halted production or experienced product delays (source: CNBC).

As global supply chains are interlinked, the market has already shown signs of shippers with valuable, time-sensitive shipments switching to air freight due to the ocean freight chaos.

Asia to Europe air freight rates will also be exposed to further upward pressure through the upcoming Lunar New Year, which begins on 10 February across major manufacturing countries (China, South Korea and Vietnam) and will inevitably trigger a surge of cargo demand ahead.

Beyond Asia to Europe trades

In addition to its impact on the Asia to Europe market, the Red Sea crisis will also likely spark interest in sea-air modes via Dubai and Los Angeles.

In the immediate vicinity to the Red Sea, Dubai will likely see increased ocean imports from Asia and air exports to Europe. For valuable, time-sensitive shipments, shippers can take advantage of both air freight´s shortened transit time and cheaper ocean freight to Dubai in an effort to mitigate costs.

On 14 January the ocean spot rate from China to Dubai was USD 3485 per FEU dry container, which was USD 653 ‘cheaper’ than the ocean spot rate from China to Europe. Dubai to Europe air spot rate for general cargo in the same week stood at USD 1.17 per kg, a level similar to the same period in 2019.

This translates into a Dubai transit sea-air cost of USD 1.61 per kg, just over three times the pure ocean freight rate from China to Europe (USD 0.52 per kg). The one-way transit time is approximately three weeks shorter than pure ocean transport.

The potential increased demand from sea-air mode could see Dubai to Europe air cargo spot rates soon climb above pre-pandemic levels. This is based on the fact air cargo demand from Dubai to Europe in the two weeks ending 7 January had already shown an 11% increase from its level two weeks earlier. This is in contrast to demand trends in previous years, which tended to show double-digit volume decline in the same timeframe.

Los Angeles could be a good option

Furthermore, Los Angeles to Europe air cargo rates could be on the rise if ocean shippers get creative and adopt a sea-air mode from China to Europe via Los Angeles. This could be an even more cost-efficient option compared to sea-air mode vis Dubai.

On 14 January, ocean spot rate from China to Los Angeles was USD 2849 per FEU dry container, a further USD 636 lower than the ocean spot rate from China to Dubai. The air cargo spot rate for general cargo (from Los Angeles to Europe) stood at only USD 0.98 per kg in the week ending 14 January, which was the cheapest air freight option compared to China to Europe and Middle East to Europe air freight rates.

So, the total freight cost for the sea-air mode via Los Angeles would be USD 1.33 per kg, only 2.6 times the pure ocean freight rate from China to Europe (USD 0.52 per kg), with a transit time shortened by around five days compared to sea-air via Dubai. In short, shipping sea-air via Los Angeles is less costly and faster when compared to a modal shift in Dubai.

Global air freight shippers should monitor the situation closely and be prepared for possible disruptions. The Red Sea crisis poses a serious threat to the ocean shipping on Asia to Europe routes and could extend beyond the immediate routes for air freight and into other trades.

Want to Learn More?

Watch the latest episode of our monthly State of the Market Webinar for air freight rates to see where you stand in the volatile markets. If you have any questions, please send them to info@xeneta.com.

.png)