The Red Sea crisis shows no signs of easing as A.P. Moller – Maersk announces it is pausing all transits through the region ‘for the foreseeable future’ and ocean freight shipping rates continue to surge.

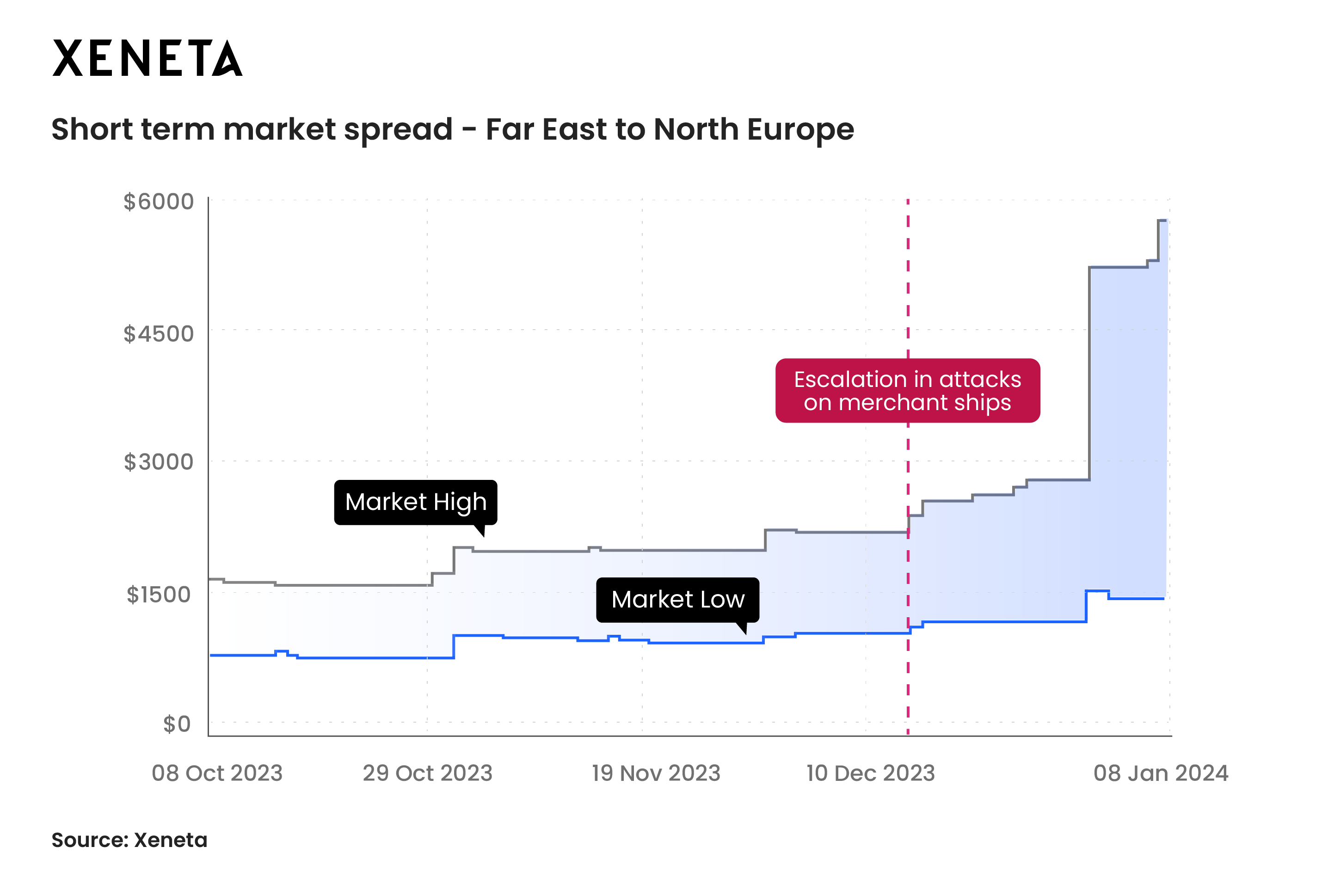

The latest data from Xeneta released today, 9 January, shows ocean freight shipping rates between the Far East and North Europe have increased 124% since the crisis escalated in mid December 2023. Rates between the Far East and US East Coast have increased by 45% and rates into the Mediterranean have increased by 118%.

Peter Sand, Xeneta Chief Analyst, believes the announcement by Maersk on Friday, 5 January, could prove to be a significant waypoint in the crisis as shippers look to protect their supply chains.

He said: “The upside to the Maersk announcement is that it gives shippers clarity to take decisive action. The downside is that the situation is going to get worse before it gets better.

“Shippers will be urgently looking to secure capacity with freight forwarders and carriers. They must also look at availability of equipment. You need the box as well as space on board the ship, otherwise you are in trouble.

“Another immediate priority for shippers is to get more goods moving because this disruption will result in much higher floating inventories. For example, if a shipper had bookings on 14 vessels before the crisis, that will now be 17.

“They need to get their act together quickly, especially with the traditional squeeze on capacity in the run up to Chinese Lunar New Year on the way.”

Sand is warning securing reliability and stability in ocean freight shipping during a black swan event such as the Red Sea crisis will come at a cost.

He said: “Shippers are being told agreements on long term rates will not be honored and are being pushed onto the spot market. The budgets they agreed, sometimes as recently as last month, can be thrown out of the window.

“This results in big differences in the amount shippers are paying and a widening gap between the market high and the market low. At times like this, shippers should not want to be paying the lowest price because ocean freight carriers will look at those contracts and deem them to be lower priority than those agreed on the spot market at higher rates.

“The over-supply of container shipping capacity we saw in the market in 2023 may not be readily available to save the day. If there is no room on the ship, your goods won’t be moved. It’s a serious risk to supply chains.

“That is why many Xeneta customers are using our platform to target mid-high rates on the short term market during new negotiations with freight forwarders and carriers to ensure their containers make it onto the ship. It also means they can have internal discussions with the Chief Financial Officer to reset a realistic budget based on reliable market data and intelligence.”

If we look back a little further to the end of October 2023, rates between the Far East and North Europe have increased by 201% to today’s level.

With such significant upswings in the cost of ocean freight shipping, Sand has warned against misinformation and opportunistic behaviors which can be witnessed during black swan events.

He said: “There will be shippers out there with limited ability to monitor and analyse the market who could be taken advantage of. A freight forwarder could throw out ridiculous prices and a shipper who is desperate to protect supply chains may decide to accept it if they have no understanding of the market.

“This is why it is so important during a black swan event to have reliable, neutral data upon which you can make your business decisions.”

Navigate the uncertainty and minimise supply chain disruption by following the four steps in this guide here.

.png)

.avif)