The October 2019 Xeneta Shipping Index public update and commentary on the long-term market is now available. Here is a snippet of how that market has moved so far in September 2019 on the main trade corridors.

You can find an excerpt of the report below. Get the full October 2019 XSI® report (PDF) with all graphs here.

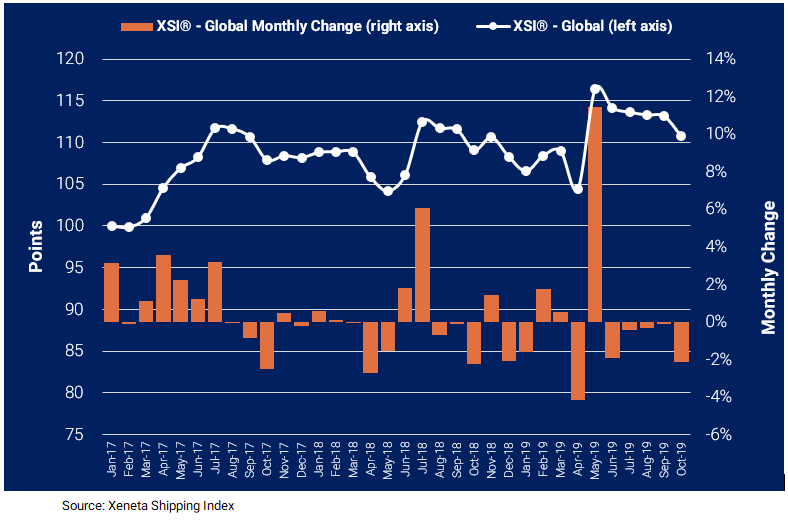

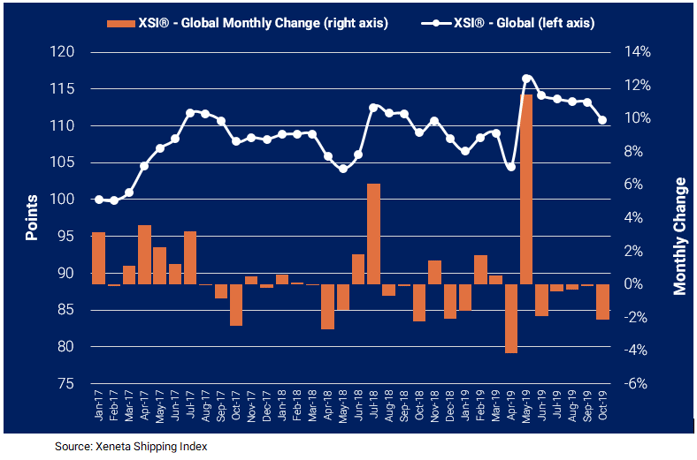

XSI - Global

The global XSI fell by 2.2% in October to 110.74 points, thereby marking the fifth consecutive monthly decline.

Elsewhere, the next few months could be critical in shaping contract negotiations on key trade lanes, with significant FAK increases planned on the Far East-North Europe trade, as well as the transpacific for November 1st.

XSI - Europe Imports / Exports

Imports on the European XSI remained mostly unchanged month-on-month in Oct-19, falling by just 0.1% to 111.42. While the index is 3.6% higher than in Oct-18 and is up 1.8% since the end of last year, it has failed to gain any sustained upward momentum, fluctuating between 106.83 and 112.95 points since Jul-18.

In signs that the Far East-North Europe trade faces continued headwinds, Maersk and MSC have announced they will be extending the suspension of their AE2/Swan service by an additional 2 weeks.

The short-term capacity reduction will be combined with efforts to increase FAK rates to $1,100 per TEU, while CMA CGM is similarly looking to raise them to $1,000 TEU. Whether the short-term capacity reduction will be enough to ensure the increase is sustained is questionable, given rates have been falling since the start of 2019 and previous improvements have been short-lived. However, with annual contract negotiations on the horizon carriers will desperately try and improve rate conditions, even if only temporarily.

XSI - Far East Imports / Exports

Far East imports on the XSI fell to another all-time low having declined by 4.5% in Oct-19. At 93.83 points the benchmark is 17.6% lower than the same period of 2018 and is down 17.3% since the end of last year.

Meanwhile, Far East exports declined by 4.0% in Oct-19 to 117.25, thereby reversing the gains reported over the previous two months. This fall means the index is now 3.0% lower than in Oct-18 and is down 0.9% since the end of 2018.

XSI - US Imports / Exports

Imports on the US XSI fell by 0.3% in October to 121.78 points. Despite the month-on-month decline, the index remains close to an all-time high. As a result, it remains 20.3% higher than in the same period of last year and is up 19.9% since the end of 2018.

Meanwhile, exports remained almost unchanged since September, at 94.22 points. Compared to the equivalent period of 2018, the index is up 10.8% and it has risen by 7.6% since Dec-18.

Don't miss out! Get your copy of the full October 2019 XSI report (PDF) with all graphs now. Xeneta Shipping Index Public .

MEDIA: Please have a look at the press release here.

.png)

-1.jpg)