After over two years of rising rates and overstretched capacity, the rapidly cooling ocean freight market looks set for an "extremely challenging" 2023.

Dark clouds are ahead for the global economy as falling demand is going to affect business for shippers and carriers. The cost-of-living crisis will decide the destiny of changing consumer demand over time.

With a lot of uncertainty still looming in the supply chain industry, we are happy to share key takeaways from our recently published customer report to help you prepare for what seems to be a rocky start to the new year in terms of declining demand, volumes and freight rates.

With more and more services coming back after the pandemic (travel, hospitality, entertainment, dining out etc.), the share of wallet, i.e., the spend on goods, should return to pre-covid levels, falling from the elevated share during the Covid years.

For volumes to remain unchanged from 2022, a fast normalization of energy prices, a swift decline in European inflation and a China without a zero-Covid policy must occur. At their very best, transported volumes will be on par with the 2022 level, with most being to the downside. Volumes for 2023 could fall by up to 2.5% points. Some expect that we can see even larger volume drops than that.

Shippers will see their volumes reduced and will have less leverage to negotiate with carriers. However, this will overlap with carriers becoming desperate for any volume. In between, Freight Forwarders may find a sweet spot, catering to the SMEs while playing the short market against the carriers.

In addition to the above, geopolitical turmoil and too much stimulation of the economy through the COVID crisis might push us into an extended period of low economic growth.

Fasten seatbelts for a bumpy ride in the skies

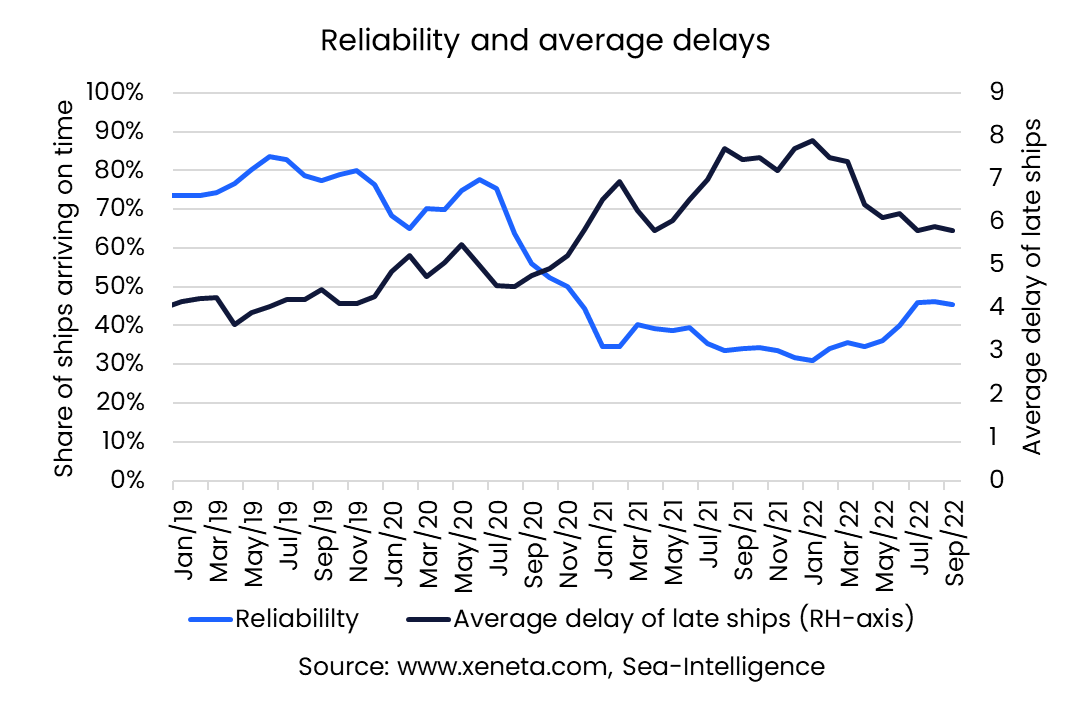

For air, 'general' cargo demand will fall more than 'special' cargo. The historically low schedule reliability numbers of the ocean carriers prompted many shippers to move a higher share of their goods by air.

However, as port congestion eases, it can be expected that schedule reliability will improve. This will increase confidence levels among shippers and therefore reduce the need for air freight.

So, there will be a trend of a modal shift away from the air back to the less-costly ocean shipping option.

The relative cost difference between air and ocean will play a minor role here, but a key factor that pops up more and more in conversations with shippers/BCOs is the focus on reducing their carbon footprint.

This could dampen the growth of the general air cargo market. These developments are insignificant for the ocean market, but the tiniest move from ocean to air can significantly impact the air market.

The space race backtracks

As demand falls, congestion eases. Congestion is currently at around 8%, but this could fall to 4%, depending on the USWC, USEC, and North Europe.

If congestion eases across the globe, we will see even more shipping capacity returning to active service on the trade lanes. This move is already underway, but the trend will increase the pace. Soon after, carriers will also plan to redeploy ships to their pre-pandemic routes.

Redundancy notices

Idling of ships will start climbing again, from next to nothing at present up to 1 million TEU or maybe more. Demolition will remain low for the year as 'candidate' ships are still out on charter to a carrier and generally represent a small share of the fleet.

With a nominal inflow of 1.65m TEU and some demolitions to dent the growth, the fleet will grow by +5.9%, meaning that overcapacity will once again reign. Only if we assume the upcoming number of demolitions to exceed a doubling from our base case fleet growth could go below 5%.

Renegotiations between the shipyards and the shipowners that delay the delivery of the ship will have the same impact. Meanwhile, the new regulations (EEXI, CII, EU ETS) will speed up the shift to new fuel options, slow steaming, derating of engines etc. This element represents a big unknown, but we expect the impact to be gradual over the coming year, with very little instant effect on the market balance.

Finally, we are yet to see a signed agreement between the ILWU and PMA that will prevent frequent and more widespread disruptions like strikes and lockouts at the US West Coast ports and terminals than we see today.

In the meantime, the recurring strikes in the UK and clogged-up ports in North Europe prevent a full return to ‘business as usual in that part of the global supply chain.

.png?width=945&height=649&name=image%20(42).png)

Calming the belly ache

The long-awaited air freight belly capacity is expected to recover further on East Asia-associated routes. However, there is still some caution surrounding current Covid lockdowns in China, Hong Kong, South Korea and Japan, and a potential surge of Covid infections during the winter season may postpone/set back any recovery of passenger traffic.

Supply will continue to recover/grow because of more intercontinental passengers traveling the world, resulting in more belly capacity. Secondly, the conversion and freighter orders placed during the air cargo peak will start hitting the market.

However, in many markets, this increase in capacity is unlikely to be supported by a similar growth in demand, therefore putting downward pressure on load factors. One element in the supply chain that could still cause congestion is the lack of operational staff at airports, airlines and forwarders. The level of automation in the general air cargo market (as opposed to the small parcel business) is very low.

Pressure will squeeze rates

The current economic turmoil indicates that rates will continue to go down. We expect rates to reduce significantly. Carriers will try to fight this fall as best as they can, but it's a tough fight to win with too much capacity expected on most trade lanes. In spite of the high consolidation of the capacity within the alliances, carriers are still not aligning or adjusting their capacity to prevent falling rates.

So downward pressure will continue in 2023 until the rates fall below break-even (which is at a higher benchmark now than before the Covid years).

We could see spot rates on some of the main trades drop below pre-pandemic levels during the first half of 2023, as demand is weakest in the first couple of quarters.

As the obstacles snarling the supply chains decline, nothing is left to keep spot rates elevated. Long-term rates will drop faster as older and much more expensive contracts expire and new, much lower contracts are signed. Long-term rates will not drop below spot rates during the first half of 2023.

Air cargo rates are expected to continue their downward trajectory, which has been much more gradual than on the ocean side. However, there will be regional differences, depending on how much capacity expansion will exceed growth in demand.

After the Chinese lunar new year (Jan 22, 2023), air cargo demand and freight rates are set to fall. Short-term rates will fall below long-term rates due to imbalances in supply and demand.

Airlines will reduce freighter cargo operations (cargo in cabin) and move oversupplied freighters to East Asia, Europe and the Americas routes to chase higher margins. Air freight rates are unlikely to fall to pre-Covid levels in the first half of 2023.This is impacted by the slow recovery of air cargo belly capacity in East Asia, labor shortages, rerouted European flights due to the war in Ukraine, elevated jet fuel prices, and high inflation.

During an air market downturn, freight rate validities are expected to be shorter as freight buyers are reluctant to fix rates on a falling freight rate market. There is increasing interest in vertical integration, and so carriers are taking more business within traditional air cargo and freight forwarder territory.

Forewarned is forearmed

Expect cyclical trends in the first quarter but with bigger swings up and down than we have seen before. Businesses should prepare to capitalize on the few opportunities that will appear.

This is where access to real-time market intelligence and the best data available is a crucial weapon in the fight to cut costs. Geopolitical events will keep everyone guessing about the future of the supply chain.

As China’s President Xi Jinping begins his third term in office, the policy of rolling Covid lockdowns across the country remains but will become less relevant as China will deliver the goods despite any obstacles. However, if China occupies Taiwan, we will have trouble. If Russia's invasion of Ukraine involves using tactical nukes, we will have trouble.

But we must be on our toes for potential curveballs.

What happens if the Ukraine - Russia war comes to an end sooner than later? This could give consumers a positive boost as the costs of many goods can decrease. On the flip side, it's important that we are not too optimistic too soon, as we can experience a second economic downturn sooner than we can say "ship".

... And if carriers pull out capacity over the next months and the economy bounces back it would create a real squeeze which could send rates quickly back up.

These 'what ifs' can, yet again, be a huge surprise factor for the industry. We can very well see ourselves in the same situation we were in when Covid hit.

Albeit, if we've learned anything in the past couple of years, planning for the unthinkable and the "what ifs" must be top of mind. There is a lot that can be debated on these topics - and much can be made of why rates could go back up. But 2023 is set to be a year of geopolitical headwinds either way.

Want to learn More?

Sign up today for our flagship monthly State of the Market Webinar to stay on top of the latest market developments and learn how changing market conditions might affect your contract negotiations.

Note: Xeneta customers are invited to join the upcoming exclusive customer session. To learn more, please visit your 'Xeneta Customer Hub.'