Welcome to Xeneta Newsroom - Your Weekly Dose of Shipping Market Insight!

Watch the latest episode of our weekly LinkedIn LIVE series where we deliver timely shipping market insights. This 10-minute expert commentary from Xeneta's Chief Analyst and market expert, Peter Sand will provide you with specific market updates so that you can anticipate any upcoming changes or disruptions and react faster to the ever-changing market conditions.

In case you missed the latest episode, you can still enjoy the recorded session HERE.

US WC Troubles Are Still Brewing

"Patience is still required", says Peter as he talks about other issues adding to the US WC troubles.

Another issue adding to the US WC troubles, including the above-mentioned port labor negotiations, is the increased time that containers on a nationwide US basis take from imports being picked up at the terminal to being returned empty. It's up from eight days to 12 cents in early May.

It is partly because major American importers are rising inventories ahead of the potential slowdown in processing boxes, going into the West Coast, anticipating not facing the same problems as last year. All of that has, of course, made some stockpiles early on.

Even though retail sales are still growing slowly, depending on which sectors or sub-sectors you focus on - durables or non-durable goods; the picture may be somewhat different obviously, but inflation will also take its toll.

Even though Peter does not expect it to fall off the cliff, he points out that the US Central bank hiked interest rates by three-quarters of a percentage point last week, which we may expect more in the future. "This is, of course, an economic headwear facing sales across the globe, and it will also bring down global containerized demand or demand for transportation," says Peter.

The silver lining is that many of the clocked-up hinterland connectivity and the ships deployed away from home right now may find time to get back and for the systems to normalize. Patience is still required.

How Can Carriers Opt For Better Ways To Spend Money?

Freight Rates Update From North Europe to Far East Main

Freight Rates Update From North Europe to Far East Main (Reefer)

Freight Rates Update From Far East Main To US WC

News From The Xeneta Blog: Air Freight Special

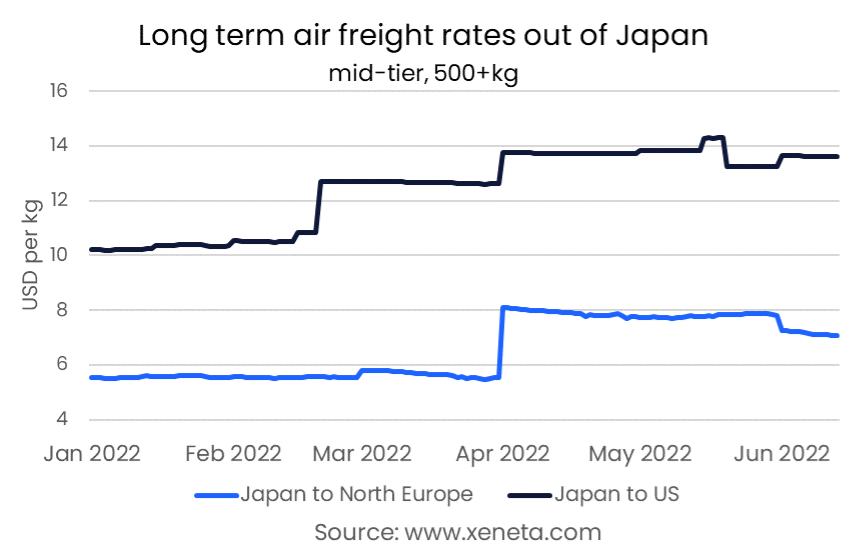

Our weekly rate update last week was for cargo for people shipping goods out of Japan, going into Europe and US. For going into Europe, the immediate aftermath of the closure of Russian airspace for many airlines prompted a lift in freight rates, from below $6 per kilo to up $8 per kilo, as per Xeneta data.

The demand for goods being transported into the US, even though rising, is much more steady. We still have a lot of lagging belly capacity for intercontinental flights from Asia to North America, from Asia to northern Europe, etc. Read full update HERE.

Want To Learn More?

With a possible global recession on the brink, shipping and supply chains will be put under further pressure.

Schedule a personalized demo of the Xeneta platform and learn how on-demand freight rate and market insight data will help you navigate through the current climate and identify potential savings in your freight spend.

.png)