As a special summer gift, we are bringing not one, but two freight rate updates for you this week. So let's start our rate update discussion with air freight rates out of Shanghai, followed by our regular container rate update later in the week.

Shanghai is once again experiencing rising COVID cases, just over a month after the easing of the previous lockdown was announced, from which air cargo volumes and capacity are yet to recover completely.

Compared to the peak of the lockdown in April, both cargo volumes and capacity have increased, as has the dynamic load factor, rising from 69% for all exports out of Shanghai in April to 93% in June.

Short Term Air Freight Rates Out of Shanghai

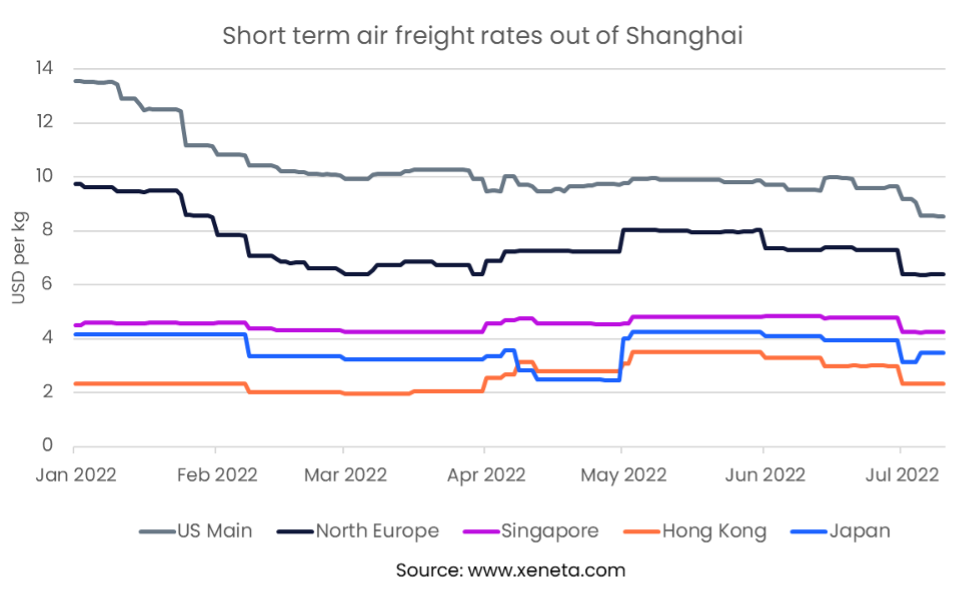

Despite the increase in the dynamic load factor, freight rates for cargo out of Shanghai have dropped on both the major outbound and intra-Asian trades.

Despite the increase in the dynamic load factor, freight rates for cargo out of Shanghai have dropped on both the major outbound and intra-Asian trades.

For example, at the start of July, short-term rates between Shanghai and Hong Kong for low and mid-tier cargoes (between 500 and 1 000 kg) have fallen to USD 2.32 per kg, down from USD 3.5 per kg in early May 2022, and at the same level as at the start of the year.

After a period of stability, the rates to Singapore and Japan dropped at the beginning of July 2022. However, the rates also reached the levels of early January 2022.

Short-term rates to Singapore stand at USD 4.2 per kg on 1 July, a 6% decrease from 1 January, while those to Japan have fallen by 25% since the start of the year to USD 3.1 per kg.

Since the start of the year, an even larger fall in the spot rate has happened on the major long-haul trades out of Shanghai. Rates to the US have fallen by 32% since the start of the year, bringing rates to USD 8.5 per kg, their lowest level since August 2021.

After stabilizing at the height of the lockdown, spot rates to North Europe again started dropping from mid-June, falling to USD per kg on 1 July, their lowest level since September 2021. This is despite an increase in the dynamic load factor, which rose to 93% in June, recovering from its trough of 63% in April at the height of the lockdown.

Want to Learn More?

Sign up today for our upcoming monthly State of the Market Webinar for ocean freight rates to learn what to expect as the long-term rates just hit record highs – again!

If you have any questions, please send them to info@xeneta.com.

.png)