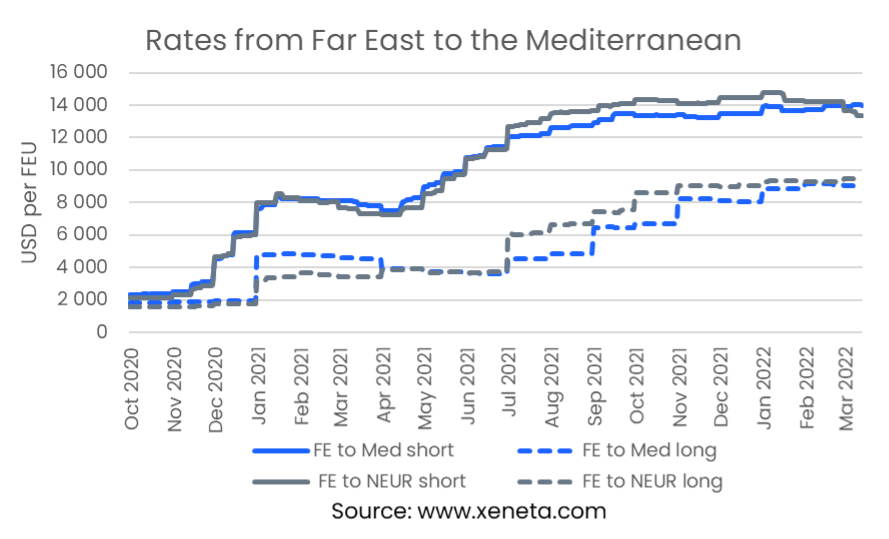

Container Freight Rates going from the Far East to the Mediterranean have been flat since this year, holding at USD 14 000 per FEU on the spot market and close to USD 9 000 for long-term contracts. In fact, on the short-term market, rates haven’t grown by much since the end of September 2021. As with other European-bound trades, freight rates were driven up, not by high volume growth but by disruptions to the industry.

Container Freight Rates on the Far East to the Mediterranean have been flat since the start of this year.

While there are still plenty of problems causing inefficiencies on a global level, conditions haven’t deteriorated significantly in the months up to mid-March.

However, with the recent lockdowns in China, this may be set to change. Instead, they are enough to keep freight rates up on the trades not directly affected by the huge congestion problems elsewhere but not push them higher up.

Long term rates have followed spot freight rates upwards, with long term contracts signed in the past three months up 100% from at the same time last year. Shippers are accepting these higher rates to get capacity commitments to minimise the risks to their operations from ongoing problems in container shipping and, more broadly, supply chains.

Rates from the Far East to the Mediterranean tend to follow those to North Europe closely, and the two have followed similar upwards paths in the past 18 months, though in the second half of 2021, a slight gap opened between the two.

Rates from the Far East to the Mediterranean tend to follow those to North Europe closely, and the two have followed similar upwards paths in the past 18 months, though in the second half of 2021, a slight gap opened between the two.

In the second half of 2021, spot rates to North Europe from the Far East were on average USD 860 per FEU higher than those to the Mediterranean, while long term rates were USD 1 350 per FEU higher.

In the first two and a half months of 2022, the gap between the two has again fallen, and on the spot market, a fall in spot rates to North Europe has fallen, leaving them cheaper than the shorter journey to the main Mediterranean ports and hubs.

As the long-term market gap has also fallen, leaving the rates at similar levels - few industries, including automotive, have recently been importing through Mediterranean ports. However, switching to importing through Mediterranean ports instead of sailing further North will not offer any substantial discount on freight rates for shippers.

Despite the softening in spot rates to North Europe in March, the latest COVID lockdown in southern China may leave both shippers and carriers again having to find solutions to new problems quickly.

Should the situation deteriorate further, it may stop the current trend of softening spot rates.

Want to Learn More?

Sign up for our March State of the Market Webinar for ocean freight rates.

If you have any questions, please send them to info@xeneta.com.

.png)