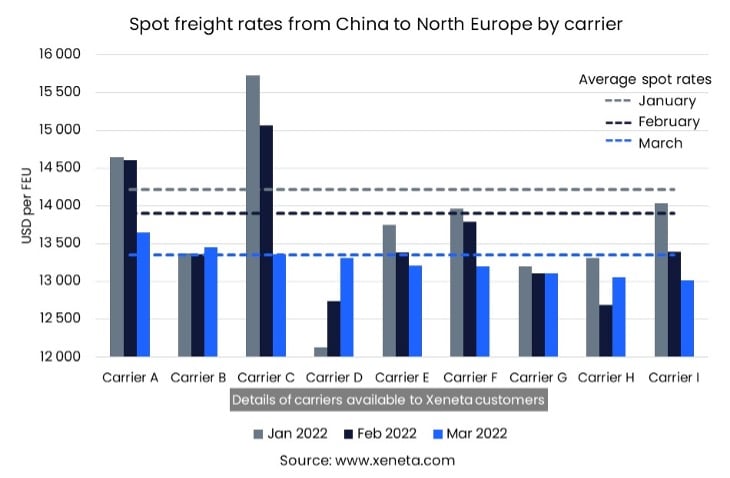

Spot freight rates from China to Europe suffered their biggest day-on-day drop since they started their upwards journey in 2020 as February turned to March. On 1 March, the average spot freight rate fell by almost USD 500 per FEU, landing at USD 13 340 per FEU. This marks the first time since September 2021 that spot freight rates on this trade are below USD 13 500.

However, it is still incredibly high compared to pre-pandemic years; in 2018- 2020, average spot rates in March on this trade stood at USD 1 500 per FEU. This lower rate equals the current Priority Shipment Fees being charged on top of the already very high freight rate. China to North Europe trade PSFs ranges from USD 1 100 to USD 2 200 per FEU.

Fall in spot freight rates from China to North Europe

The fall in average spot rates hides differences among average rates from different carriers. Some fell substantially; others increased while still others remained flat. However, the range between the different rates came down considerably in March.

In February, the most expensive carrier had a rate that was USD 2 380 per FEU higher than the carrier at the other end of the scale. In March, the spread has fallen to close to a third of that at USD 630.

A narrower spread indicates ample deployed capacity.

A narrower spread indicates ample deployed capacity.

While by no means a return to the ‘old normal’, the decreasing spread suggests the trade is becoming more competitive. This is due to a fall in uncertainty that plagued the first few months of the year and the unknown around Chinese New Year, despite the new risks associated with the war in Ukraine.

Fundamentally growth in demand is not particularly strong, and there is the capacity to meet it, giving shippers more options and forcing carriers more into line and a lower level. There is still a long way to go before a return to lower freight rates, but this may well be the start of that journey, with the big caveat that global geopolitical or health-related developments could once again throw basic supply/demand principles out of the window.

Want to Learn More?

Sign up for our March State of the Market Webinar for ocean freight rates.

If you have any questions, please send them to info@xeneta.com.

.png)