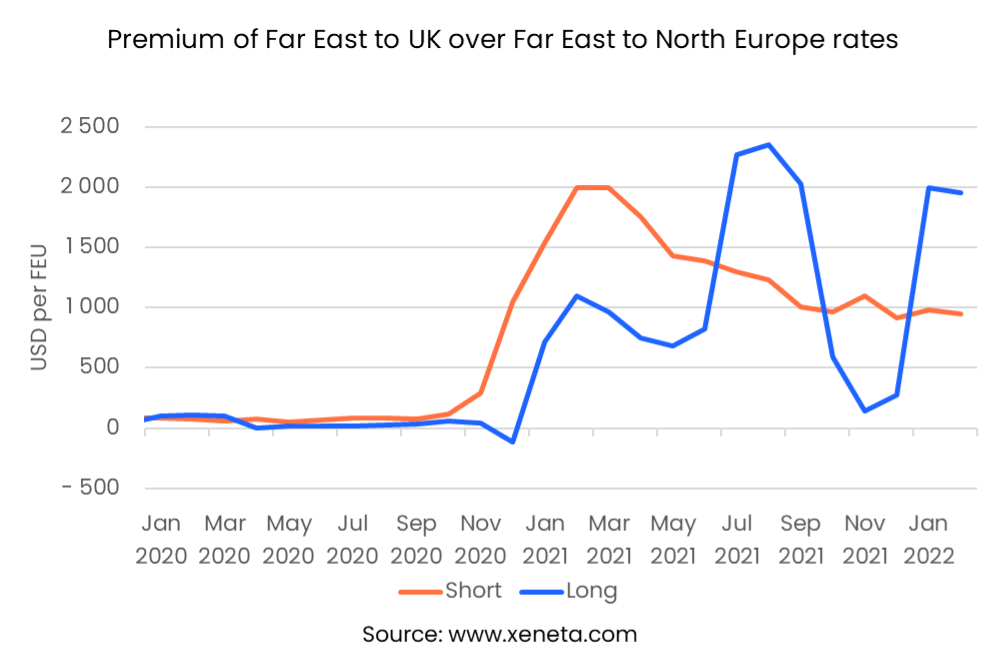

The proximity of the main UK ports and the main ports in North Europe means that historically freight rates to these areas have been the same; however, this relationship has changed over the past year. In a post-Brexit world, shippers are paying a considerable premium for UK ports compared to North Europe. This is the case both on the short- and long-term contracts.

As of mid-February, the short-term market costs an average of USD 15350 to get a container from the Far East to the UK, which has not been under 15000 since mid-September 2021.

Shipping into a port south of the English Channel would save you more than USD 950 per container, as spot rates from the Far East to North Europe never passed the USD 15000 per FEU mark.

Shipping to the UK from the Far East is considerably more expensive than going to the continent.

This premium is, in fact, lower than it has been for many months, having topped at USD 1 995 per FEU in March 2021. In 2021, you would have saved USD 1400 per FEU on average into North Europe instead of the UK, whereas in 2019 and the first half of 2020, the difference in rates was non-existent at USD 70 per FEU.

On the long-term market, the premium for going to the UK has jumped considerably as long-term rates to the UK rose by close to USD 2 000 per FEU as we entered the new year, while those from the Far East to North Europe only increased by USD 200.

Rates for long term contracts signed in the past three months stand at USD 11 359 per FEU from the Far East to the UK and USD 9 408 for those going to North Europe.

Of the three ports under Xeneta’s definition of the main UK ports, the lowest freight rate on both the long and short-term market is for containers going to Felixstowe.

At the other end of the scale, London Gateway is by far the most expensive on the long-term market (USD 13 400 per FEU), but is still cheaper than Southampton on the spot market, as here rates lie at USD 15800.

Want to Learn More?

Register Now for our February State of the Market Webinar.

If you have any questions, please send them to info@xeneta.com.

.png)