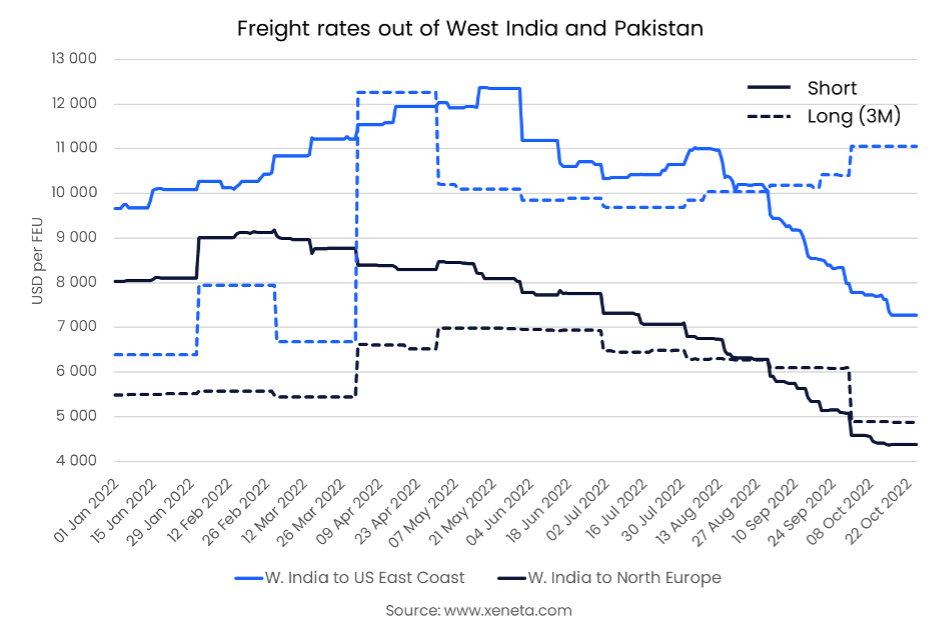

Similar to the major global trades, spot rates out of West India and Pakistan have seen considerable decreases in the past few months, though the movement on long-term rates has been more split.

The average long-term rates signed in the past three months from West India to the US East Coast increased in October by USD 600 per FEU from the end of September till 25 October. This increase comes despite the continuous decline in spot rates, leading the spread between long and short-term rates to rise to a record high of USD 3 800 per FEU.

Spot rates from West India to the US East Coast have fallen to USD 7 300 per FEU from a peak of USD 12 400 per FEU at the end of May 2022.

Read more below in Xeneta's weekly container rate update.

Demand from the broader Indian subcontinent to the US East Coast has grown strongly in the first eight months of the year. According to CTS, volumes are up by 10.1% from the first eight months of last year, yet another trade contributing to record-high imports through the US East Coast.

In contrast, volumes from the Indian subcontinent to North Europe have grown by a much smaller 1.1%, though more containers are still exported to North Europe than to the US East Coast from the Indian subcontinent.

Spot rates from West India to North Europe peaked earlier, hitting USD 9 100 per FEU in March 2022. Since then, they have fallen to less than half that level today: USD 4 400 per FEU.

Despite spot rates moving in the same direction in recent months, long-term rates to North Europe have fallen recently, in contrast to the development in long-term rates to the US East Coast. The average rate for long-term contracts signed in the past three months from West India to North Europe has fallen by USD 1 200 from the end of September, down to USD 4 900 per FEU as of 25 October.

The average rate for long-term contracts signed in the past three months to North Europe has fallen to its lowest level since last year, having peaked at over USD 7 000 per FEU in Q2 2022. However, looking at the average of all valid long-term contracts, the rate has fallen by much less, currently at USD 5 770 per FEU, more than double the average long-term rate for all contracts at the end of last year.

Note:

The 'Weekly Container Rates Update' blog analysis is derived directly from the Xeneta platform. In some instances, it may diverge from the public rates available on the XSI ®-C (Xeneta Shipping Index by Compass, xsi.xeneta.com. Both indices are based on the same Xeneta data set and data quality procedures; however, they differ in their aggregation methodologies.

Want to learn more?

Sign up today for our upcoming monthly State of the Market Webinar to stay on top of the latest market developments and learn how changing market conditions might affect your contract negotiations.

PS: Missed the LIVE session? Sign up to get the full webinar recording.

.png)