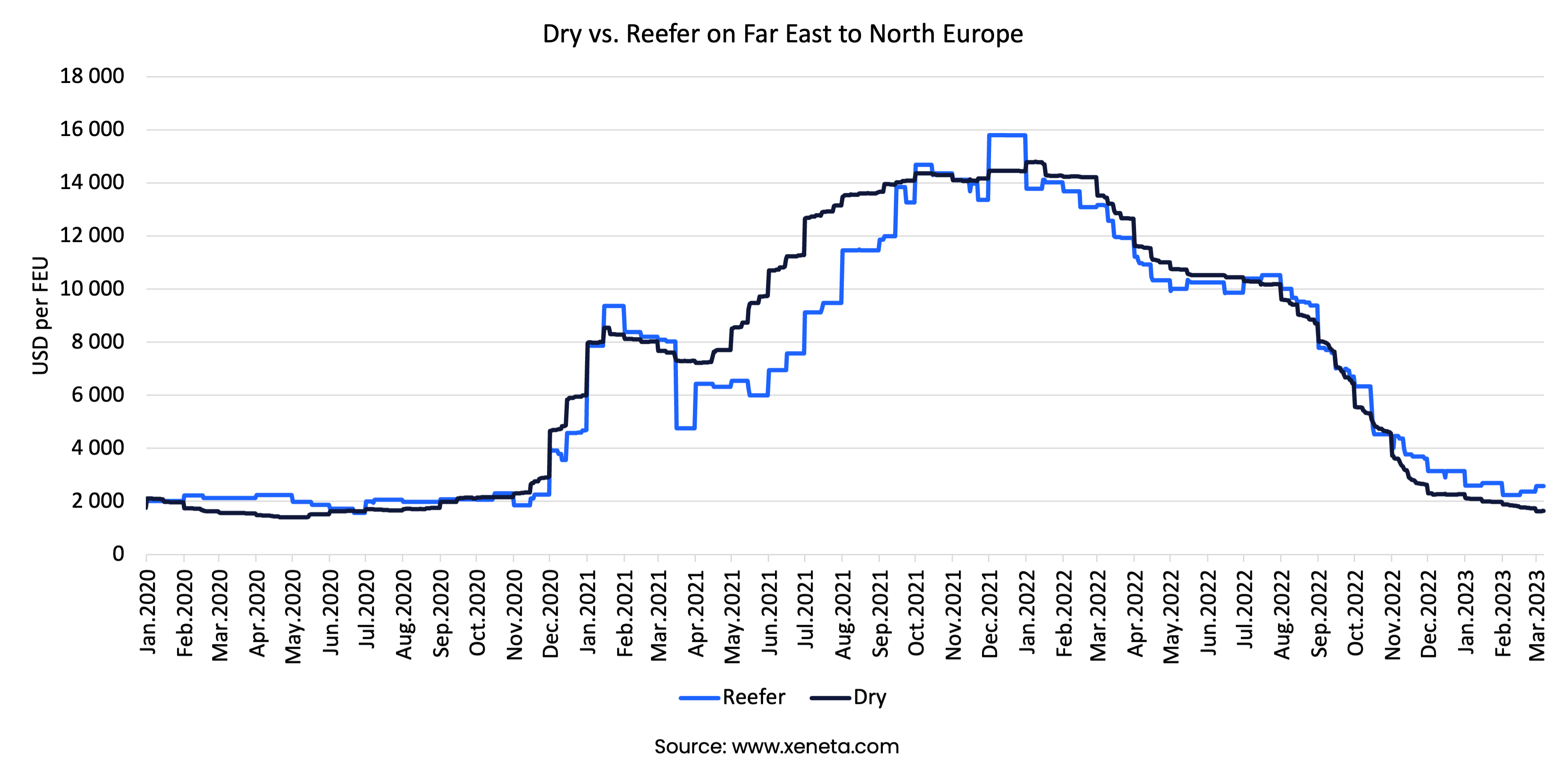

Signs of normalizing market conditions are occurring across global supply chains. Congestion is retreating, carriers are re-designing their networks to a post-pandemic reality, and even inflation is trending down. The signs prevail on the Far East to North Europe trade lane when comparing dry container freight rates to those of reefer containers.

Shippers who buy refrigerated cargo from the Far East to North Europe are yet again charged a premium for the transport service. This was not the case since late 2020 and through the middle of 2022.

During the dramatic Covid-years, especially in 2021, a premium was charged on dry containers, which went as high as

USD 3 600 per FEU on average for the month of June 2021. Since mid-January 2022, freight rates for the two different kinds of equipment have been highly correlated. That early sign of ‘normalization’ has also re-established the earlier relationship between the two that now again see reefers command a premium to dry since July 2022.

Spot rates for reefer as well as dry have been sliding, yet fairly consistently at an average premium of USD 493 per FEU more for a reefer movement - a price spread that is lower than it was in the pre-pandemic era.

The spread between spot container rates for the two different kinds of equipment reopened – as carriers are scrambling for cargoes to reach a profitable filling-factor level for their deployed shipping capacity in an otherwise lethargic spot market. Offering lower rates on dry containers is one measure, for this backhaul trade lane.

Blanking around 30% of the announced container shipping capacity sailing on this trade lane apparently is not enough.

Reefer spot container rates are very close to pre-pandemic levels, whereas dry container spot rates don’t seem to have found a floor just yet.

For European exporters of refrigerated goods, this return to normal is welcomed. The shortage of reefer equipment is no longer prevailing compared to when carriers favored the higher-paying easier-to-handle dry containers at the peak of the market.

Since reefer became the higher-paying cargo and spot dry cargo volumes retreated fast, the equipment shortage also evaporated. Now, mostly blank sailings are creating disruptions for front-haul reefer cargoes from Europe to the Far East, as ships don’t show up at all – if they are blanked.

Note:

The 'Weekly Container Rates Update' blog analysis is derived directly from the Xeneta platform. In some instances, it may diverge from the public rates available on the XSI ®-C (Xeneta Shipping Index by Compass, xsi.xeneta.com. Both indices are based on the same Xeneta data set and data quality procedures; however, they differ in their aggregation methodologies.

Want to learn more?

Sign up today for our upcoming monthly State of the Market Webinar to stay on top of the latest market developments and learn how changing market conditions might affect your contract negotiations.

PS: Missed the LIVE session? Sign up to get the full webinar recording.

.png)