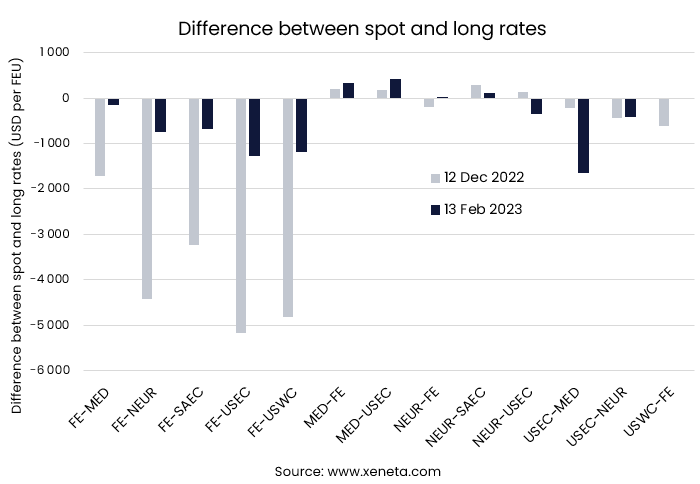

The premium paid by shippers contracting on the long term instead of the spot market has fallen dramatically on several major trades in just a couple of months. On five major trades out of the Far East, the average spot rate is now ‘just ‘ USD 810 per FEU lower than the average long-term rate, down from close to USD 3 900 per FEU just two months ago in mid-December.

The largest fall in the premium between spot and long rates in value terms was from the Far East to the US East Coast. Spot rates are now USD 1 280 per FEU, cheaper than long-term rates. In mid-December, shippers were paying USD 5 180 per FEU more for long-term contracts.

With TPM approaching and many US shippers preparing to sign new long-term contracts, expect the premium for long-term rates to continue to fall. Though carriers initially tried to ring-fence contract rates and protect them at higher levels, the high competition for volumes and the possibility of shippers moving to the spot market means they have been unable to maintain the premium for long-term rates.

On major fronthaul trades, the smallest difference between spot and long-term rates can be found from the Far East to the Mediterranean, with the premium now standing at only USD 150 per FEU. Here spot rates are currently averaging USD 3 120 per FEU, whereas new long-term contracts are averaging USD 3 270.

Despite the falling contract rates, many shippers are still looking to secure index-linked contracts to ensure they don’t miss out on further drops in rates. In a recent webinar for Xeneta customers, almost a quarter of participants responded they were signing up for index-linked 12-month deals.

Another one in five participants revealed they were shortening the length of their new long-term contracts to between 3 and 6 months to benefit from what is expected to be a continued downward trend.

On four of the smaller of Xeneta’s top 13 trades, shippers on the spot market are paying more than those signing new long-term contracts.

All four are trades out of Europe, two from the Mediterranean to the Far East and the US East Coast, as well as from North Europe to the Far East and to the South American East Coast.

On these trades, shippers have to pay between USD 10 per FEU and USD 430 per FEU more for boxes moved on the spot market than those on long-term contracts.

Note:

The 'Weekly Container Rates Update' blog analysis is derived directly from the Xeneta platform. In some instances, it may diverge from the public rates available on the XSI ®-C (Xeneta Shipping Index by Compass, xsi.xeneta.com. Both indices are based on the same Xeneta data set and data quality procedures; however, they differ in their aggregation methodologies.

Want to learn more?

Sign up today for our upcoming monthly State of the Market Webinar to stay on top of the latest market developments and learn how changing market conditions might affect your contract negotiations.

.png)