Both economic performance and the outlook for Europe have been edging downwards since peaking in Q1 2022, partly due to post-Covid-19 developments and the war raging in Ukraine. The conflict ignited inflation in the region and continues to impact the market in terms of consumer behavior.

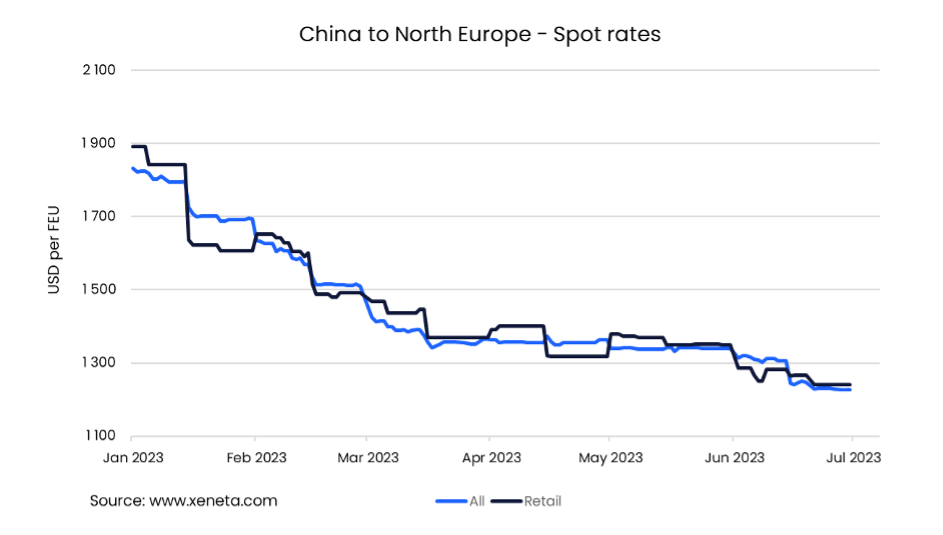

The China to North Europe trade lane has clearly reflected market trends during 2023, and here we dig deeper into the trajectory of retail spot rates on the trade versus the market average.

China dusts itself off but outbound volumes fail to fly

As for the general context, China enjoyed some momentum in economic growth following the lifting of pandemic restrictions in Q1 2023. However, the pick-up in outbound volumes of loaded containers has already lost steam (Source: CTS). After monthly year-on-year increases in March and April, demand fell by 1.3 % in May year on year, indicating a sluggish recovery. This is mirrored by China’s Purchasing Managers’ Index (PMI) for the manufacturing sector. Growth throughout the first quarter, peaking at 52.6 points in February, was followed by a slowdown right across Q2, with the PMI sliding to 49.2 in April, 48.8 in May and 49.0 in June (Source: NBS China).

Despite China’s patchy recovery, retail rates for outbound movements to Europe have continued to weaken due to well-documented overcapacity and slow demand resulting from high inflation. At such times, retailers tend to adopt a more conservative approach to inventory levels while keeping a close eye on the financial situation of consumers. On the positive side, according to Eurostat, wages and salaries in the EU had risen 2.8% by Q3 2022, while the OECD indicates that inflation will continue to fall during the rest of this year.

Prices for ocean freight, meanwhile, show no signs of increasing – or of a typical peak season for retail shippers.

Rate differential narrows through first half

Retail rates and the general market average have not exactly been ‘in sync’ since the start of the year. From a positive differential of USD 60 per FEU in the first half of January, retail rates were then less expensive in the second half of the month, with a negative differential of almost USD 90 versus the market average. Rates rose again towards the end of January and into February, to marginally above the market average. Since then, the spread has continued narrow, with retail ending the second quarter at USD 5 above the market average.

The February jump may have been down to a shift in demand following Chinese New Year, with European retailers starting to prepare for the summer season. Earlier learnings will determine how they position themselves in the freight market during Q3 – and all bets are open as to whether there will be another increase in rates in the second half.

Note:

The 'Weekly Container Rates Update' blog analysis is derived directly from the Xeneta platform. In some instances, it may diverge from the public rates available on the XSI ®-C (Xeneta Shipping Index by Compass, xsi.xeneta.com. Both indices are based on the same Xeneta data set and data quality procedures; however, they differ in their aggregation methodologies.

Want to learn more?

Are you looking for visibility into the volatile container shipping market? Find out how simple it is to get the insights and intelligence you need to make sure you, your team and your business quickly adapt to changing market conditions.

Know instantly how your freight rates compare against the market, justify your transportation costs, prepare for your tender period and report on your success with one powerful easy-to-use platform. Get a demo now!

.png)