Looking for the latest update? Read the 2025 supply chain risks.

Proactive risk management is essential to reducing disruption in ocean freight, embracing risk (not just mitigating), and successfully building an anti-fragile supply chain.

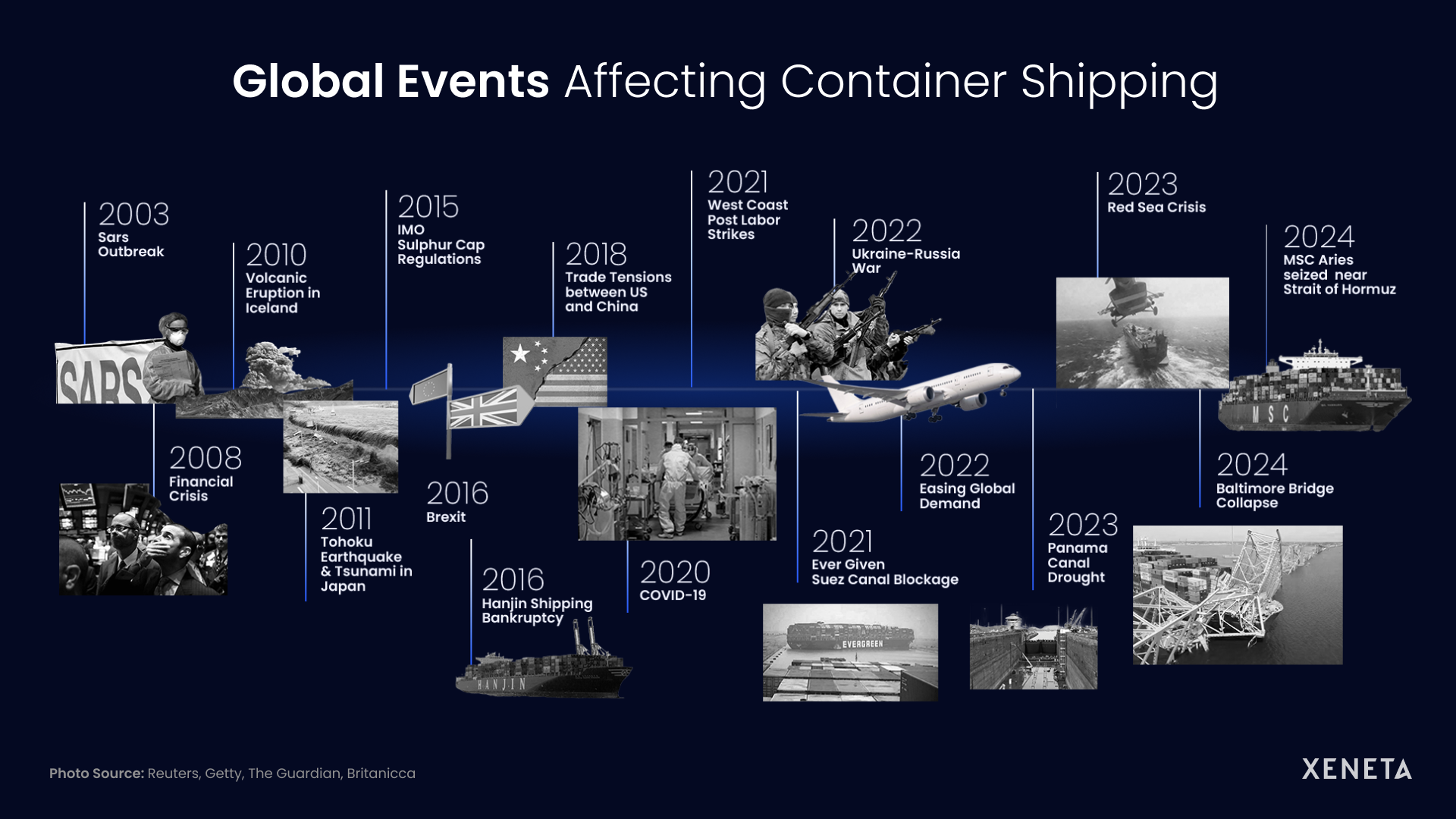

Change is inevitable in modern supply chain management, and risk management is essential to success. As the past six months alone have shown, risks evolve and become more prevalent with time. Risk management strategies of yesteryear are ineffective in this changing landscape, and no mode of transport can avoid risks.

A poor grasp of risk in your supply chain will increase freight spend, jeopardize relationships with suppliers and customers, and see you miss opportunities as the market moves. Not to mention, you’ll be exposing yourself to unnecessary and entirely avoidable disruption.

In no particular order, here are the top ten risks we believe your company needs to monitor and steps you can take to navigate them.

Supply Chain Risk #1: Geopolitics

Geopolitical unrest has launched supply chains into an era of exponential risk. The Red Sea crisis, ongoing Russia-Ukraine war, Iran seizing an Israeli cargo ship, increasing tension over Taiwan, US-imposed tariffs on China imports... each have caused (or have the potential to cause) far-reaching, long-lasting impact on freight rates, schedule reliability, production halts caused by raw material shortages and interruptions to global supply chains.

And with the US Presidential election around the corner, there is added uncertainty over the impact the outcome may have on global trade (particularly in terms of China) and stability in global supply chains in the remainder of 2024 and beyond.

Steps You Can Take...

Increasingly, industries are relying on globalized supply chains. Those who have the ability to do so, might consider shifting towards a more regional focus, improving access to critical resources affected by geopolitical tensions and trade barriers. Some have chosen to reroute their entire networks – moving production closer to the end consumer. Others are looking at ways to diversify their supplier community, enabling the ability to source alternative suppliers if disruptions impact one geographic region.

Onshore. Offshore. Staying global. Going regional. However you choose to navigate geopolitical circumstances, you should maintain a stricter level of compliance in your operations, even if governments allow for a less-stringent approach. These reduce the risk of compliance violations and safeguard against the enforcement of new regulations.

Supply Chain Risk #2: Economic Instability

According to the World Economic Forum, cost of living will dominate global risks in the next two years, with “the knock-on effects being felt most acutely by the most vulnerable parts of society and already-fragile states, contributing to rising poverty, hunger, violent protests, political instability and even state collapse”.

Intermittent lockdowns in response to COVID-19 (particularly in the Middle East and Asia) and ongoing wars are driving up the cost of raw materials. With production low or interrupted, delivery risks and narrow labor markets, the gap between demand and supply has widened, ultimately leading to higher prices and further pressure on procurement teams to source essential resources at a premium. For instance, after Russia's invasion into Ukraine, energy prices increased by 20%.

Carriers are also taking the opportunity to make money from shippers who want to use the spot market to frontload additional volumes ahead of peak season, which has seen rate increases on the world’s top trades since the start of May.

Another area to watch is air cargo. While the transatlantic air cargo corridor has had a weak start to the year, the global air cargo market has seen demand rise to +11% year-on-year for a third consecutive month in March. These higher volumes have outpaced growth in capacity supply in Q1, which increased by +8% year-on-year and can be explained by buoyant e-commerce volumes as well as disruption in ocean containerized shipping.

Steps You Can Take...

As Emily Stausbøll, Senior Analyst at Xeneta notes “There is no single ‘best solution’ in such a complex market – it is a case of each shipper understanding their own supply chains, assessing the risks and using data to gain insights and make evidence-based decisions.”

More than anything, developing an agile procurement strategy will allow for quick adjustments, such as shorter contract terms, a shift in transport modes, or dynamic pricing models during economic instability. Other approaches include diversifying your suppliers and strengthening existing supplier relationships, so you are more likely to receive better communication, flexibility, and support during challenging times. If you have the space, you might also consider increasing inventory buffers for critical materials to ease pressure.

Supply Chain Risk #3: AI and emerging technologies

Generative AI will power nearly 25% of all logistics KPIs by 2028 (Gartner). And executives forecast that 25% of key performance indicators within the field are set to be driven by emerging technology. As it stands, one of the most popular use cases is contract risk analysis, with half of organizations predicted to be using AI-enabled tools to support their supplier contract negotiations by the year 2027. Additionally, the synergy between AI and IoT is creating a highly efficient operational environment, with AI expected to make supply chains 45% more effective in timely and error-free product delivery (Research and Markets).

Another area of interest is digital twin technology. Digital twins create a digital model of a physical product, system, or process, including its functionality, features, and behavior. This model enables organizations to test, monitor and anticipate how proposed changes will perform or will need to be maintained in different conditions before implementing them in the real world. Not only can you create a digital twin for the supply chain (DSCT), it is now possible to create digital twins for customers (DToC). This end-to-end integration of DSCT with DToC will enable better, faster decisions and deliver a more personalized, customized set of supply chain responses in line with shifting customer demands.

Steps You Can Take...

A lot of people are excited about the possibilities of AI across the supply chain, but very few have the internal skillset, technical maturity or data available to deploy AI technology today. Instead, the most common plan for 2024 is to build use cases and conduct pilots.

Before jumping on the GenAI bandwagon, we recommend assessing your organization's level of maturity, talent, appetite for change, internal capability and data availability. It’s also important that you know why you’re using Gen AI, and the impact it will have on existing teams, tools and processes. Start by establishing KPIs before exploring use cases. Before scaling successful pilots, be sure to consider how any new technology will integrate with your existing tech stack too.

Supply Chain Risk #4: Evolving role of the Chief Supply Chain Officer (CSCO)

Speaking at the Gartner Supply Chain Symposium/Xpo, VP Analyst Tom Enright warned that “CSCOs must focus on initiatives that deliver multiple sources of value” or risk losing influence and control of their strategic objectives. This means looking to initiatives that encompass resilience, agility, and sustainability, not just cost management.

These three priorities are being considered by McKinsey & Company as a ‘once-in-a-generation opportunity [for CSCOs] to future-proof their supply chains’ and move procurement operations from a tactical to a strategic mindset; reactive to proactive risk management.

Steps You Can Take...

As well as improving day-today supply chain processes, CSCOs are tasked with the increasingly complex responsibility of anticipating, mitigating, and managing disruptions. This is only possible if you have a complete and comprehensive view of the market. Start with global data coverage — with separate views of short- and long-term rates, schedule reliability, carbon emissions, surcharges and spend benchmarks.

Next, look for partners who offer index-linked contracts. Indexing offers shippers and LSPs a dynamic way to manage freight costs, by attaching contracted rates to a market benchmark. This can translate into greater price stability, risk mitigation, and fairer pricing. When tender acceptance ranges from 98% to just 75% over the course of a freight cycle, indexing can also improve strategic commitments between shipper and carrier by removing friction and building trust in bidding cycles – which are becoming more regular and labor-intensive.

Supply Chain Risk #5: Extreme Weather Events

Extreme weather represents one of the most significant global risks to ocean freight. It is considered the top risk likely to cause a material crisis on a global scale in 2024 (WEF), and it’s not difficult to see why.

Billion-dollar weather events in the U.S. have increased from every four months in the 1980s to every three weeks today (Everstream). Smoke from prolonged wildfires in Canada caused delayed deliveries by up to two days in 2023, while reduced visibility caused shipments in different areas to fall — by up to 75% in some places. Droughts in the Panama Canal have triggered slowdowns on major shipping channels and flash flooding in Dubai was responsible for submerging an international airport.

Forecasts for the upcoming hurricane season (June to November) also suggests heightened risk for weather-related production outages in the U.S. oil and natural gas industry. If forecasts come true, suppliers located in affected areas could experience factory closures and production delays, transportation and distribution routes might be damaged forcing new and longer routes, and increased aid relief efforts could impact capacity levels in certain transport modes – leading to higher freight rates.

Steps You Can Take...

Shippers must evaluate their preferred route use and determine which carriers can increase shipping in anticipation of extreme weather events. This allows for flexibility to scale back operations, or shift modes during tumultuous times. It can also be beneficial to balance between local suppliers to reduce transportation risks and global suppliers to diversify geographical risks.

For carriers, extreme weather events often trigger a surge in demand for crucial commodities such as home repair supplies and essential goods. At the same time, damage to manufacturing facilities, warehouses, and distribution centers can disrupt production and in turn, supply shortages. You could also face fuel shortages and port closures, resulting in heightened price volatility.

Supply Chain Risk #6: Environmental, Social and Governance (ESG)

Impact on the environment makes up another critical risk in global trade. Q1 2024 saw the average Carbon Emissions Index reach above 100 at a global level for the first time – marking a 15.2% increase from Q4 2023. The fact such a high number of trades have seen carbon emissions increase in the past four months, even those that do not ordinarily transit the Suez Canal, demonstrates the global nature of supply chain disruption.

As more laws are passed governing the environment, ocean freight carriers will come under greater scrutiny. The IMO’s target of net zero GHG emissions by 2050 from the international shipping community will also apply pressure on shippers and LSPs to build more sustainable practices into their supply chain. While policy gaps are delaying the scaling of green solutions, we expect to see ESG policies influencing three main areas:

- Supplier and carrier choices,

- Ethical sourcing and procurement practices (Unilever is an industry leader for this),

- Enhanced supply chain transparency and real-time data – for reporting and informed decision-making.

We may also see more companies follow in the footsteps of Philips, who have committed to generating 25% of revenue from circular products, services and solutions by 2025.

Steps You Can Take...

Peter Sand believes that data will be key to supporting the industry on the path to net zero and further regulation may be required to achieve the lofty emissions targets – as well as robust data reporting and analysis.

He said: “We talk about the introduction of EU-ETS emissions regulations in Europe but perhaps some sort of global emissions trading scheme is required – or any other way of putting a price tag on carbon emissions.” Sand also speaks to Xeneta’s Carbon Emissions Index (CEI) in partnership with Marine Benchmark, which provides insight on the carbon intensity of ocean freight shipping lines and carriers across 48 global trades.

“From an actionable point of view, it allows shippers to choose a carrier to transport their cargo with a proven track record for having a low carbon footprint. Maritime shipping also has an energy efficiency index to identify and take action against the poorest performers from an emissions point of view. If you are a bad carbon emitter then you need to do something about it, whether that is slow down, de-rate the engine or scrap the ship.”

Supply Chain Risk #7: Procurement inefficiencies

Despite two decades of shifting business landscapes, procurement operations have remained mostly unchanged. As well as antiquated processes, most procurement teams use just 5%-10% of the tech stack already available to them. Logistics professionals also comb through 3-4 freight data sources on average before feeling they “know the market” enough to make a decision on freight rates, LSP or transport mode. This means for some, there is upwards of 90% of waste in their tech stake and three times the effort to use data they don’t entirely trust.

Limiting solution vendors can be a practical exercise, but sometimes it’s better to look for functional solutions that create an end-to-end procurement platform stack, while removing fragmentation and improving cross-team collaboration.

Steps You Can Take...

Survey your team to best evaluate how they use your existing tech stack. Remove tools and platforms no longer of value, and double check auto-renewals to prevent wasted budget.

For greater cross-team collaboration, align procurement operations with wider business objectives: ensuring all supply chain executives understand the relationship between freight rates and factors such as schedules, capacity, and carrier strategies. This can help facilitate urgent requests, improve cross-team knowledge and collaboration and move the focus of negotiations away from chasing the final dollar.

Supply Chain Risk #8: Cyber-Attacks

Cyber-attacks are a predominant risk in modern supply chain management. Gartner predicts that by 2025, 45% of organizations worldwide will have experienced attacks on their software supply chains, a three-fold increase from 2021. There has also been a significant increase in the number of cyber-attacks resulting from vulnerabilities within the supply chain (NCSC).

What’s more concerning is that only 13% of businesses review the risks posed by their immediate suppliers, and only 7% review their wider supply chain (2022 Security Breaches Survey). For cybercriminals, the complexity of today’s supply chains makes them an enticing target. Comprised of multiple vendors, manufacturers and other third-party organizations (often with access to centralized data and systems) there’s potential for a real domino effect of destruction when it comes to a data breach or cyberattack.

Steps You Can Take...

Choose supply chain systems vendors with a proven record of maintaining stringent cybersecurity protocols. Limit personnel access to the system to those necessary for shipment processing and maintain the strong physical security of your facilities. Penetration testing, continuous monitoring and modern IT skillsets can also reduce cyber-attack risk.

Supply Chain Risk #9: Data Integrity and Quality

Data integrity refers to the quality and strength of data for use in supply chain management. The wrong freight procurement data could leave shippers with reduced profitability and open doors to failure. Also, more companies are apt at isolating their data from others, increasing risk. The fear of a breach is omnipresent, but data integrity can be strengthened by sharing it with the proper supply chain partners.

This is particularly important if you want to implement AI or Machine Learning models, or simply wish to have a consolidated view to minimize data fatigue.

Steps You Can Take...

Validate data for accuracy and timeliness. Bad or outdated data is worse than having no data at all, and systems that leverage real-time data monitoring can be a crucial step in increasing data integrity and quality. Consider also using blockchain-based technologies to eliminate erroneous changes in data retroactively. Shippers who switch to collaborate with data can increase data integrity and decrease ocean freight spending.

Supply Chain Risk #10: T-shaped Procurement Teams

Together, The Great Resignation of 2021 and the following recession-like tailwinds have caused a skills gap in the procurement function and supply chain industry. In fact, the 2024 MHI Annual Industry Report shows that talent shortages are one of the top challenges for supply chain operations (56%), with hiring and retainment just slightly ahead (57%). This is seeing companies push current employees to do more with less to fill the vacuum.

In response, we’re seeing the rise of T-shaped procurement teams in 2024. These refer to individuals who possess both a deep expertise in one area, and a broad set of skills or knowledge in related areas. T-shaped teams suit the volatile nature of the modern supply chain by reducing dependencies between teams, resulting in faster decision-making and aligned priorities. They also help foster team ownership, and reduce handoffs between knowledge silos, avoiding information loss.

Steps You Can Take...

DHL Supply Chain has indicated the procurement skills shortage falls to four main issues: demographics, a need for modern skills, cost cutting measures and a lack of training programs. With this in mind, recognize where you have skills gaps (presently or forecasted) and invest in education, mentorship and training. This will foster a culture of continuous learning, as well as stronger employee engagement and retention. Your team’s improved knowledge will also positively circle back into the overall success of your supply chain.

Where your team is already at capacity, leverage procurement technology and automation in the shape of e-sourcing tools, spend analysis software, and other procurement technologies. This will free up your team for more value-add activities and improve efficiency and effectiveness in routine takes.

Proactive Risk Management Is Key to Ocean Freight Success.

Failure to understand top market risks is a risk in itself, putting your organization on the brink of profit loss and disruption.

To keep pace with today’s market volatility, shippers must rethink risk management strategies to include all potential risks in the global supply chain and how they affect supply chain partners. The best-laid supply chain strategy is doomed without full risk assessment and management.

And procurement strategies are limited without full market transparency and predictability.

If faster market monitoring and decision-making are important to you, discover the new era of ocean and air freight market intelligence.

Speed. Layered Data. Granularity. Context.

A view of everything impacting your deliverability and bottom line, all in one place. So you benefit from real-time market highlights and personalized insights to simplify reporting, streamline tender processes and help you identify where to focus when disruption hits.

Discover the next level of freight intelligence today and start modernizing the way you buy and sell freight.

.png)

.png?width=860&height=258&name=Newsletter_BlogCTA%20(1).png)