Margins in the retail industry are under huge pressure in this tough macroeconomic environment. Consumers are increasingly cost-conscious following a year of high inflation and now record-high interest rates in the Eurozone. This weak demand is driving retailers to push extra hard for lower rates, and they seem to have been successful on long-term contracts.

Both carriers and freight forwarders negotiate long- and short-term contracts with Beneficial Cargo Owners (BCOs), but what has been eye-catching during the first half is the difference in pricing dynamics between these service providers on that long-term market.

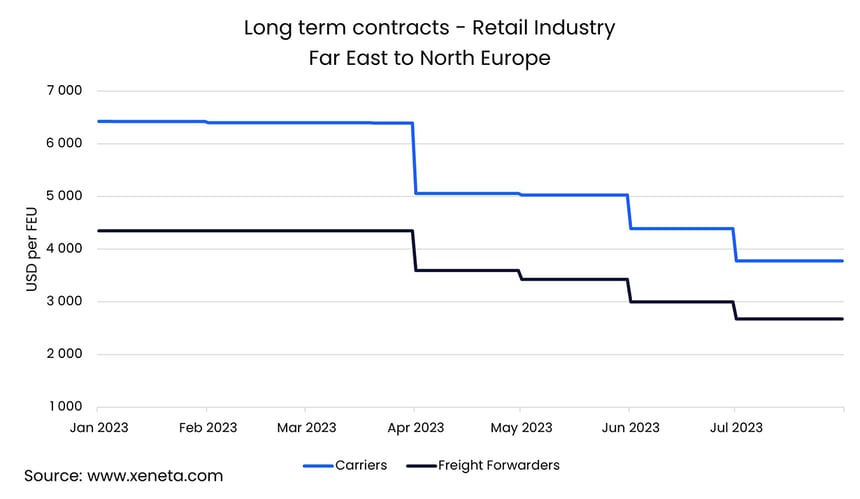

On the high-volume Far East to North Europe trade lane, the average rate paid by retailers has been consistently lower when contracted through freight forwarders than through carriers.

At the end of July, retailers paid an average of USD 1 570 for long-term rates from carriers—USD 640 more than the same rate offered by freight forwarders.

On January 1st, carrier rates were even higher, a whopping USD 2,300 above freight forwarders. Although a steep Q2 rate fall of 39.6% between March and June (freight forwarder rates fell much less) shrank the spread between the two to just under USD 1,000, freight forwarder pricing remains more attractive in purely financial terms.

This data is especially crucial for shippers to consider before their next tender. Where is it better to work with forwarders vs direct with carriers?

The overall long-term rate retail shippers are paying on this corridor has also been lower than that of the rest of the market. On 31 July, retailers were paying on average USD 760 lower than other industries, showing that retailers’ efforts to lower rates have borne fruit.

As carriers have been so far successful in raising their rates through recent General Rate Increases, the dynamic between carriers and freight forwarder pricing may shift. All shippers, but particularly retailers, should monitor these developments to make strategic, long-term decisions.

Want to learn more?

Contact us to learn how Xeneta can help you prepare for this upcoming tender season and supplier/buyer negotiations. Gain the upper hand with actionable real-time ocean and air freight rate and capacity data.

.png)