This week, Xeneta released the latest Carbon Emissions Index (CEI) report which revealed emissions on trades between the Far East and Mediterranean were up by 63% in Q1 2024 due to conflict in the Red Sea.

This next instalment of the CEI update will focus on how the Red Sea diversions and longer sailing distances around the Cape of Good Hope in Africa have impacted individual ocean freight container carriers.

No carrier was immune from the impact of Red Sea diversions, with each one posting a CEI score of more than 100 points in Q1 2024 between the Far East and Mediterranean.

The baseline of 100 was set when the CEI was first introduced in Q1 2018 – meaning all carriers are currently emitting more carbon than the trade lane average six years ago.

Maersk sees big increase in emissions

Out of all carriers on the CEI, Maersk saw the biggest movement in its CEI score, rising from 72.3 in Q4 2023 to 133.7 in Q1 2024 – an increase of 84.9%.

While Maersk saw the biggest shift in Q1, the score of 133.7 is still lower than other carriers on the CEI. For example, ZIM sits the bottom of the index amongst major global carriers with a score of 207.3 in Q1 2024, up from 121.1 in Q4 2023.

While this quarter is the first time Maersk has breached the 100 point mark, ZIM has only achieved a reading below the baseline once since it was set back at the start of 2018.

Emissions are inevitable consequence of longer sailings

The biggest driver of increasing emissions between the Far East and Mediterranean is the longer sailing distances around the Cape of Good Hope as most container ships continue to avoid the Red Sea and Suez Canal due to the threat of attack by Houthi militia.

While the average sailing distance on the Far East to Mediterranean trade is up by 60.7% from Q4 last year, the increase has not been uniform across all carriers.

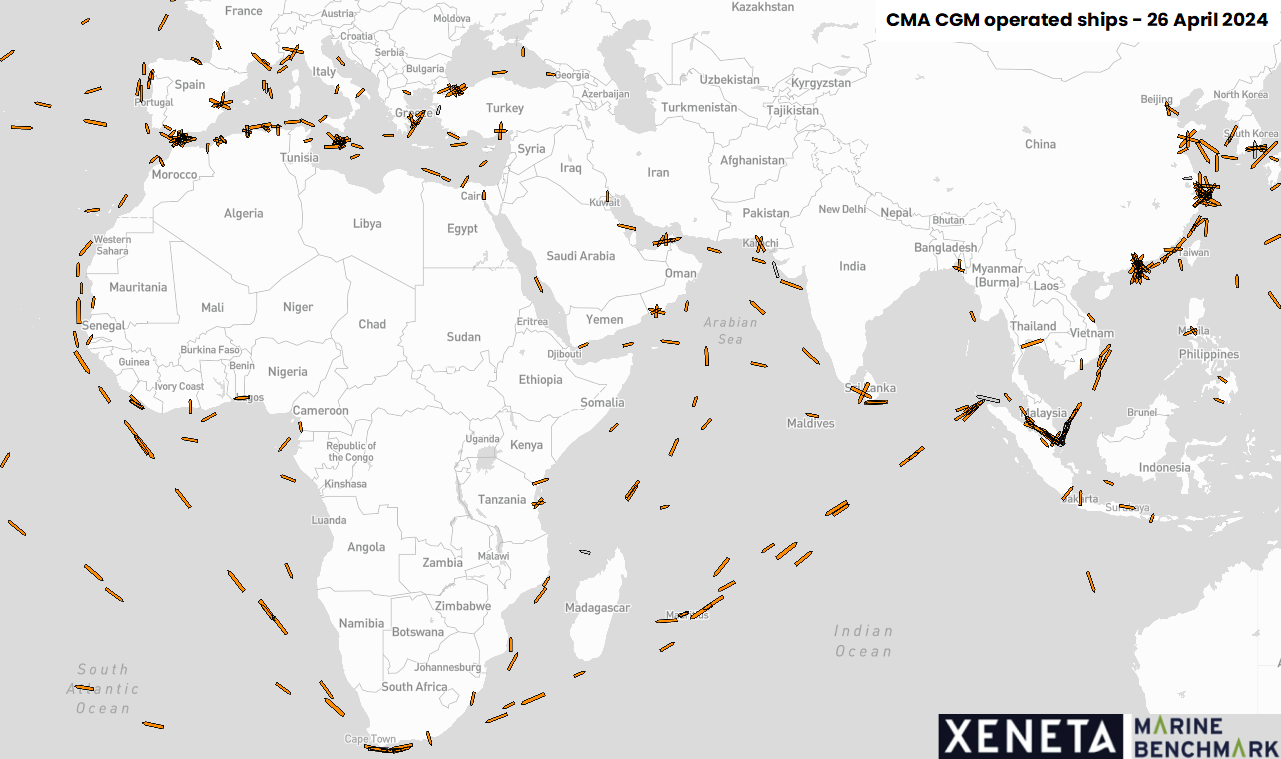

For example, CMA CGM’s average distance on this trade ‘only’ rose by 34.7% from Q4. How can this be the case if carriers are taking the same diversion around the Cape of Good Hope?

The answer is that CMA CGM waited longer than other major carriers before taking the decision to stop transiting the Red Sea and Suez Canal. CMA CGM only made its final decision in early February, meaning more of its journeys in Q1 took the shorter route to the Mediterranean via the Suez Canal.

CMA CGM’s has also announced a return to the Red Sea region, stating it will assess the risk of each transit on a case by case basis. Even though many if its ships are still diverting around the Cape of Good Hope, this decision could help CMA CGM’s CEI score further in Q2.

Different diversion strategies

Although most carriers took the decision to avoid the Red Sea, they still had different approaches to mitigate the increased sailing distances.

Many have chosen to increase the use of the ports of Algeciras and Tangier Med as transshipment hubs, rather than sailing further into the Mediterranean. Offloading containers in Western Mediterranean Sea ports for onward transshipment to Central and East Mediterranean Sea ports may reduce sailing distance for carriers, but it also creates pressure and higher container yard density. Ultimately this makes port terminals less productive.

Meanwhile, other carriers have continued to call at the usual ports, which adds considerable distance, especially for destinations in the Eastern Mediterranean Sea.

Perhaps not surprisingly, given it has the highest CEI score, ZIM had the longest sailing distance on this trade at 17,030 nautical miles. This is compared to CMA CGM’s 12,840 nautical miles which is the shortest average sailing distance on this trade.

In Q4 last year the average distance on the trade was 9,450 nautical miles, along with a much smaller spread between carriers.

Higher sailing speeds on the backhaul

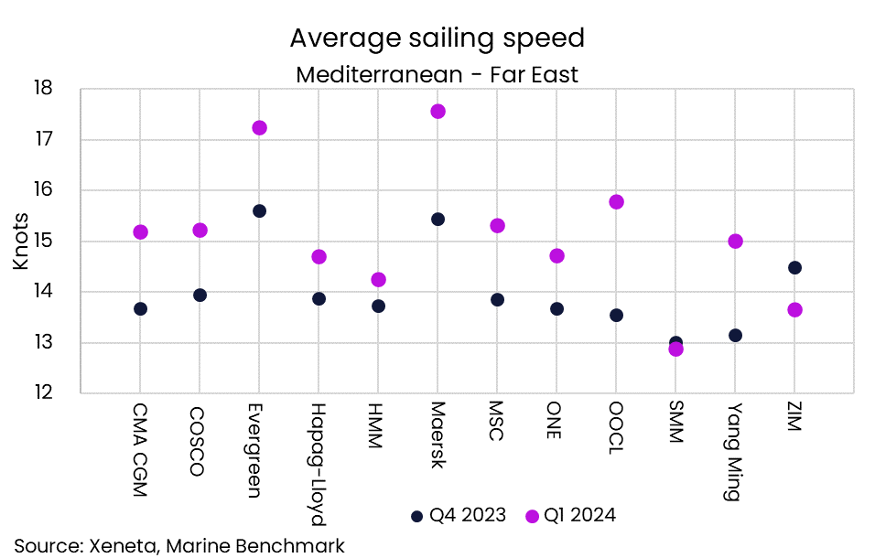

With diversions around the Cape of Good Hope placing additional pressure on capacity, many carriers responded by increasing sailing speed in an attempt to make up time.

The biggest increase in sailing speed in Q1 is from the Mediterranean to the Far East, as carriers try to limit the longer transit times on the backhaul trades.

Across all carriers on this backhaul trade, the average sailing speed increased from 14.0 knots to 15.3 (+9.8%) in Q1 2024. However, even with this increase in speed, the average transit time from the Mediterranean back to the Far East has increased by 11 days compared to Q4 2023.

In Q4 2023 there were only three carriers with an average speed over 14 knots between the Mediterranean and Far East. Back then the fastest carrier was Evergreen, averaging 15.6 knots.

In Q1 this year only two carriers were still sailing at an average speed under 14 knots, whereas three carriers now have an average speed of more than 17 knots. Maersk operated ships sailed the fastest, averaging 17.6 knots in Q1, which is a 14% increase from Q4 last year.

Emissions may reduce in Q2 but will remain above 2018 levels

Sailing longer distances at higher speeds will inevitably burn more fuel and are the two primary reasons behind higher CO2 emissions.

Looking ahead, CEI scores will remain high compared to 2018 as long as ships continue to sail longer distances around the Cape of Good Hope. However, sailing speeds may decrease as carriers introduce more capacity and this may well help reduce CEI scores in Q2 compared to Q1.

The higher sailing speed and longer distances mean no carriers on this Mediterranean to Far East backhaul had a CEI below 100 in Q1 – indicating higher emissions per ton of cargo transported than the trade average in Q1 2018.

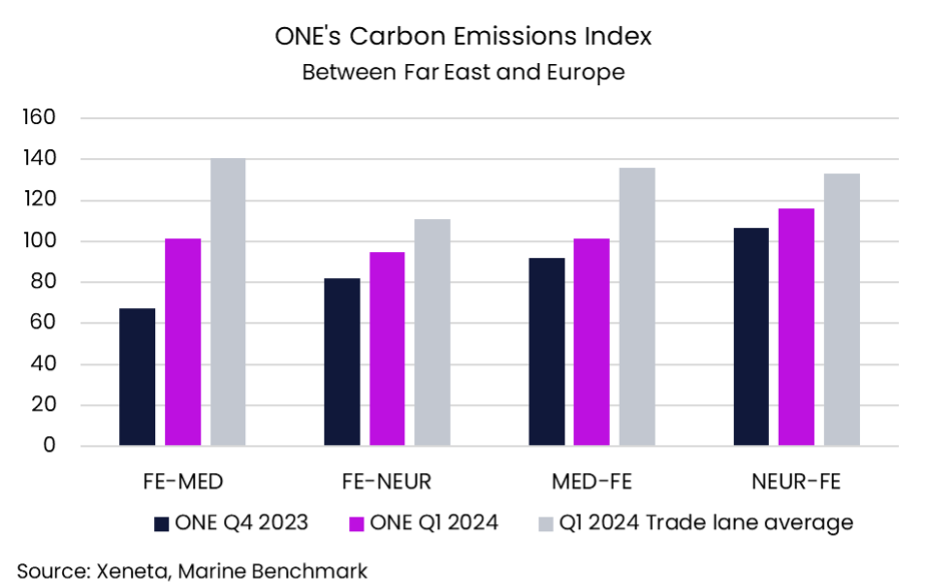

ONE is most efficient carrier between Far East and Mediterranean

Similarly to the backhaul trade, no carrier had a CEI score below 100 on the fronthaul trade from the Far East to Mediterranean in Q1. Even ONE, which was the best performing carrier on the CEI in both Q4 2023 and Q1 2024, saw its score increase by 51% from 67.2 to 101.5.

As well as the fronthaul and backhaul between the Far East and Mediterranean, ONE is also the most efficient carrier on the CEI for both fronthaul and backhaul trades between the Far East and North Europe.

The fact ONE is commanding top spot on the CEI on all four of these trades despite its performance deteriorating in Q1 this year demonstrates just how big the increase in emissions across all carriers has been.

The only one of the four trades between the Far East and Europe which ONE managed to register a CEI score less than 100 is the Far East to North Europe trade at 94.7 points.

OOCL and Yang Ming also top CEI trades

While ONE is the best performer on four of the 13 top CEI trades, there are two other carriers which claimed top spot in two trades.

OOCL takes top spot on the two backhaul trades from the US East Coast to the Mediterranean and to North Europe. Meanwhile, Yang Ming is the most efficient carrier on trades from the Far East to the South American East Coast and Far East to the US West Coast.

Both Maersk and Evergreen, which were the most efficient carriers in two and one trade respectively in Q4 2023, can no longer claim to be the best on any top 13 trades on the CEI in Q1 this year.

Hapag Lloyd, which had no top spots in Q4, has since become the most efficient carrier between North Europe and the South American East Coast.

Yang Ming posts lowest CEI score on Transpacific

Yang Ming can boast the lowest CEI score of any carrier across all the top 13 trades.

Between the Far East and the US West Coast, Yang Ming had a CEI of 57.8 points, which is 22% more efficient than the average.

Though the average CEI on this transpacific trade was up in Q1 compared to the end of last year, its relative isolation from the impacts of the situation in the Red Sea means it is the trade with the most improvement in emissions since Q1 2018, with a CEI reading of 73.7 points.

Sustainability on the agenda

With major black swan events seemingly becoming more frequent in recent years (eg, Red Sea conflict, Ever Given, drought in Panama, Covid-19), understanding their impact on carbon emissions is becoming an increasingly important consideration.

With carriers taking different approaches in response to these major events, the CEI allows Xeneta customers to make decisions based on cost, service reliability and the carbon emissions performance of their chosen service provider.

.png)

.avif)