The world of shipping has entered a time devoid of a single global trend and where previously accepted norms no longer apply.

So if you think you know your global supply chain, maybe it’s time to think again.

Throughout October, Xeneta is running a mini-series of shipping insights called, No Two Trades Are Alike, shedding some much-needed light on this new world.

If you want to be able to make informed decisions then you need to take a fresh look at each and every trade lane in your global supply chain.

This week the spotlight falls on the Trans-Pacific back-haul trade lane from the US West Coast to the Far East. So how do we begin to characterize and understand this lane?

Unlike other major trade lanes, it is without any real seasonality. We must also recognize the Far East is vast and complex, encompassing many regions which share similarities as well as striking differences.

Trans-Pacific is also a main haul for US exporters of soybeans and nuts, plastic waste, and wood, but a back-haul in general container shipping terms. For every container exported from the US West Coast to the Far East, four containers come back loaded.

What is the current state of play on the Trans-Pacific back-haul trade lane?

In the first seven months of 2023, 1.6m TEU left the US West Coast bound for the Far East, which is 7.0% down on 2022. But to see the full picture we must delve a little deeper into demand share within the Far East.

Demand for US West Coast exports into Southeast Asian destinations actually went up by 3.4% (+20k TEU), whereas demand from North Asia and China went down by 10.2% (-80k TEU) and 14.2% (-60k TEU) respectively. (Source: CTS).

Xeneta’s platform identifies the finer details of these inter-regional variances and the impact they have on freight rates, such as containers heading for Southeast Asia being priced differently to Northern Asia.

If you’re a shipper entering tendering season and you’re sending your soybeans or almonds to the Far East, this is the information you need to understand the prices you should be paying. Only then can you be assured you are getting the best price and service.

It’s not enough to simply inform your decision based on front-haul data, we must consider back-haul insights.

Performance on back-haul being only -7% is possibly surprising given front-haul into the US West Coast from the Far East is down by 19% (-1.3m TEU) in January to July compared to last year. So is this playing its part in the gravity-defying freight rates on this trade lane?

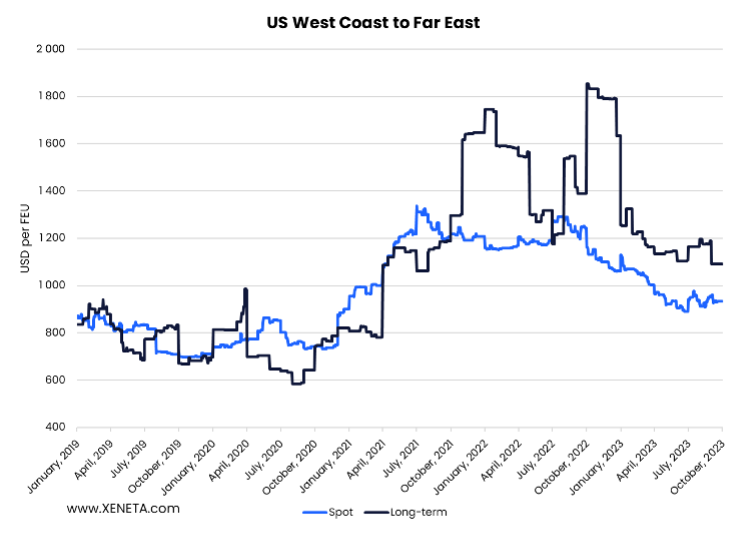

As the long-term freight rate dropped by USD 100 per FEU in early September 2023, the spread of long-term contracts and spot rates fell to USD 130.

This spread then widened during September as the spot market fell by a further 3% to end just short of USD 160 per FEU.

Of course it is true that spot rates being lower than long term isn’t unique to the Trans-Pacific back-haul lane following the crazy covid years, so we may currently be in a transition phase to the market entering the “next normal” during 2024.

Yet this spread is still abnormally high by historical levels so let’s put some more context around these figures.

In 2019, spot rates were higher than long term contracts but by only $2.50. This gap then went up to $50 as the early days of the Covid-19 pandemic drove long-term rates down from April through to September.

And the story doesn’t end there. For one, the current spot sits 25% higher than the 2019-2020 average, currently at USD 933 per FEU, with the year-to-date average being USD 40 higher. The long-term rate today is 55% higher than its 2019-2020 average, as it has only come down half-of-the-way from its 2022 high. We should remember this was a high that had shippers paying twice as much as they were accustomed to for the long-term contracts.

Whereas the 2023 year-to-date average for long-term contracts is USD 380 per FEU lower than that of the full year 2022, it’s still USD 412 per FEU higher than the 2019-2020 average.

So shippers are still feeling the pain of gravity-defying higher rates on this lane. Further pain is also felt through carriers blanking sailings – particularly following Chinese Golden Week which sees 50% of sailings cancelled.

The knock-on effect? North American exporting shippers remain at the mercy of poor conditions on the front-haul.

As we can now clearly see, no two trade lanes are the same. It is not common under current market conditions to have any rates sitting 50% higher than a few years ago, and it may be the case that some other major trades (back-haul and front-haul) are now at or even below their pre-pandemic level. But it is not a global trend, as can be seen on the gravity-defying Trans-Pacific back-haul.

Not only must we consider what is currently impacting trade lanes, we must also be aware of the factors that should no longer be a driver of prices.

For example, the repositioning of empty containers back to the main exporting regions is in most part complete on this trade. So you might think capacity that is no longer engaged by empties should be readily available to exporters?

Well, while container repositioning is mainly resolved, capacity is still negatively impacted by the blanked sailings on the front-haul, which may disrupt the supply chains of US exporters. On top of that the negotiation power of carriers shouldn’t be underestimated – especially on the Trans-Pacific back-haul, which is a key battleground for them.

But container repositioning should no longer be a reason for gravity-defying rates on the Trans-Pacific backhaul. If you are entering negotiations, this is information you should be aware of before sitting around the table.

So what to make of it all? How can we make sense of a shipping world that is unrecognizable to the past?

In the same way no two lanes are the same, it is also true that no two businesses are the same and there will be many considerations as well as price, such as reliability of service.

But if the trend is your friend then lower rates should come about on the Trans-Pacific backhaul. Perhaps you should consider if now really is the right time to strike a new long-term contract or whether it is best to wait it out.

If you do wait it out on the Trans-Pacific back-haul you may be able to focus your attention on other trades which have seen prices take a different post-pandemic trajectory.

Next week’s installment of our No Two Trades Are Alike mini-series will give you the lowdown on those lanes that may benefit from more immediate action.

Want to learn more?

Contact us to learn how Xeneta can help you prepare for this upcoming tender season and supplier/buyer negotiations. Gain the upper hand with actionable real-time ocean and air freight rate and capacity data.

.png)