Should I stay or should I go now? That’s the question on the lips of shippers who shifted volumes from US West to East Coast destinations to avoid protracted port labor disputes. However, now that situation is resolved, after a year and a half of negotiations, the issue of what to do with those imports raises it head. Those in the know are looking at the spot market, and long-term contracted, spreads when assessing their next moves.

Nothing ever stays the same - an observation only too familiar to shippers importing, and exporting, via US West Coast (USWC) ports. In 2020, the covid pandemic landed with an almighty thump, disrupting global supply chains, only for port labor disputes centered on automation and salary to break out and further derail plans.

Cue a move to sidestep these obstacles, by shifting corridor from the USWC to the US East Coast (USEC) and US Gulf Coast. Greater demand then worked to supercharge this market, with container shipping freight rates to the USEC becoming considerably more expensive than to the west.

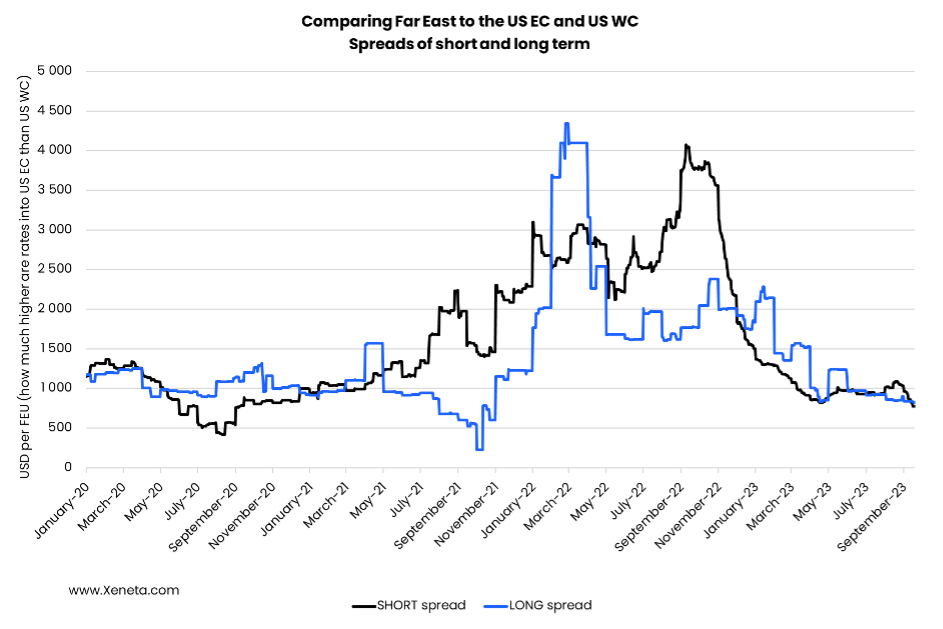

Taking a historical perspective, the spread between East and West sits slightly above USD 1 000 per FEU. But in 2022, the market hit overdrive, as first the long-term contract rates spread accelerated over the USD 4 000 per FEU mark, only for short-term rates to follow suit half a year later. The shift from coast to coast began in November/December 2021, before peaking in September and October 2022, as the chart illustrates.

In real money terms, the peaks saw Far East (FE) to USEC spot rates climb above USD 8 000 per FEU, while the equivalent FE to USWC rate reached a shade under USD 4 000 per FEU. With the spot rates beginning their decline earlier on the FE to USWC lane, the spread almost doubled, before trending fast and furiously down to hit a then-low point by mid-April. This low point has just been breached in mid-September, with the spot rate spread now at ‘just’ USD 776 per FEU.

Has the USWC got cheaper, or the USEC more expensive?

Neither. The spread hovered around its historical average in June 2023, before the USEC spot rate increased more than its counterpart, driving the spread up. September saw USEC spot rates falling faster than those for USWC bound cargoes, bringing the spread down again.

It’s now aligned with the spread for long-term rates, which is also below the ‘historical’ average. This has occurred as, since June, long-term USEC rates have been falling faster than those for the USWC.

Speaking volumes - a permanent shift in destination?

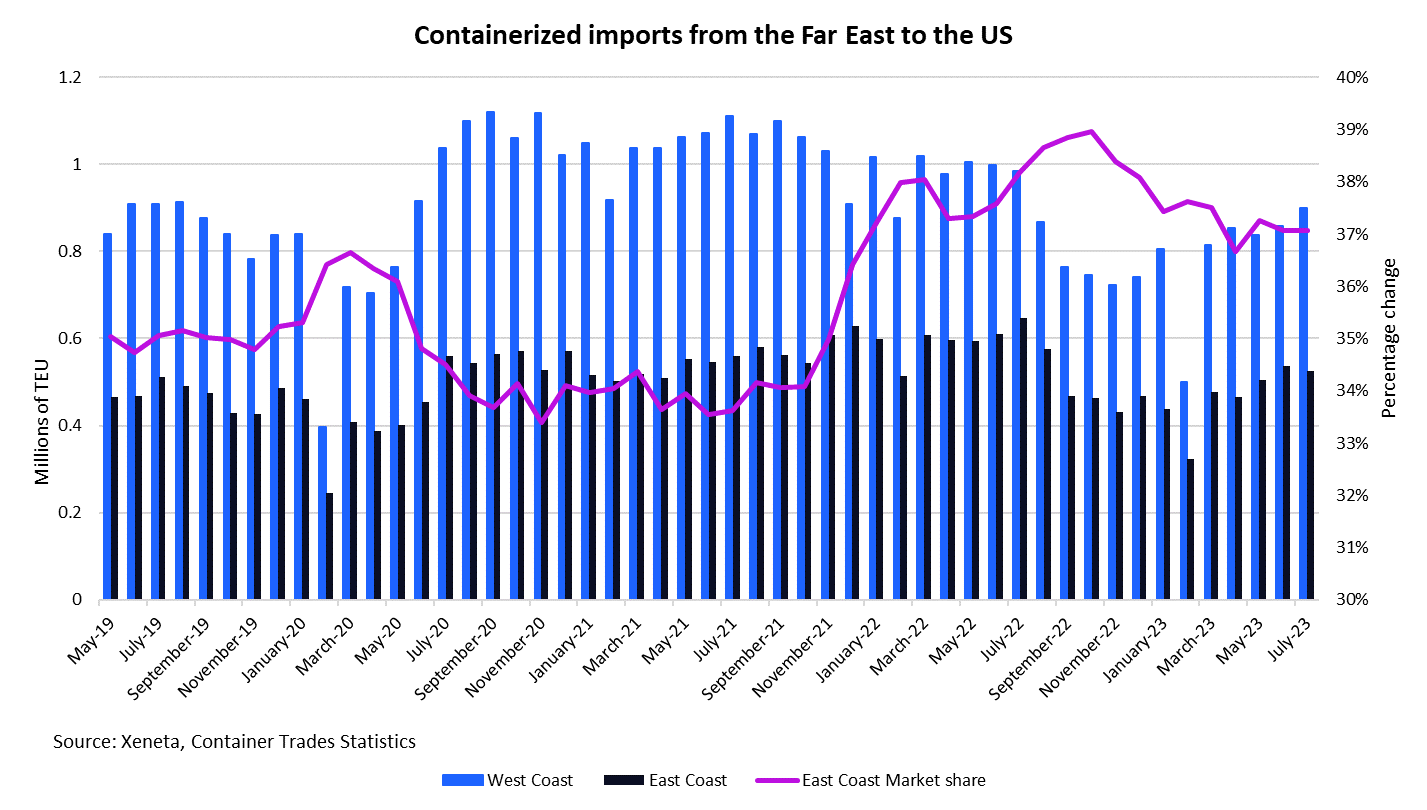

In 2019, 35% of Far Eastern imports went through USEC ports, a market share that fell to 34% from the second half of 2020 through to October 2021. From thereon in, the USEC ports have found increasing favor, with the share peaking at 39% in October 2022, before sliding back to 37% in July 2023. The Port of Los Angeles CEO has been very clear about this shift too. He knows there is no easy fix, understanding that only hard work and proven reliability are capable of bringing back lost volumes.

The problem he (and the west in general) faces, is that lower rates into the east could act to keep volumes on this side of the country for the foreseeable future. Hard work and reliability are very important, of course, but at the end of the day, as all ocean freight stakeholders know, money talks.

The big picture – East showing its strength

When comparing total inbound volumes for the two coasts, the lion’s share of containers have arrived in the east since November 2021, peaking at 55% in December 2022. The coast currently commands a 52% share (source: CTS).

While the jury remains out on the return of Far East containers to the USWC ports, the trend appears locked-in, and steadily changing, for total inbound volumes. In 2011 the ratio of total volumes stood at 60:40 in favor of the west, shrinking to 55:45 in 2017. The temporary ‘comeback’ in 2020/2021 has now been consigned to the history books.

Is now the time to look to long-term contracts on USEC or USWC?

If you’re a shipper who’s been diligently rerouting cargo from the west to the east, you may be wondering if now is be a good time to turn the tables and head back ‘home’ with those containers. But would that be wise?

At present, the USEC showcases promising opportunities with favorable container rate levels and less volatility than the USWC. Moreover, carriers are gradually shifting their focus towards the USWC, particularly with regard to the Far East - USWC route. It’s also worth noting that recent carrier capacity management strategies have not been particularly focused on USEC operations, presenting a golden opportunity for shippers to seize the moment and capitalize on potentially lower rates.

Looking ahead, keep in mind that labor talks have the potential to shake things up in USEC ports in perhaps a year’s time. So, it is prudent to be vigilant in this perpetually evolving industry. Therefore, your strategic approach will depend heavily on your procurement strategy; namely, whether you prefer entering into one-year contracts or opt for quarterly agreements.

Strike soon, but stay flexible

At present, with long-term rates as of mid-September 2023 reverting to pre-pandemic levels, there's a limited scope for negotiating lower contracted prices. This scenario sets the stage for shippers to secure long-term contracts, offering a semblance of stability and peace of mind amidst fluctuating market conditions. However, it is essential to keep an eye on the growing overcapacity, which is anticipated to persistently affect freight rates in the forthcoming years. As a consequence, preserving some flexibility by choosing three to six-month agreements over one to two-year contracts might allow you to leverage potential opportunities in the future.

In conclusion, your decision should be grounded on accurate, up-to-date data and insightful analysis. Keep abreast of the latest industry developments by following our blog. Your next strategic move in the shipping industry demands an informed choice.

Want to learn more?

Contact us to learn how Xeneta can help you prepare for this upcoming tender season and supplier/buyer negotiations. Gain the upper hand with actionable real-time ocean and air freight rate and capacity data.

.png)