Freight forwarders looking for room to negotiate, and optimize their margins, should keep a keen eye on developments on the Far East to USEC corridor. With Golden Week approaching, carefully managed carrier capacity, and some recurring issues on a certain canal, short-term rates could be feeling further pressure.

The transpacific trade lane, a major shipping artery known for its high capacity and volume, provides an ideal platform to assess how the wider market is set to develop. This is particularly important for freight forwarders, who need to be ready to pounce on any market changes, using price volatility to improve business margins. Accessing data relating to the pricing of individual carriers is especially relevant, as the forwarders procure long-term contracts from a spread of industry players.

From challenge to opportunity?

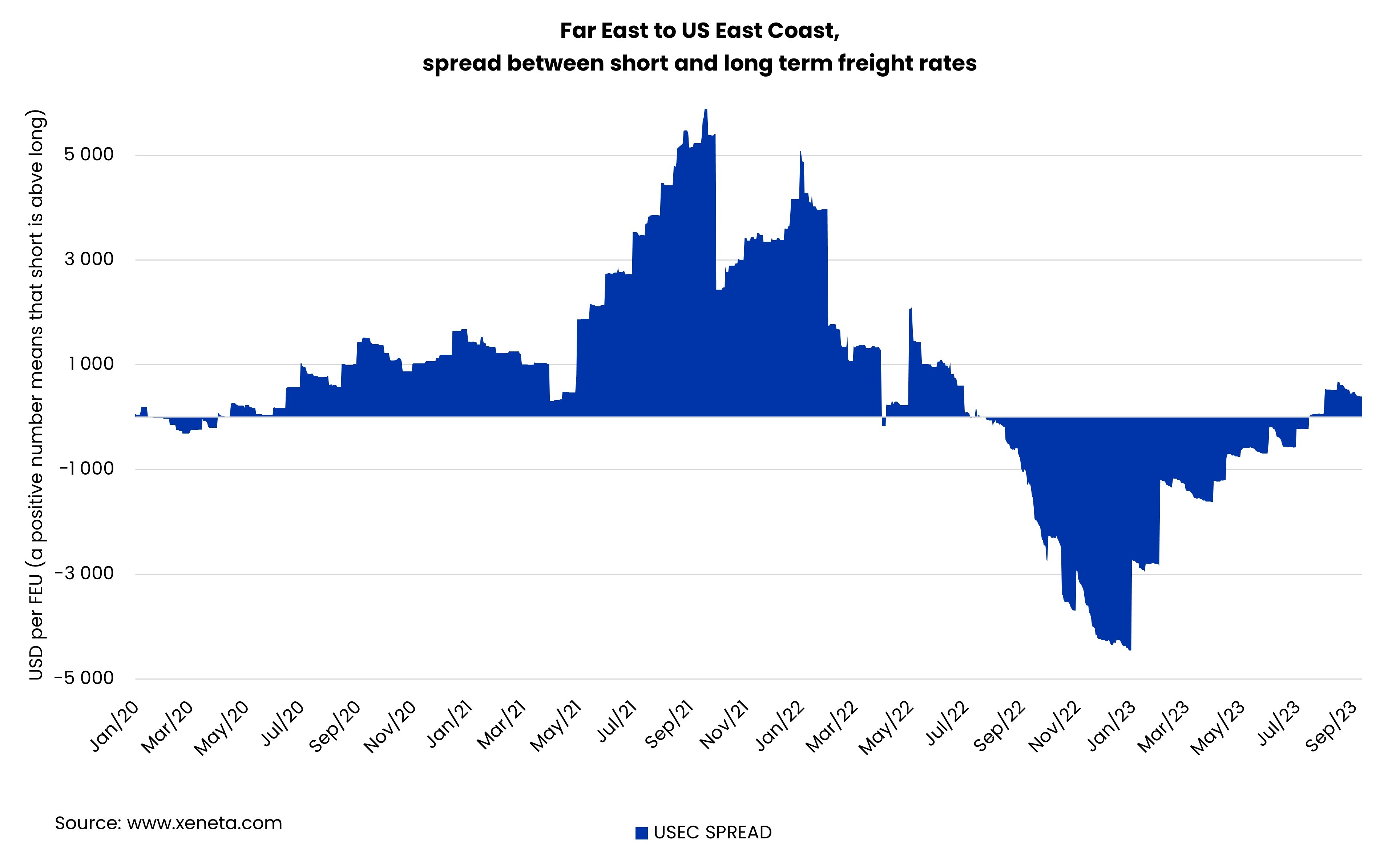

Up until this summer, it’s been a challenging year for all freight forwarders. Long-term rates have been higher than short-term rates, while container volumes into North America have fallen rapidly from last year’s highs. It’s a combination of factors that restricts their negotiating power with both carriers and customers.

However, over the summer months the market shifted. Short-term rates on the transpacific front hauls out of the Far East into the US West and East coasts surpassed long-term rates in July and continued to climb into August. In the most recent weeks, GRIs implemented by the carriers have failed to stick, restricting development as we progress through September.

East Coast power play

At present, spot rates from the Far East to the US East Coast (USEC) are 40% higher than they were at the end of Q2, and USD 425 per FEU above the long-term rates. This translates to a significant increase for global freight forwarders that move thousands of TEUs per month, providing a very compelling reason for them to act.

The higher spot rates on the US East Coast are being driven by carrier strategies to manage capacity on the trade, with data from Sea-Intelligence revealing a reduction in sailings in July and August. Xeneta expects this to continue, with carriers managing capacity at large in September as we approach Chinese National Day on 1 October, and the start of Golden Week, only to blank even more sailings in October once the holiday pressure is gone.

Rising pressure

Another factor in the Asia to US East Coast market are the current draft and transit restrictions on the Panama Canal. These are prompting carriers to consider alternatives for moving the cargo to its intended destination, creating additional capacity pressure for this trade lane. It is important to note that, if constraints continue, short-term contracts may continue an upward trend. So, remember to keep a close eye on rates development to ensure your business is prepared to act.

On the subject of remembering… you may recall that the protracted labor dispute on the USWC, and the resulting terminal disruption, led to a shift in volumes to the USEC. As it’s not entirely certain that all the boxes will ‘find their way home’ to the West Coast, there may be some market impact to watch out for.

Keep your eyes peeled for our next Weekly Rate Update to find out more

Want to learn more?

Contact us to learn how Xeneta can help you prepare for this upcoming tender season and supplier/buyer negotiations. Gain the upper hand with actionable real-time ocean and air freight rate and capacity data.

.png)