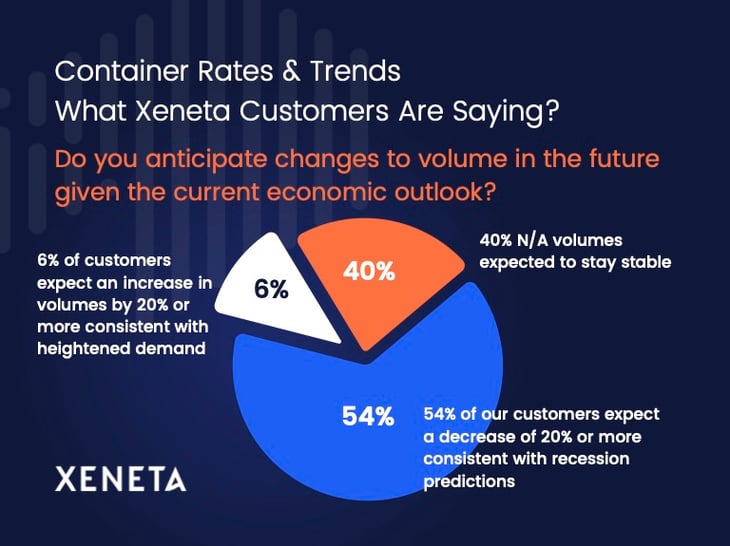

With the recent influx of negative headlines and the economic outlook anticipating an imminent stock market collapse, Xeneta customers were recently asked this week how they expect this to impact their freight in a customer-exclusive webinar. Changes to volume are to be expected due to seasonality, a drop in availability of exports and most recently, inflation’s impact on consumer demand – but can the combination of these factors sustain the looming chance of recession?

Xeneta VP of Strategic Accounts Michael Braun and CPO, Erik Devetak asked our customers, and you’ll find the results below. The implication of this considering how much GDP is connected to the customer consensus could mean recession alone.

Key Highlights | Xeneta Customers Say

- 54% of customers anticipate a decrease in volume in the coming months consistent with recession predictions

- 30% of customers believe their forecasted allocation to be too high, showing a reduction in demand

- 44% of customers no longer feel confident in the stability of long-term contracts

Additionally, over half of the customers were impartial to the security provided by long-term contracts.

When asked about their confidence in long-term contracts:

- 22% of Xeneta customers said they were more likely to allocate lower volumes only to cheaper contracts

- 22% preferred to move allocation to the spot market as soon as it’s lower than long-term.

This adds pressure to the remaining 57% of customers who admitted to staying committed to previously contracted allocation even if volumes are lower than expected. A pandemic-imposed shift, a modern contract structure is emerging with more shipper autonomy and less power to the age-old long-term contract at a fixed rate.

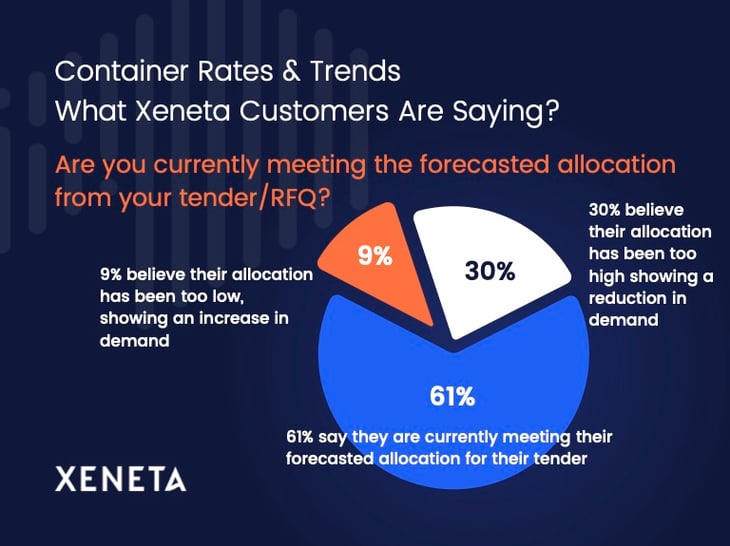

Michael and Erik engaged customers further, asking:

How many customers felt they were currently meeting their forecasted allocation/RFQ?

- 61% of Xeneta customers believed they were just about meeting their forecasted allocation from the tender season.

- 31% of customers implied they have already seen a decrease in consumption impact demand as their allocation has been too high.

Want To Learn More?

Xeneta customers get access to monthly market commentary during the Ocean Freight Market Pulse Webinars. Learn more about the Xeneta platform and how to become a customer now.

.png)