2024 promised to be the year that heralded a return of classic seasonality in the air freight market as airlines continued to restore capacity through passenger service schedules alongside recovering demand. This saw freight buyers increasingly move towards longer-term contracts rather than relying on the spot market.

Then came the escalation of the Red Sea Crisis in mid-December, which as we have already seen, is starting to impact air freight volumes on trades such as Vietnam to Europe.

But, could the combination of the Red Sea crisis and the upcoming Lunar New Year impact the market beyond the Asia to Europe trades?

A good place to start looking is the Transpacific market.

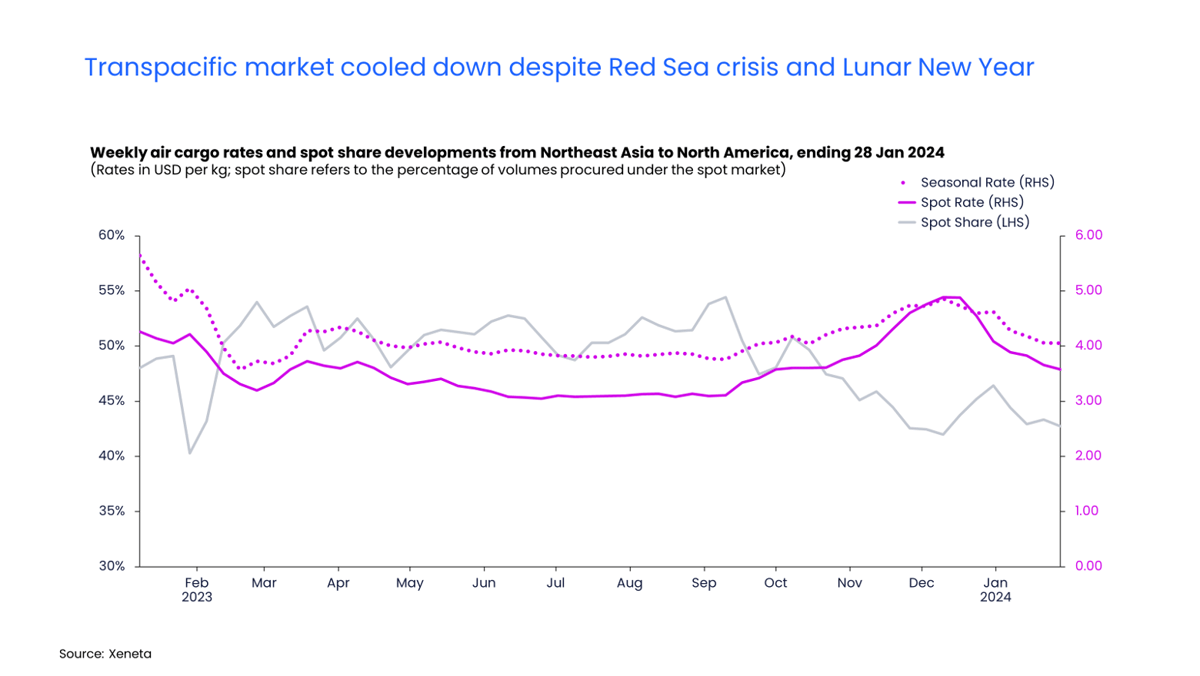

In the week ending 28 January, the average air cargo spot rate from Northeast Asia to North America was USD 3.58 per kg, a significant 27% decrease from its peak in early December due to declining demand. (Northeast Asia refers to mainland China, Hong Kong, Japan, South Korea, and Taiwan)

The Transpacific air cargo market has leaned towards a freight buyer's market. With the exception of early December, the spot rates (valid for up to one month) mostly remained below seasonal rates (valid for over one month) throughout 2023 until January of this year.

The gap between spot and seasonal rates narrowed in the final quarter of the holiday season last year. However, as e-commerce demand weakened after the holiday season, the spot rate fell faster than the seasonal rate in the first month of 2024, widening the price gap once again (although to a lesser degree when compared to March through October 2023).

The lack of an increase in either spot or seasonal rates for the Northeast Asia to North America market in January suggests the Lunar New Year or Red Sea crisis did not trigger a cargo rush on this route. This contrasts with the Northeast Asia to Europe corridor, where the spot rate in the week ending 28 January increased by 7% compared to three weeks prior.

Spot market or not?

Looking at freight forwarders' procurement strategy, the share of cargo volumes under spot market rates (spot share) has decreased since the last quarter of 2023. This decrease is likely due to the anticipation of weak general air cargo demand, with spot rates mostly remaining below seasonal rates. To secure volumes, airlines agreed to fix rates longer than one month with freight forwarders heading towards the end of the year.

But then came the unexpected surge in e-commerce demand in the Q4 holiday season, with some freight buyers locking in volumes for longer than one month to secure space in the final months of the year. By the week ending on 28 January, the spot share on this route had fallen by a noticeable 12 percentage points from early September 2023 to 43%.

Despite this decrease, freight forwarders are still procuring more volumes in the spot market when compared to pre-pandemic levels. This is not only due to the expectations of general weak air cargo demand, but also the potential further recovery of belly capacity. In January, the spot share of 43% remained seven percentage points higher than the same period in 2019.

Looking ahead

Freight forwarders are unlikely to alter their current approach and continue procuring a significant share of volumes on the spot market in the short term. With the Red Sea crisis not triggering a cargo rush on the Transpacific routes, demand will likely remain subdued, especially with retailers and wholesalers trying to avoid increasing inventory levels and a repeat of the overstocking earlier in 2023.

Further pressure could be applied on air cargo rates through continued belly capacity recovery on this route. As per the October 2023 agreement between US and China governments, the services are less than 20% of pre-pandemic levels – leaving plenty of room for additional increases.

For more insights specifically on the Red Sea Crisis, Xeneta is currently monitoring the situation and updating its Red Sea Crisis newsfeed as new insights become available.

.png)