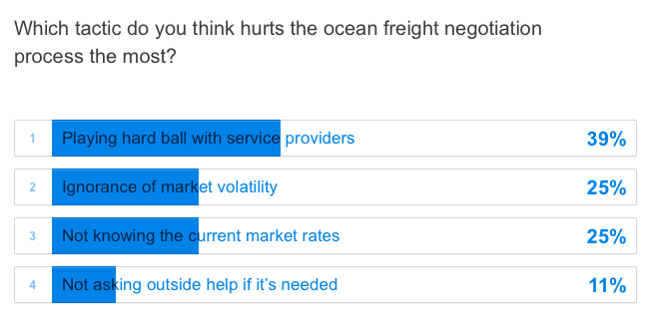

Shipping costs are one of the most misunderstood or miscommunicated terms in shipping and freight and in a lot of the cases means the difference between a successful trade deal or not. Last week we asked our community the following question: “ Which tactic hurts the ocean freight negotiation process the most?”

Ocean freight negotiation is an important part in the whole trade process and involves several entities such as the carrier, the BCO (Beneficial Cargo Owner also known as Shipper), or an Ocean Transport Intermediary such as NVOCC or Freight forwarder.

Ocean Freight Negotiation may occur in many forms either as a direct negotiation, an RFQ or an indirect negotiation.

Whichever forms these negotiations take, there are some tactics that may hurt the ocean freight negotiation process more than it helps.

Survey Results

The Hardballers

Many customers try to bulldoze their way through negotiations purely because they feel that they are “entitled” to the lowest rate and the best service from a shipping line based on the volumes that they give the shipping line.

However, these customers forget that each shipping line has a threshold up to which they can withstand the continuous lower freight rates in the market..

Hanjin Shipping’s filing for court receivership in 2016 and the subsequent official announcement of Hanjin’s bankruptcy in 2017 is a grim reminder about such thresholds.

Even the world’s largest container shipping line, Maersk Line, is seemingly not immune to the effects of lower freight rates as they announced a loss of USD 376 million in 2016, citing a 19% decline in freight rates compared to 2015 as the overriding reason for the loss..

While pricing may be negotiable and clients may be able to secure lower rates, it does not always guarantee the best service and this could end up compromising the shipper’s reputation in the market.

Therefore, it is in the best interest of the customer that they don’t play hard ball with the service providers and squeeze them for the lowest rates as they might soon run out of “reliable” service providers.

Commenting on the survey, Specialist perishable cargo service provider Easy Fresh Global said that shipping lines should not follow the practice of prioritizing volume over good/quality customers who do not negotiate on the basis of volumes but more on the basis of their specialization and the reliability they can provide to the shipping line.

Don’t Be Blindsided

Some clients enter blindly into negotiations without analyzing the current market conditions and what their competition is able to negotiate in the market. This becomes more relevant in cases where the current market rates may be less than what you are negotiating and eventually you may end up paying more because you were not aware of the market.

[INFOGRAPHIC] 12 Steps to Benchmarking Anything in Your Supply Chain

Consider Market Volatility

Volatility in ocean freight rates is an important factor to consider in ocean freight negotiation. A customer should ignore the importance of market volatility at their own peril.

While there is no hard and fast rule for a customer to follow when deciding who they must have the ocean contract with, not considering the seasonality of such negotiations may be suicidal.

While commenting on the same survey, Hariesh Manaadiar of Shipping and Freight Resource was of the opinion that ignorance of market volatility especially during peak and off peak season would be a very poor tactic on the part of both the customer and the shipping line as both seasons could influence the rates negatively or positively.

Using 3rd Party Services

Negotiating ocean freight rates may not be a forte for many shippers, but there are several service providers that can help with this. Using such service providers can improve the management of rates, routes, schedules and ultimately the entire contract for the shipper.

Conclusion

An ocean freight negotiation should be looked upon as the first step in a lasting business relationship between a carrier and shipper and should not be looked upon as showing one’s superiority over the other (whether you are a carrier or a shipper).

How you manage your ocean freight negotiation and the approach you take towards these negotiations can affect your relationships and in a market, that is ever changing due to the supply and demand volatility, what goes around could come around sooner than expected.

.png)

-1.jpg)