Xeneta experts see a slow start to the next year. With the increased cost of living and tighter consumers budget, 2023 will see people spending more on services and less on goods.

Amidst so much market uncertainty, industry parties are increasingly choosing shorter-term deals as they wait to see how business trends unfold in the coming months.

Tune in to our big fat air freight wrap-up webinar with Niall van de Wouw, Chief Air Freight Officer at Xeneta, and Wenwen Zhang, Air Freight Analyst at Xeneta, as they revisit 2022’s significant market movements and explore what could be on the horizon for 2023.

Key webinar insights

- Changes in air cargo rates are less diverse compared to ocean

- Three-phased air cargo market in 2022

- Belly capacity continued to slowly recover in 2022

- Air freight rate trends from the Xeneta platform

- Looking ahead into 2023

Market development so far...

According to Xeneta air freight press release in December 2022, airlines saw demand drop 2% month-over-month in November as general airfreight volumes dipped for a ninth consecutive month. Freight forwarders are taking a ‘wait and see’ approach before making long-term air cargo capacity commitments.

“What we are seeing is a lot of uncertainty still. After such a big drop of -8% in air cargo demand in October, we saw a little stability return in November, so the market is not worsening; it’s just very hard to read longer-term. This is reflected in the rise in short-term contracts, with forwarders unwilling to commit to long-term deals.

Shippers should see some benefit from this in terms of their air and ocean budgets, and falling rates may provide one glimmer of hope for cash-strapped consumers that potentially lower shipping costs in 2023 and will make some goods more affordable. There are still so many influencing factors to consider, including the depreciation of the US dollar and its impact on trade,” said Niall van de Wouw, Chief Airfreight Officer at Xeneta.

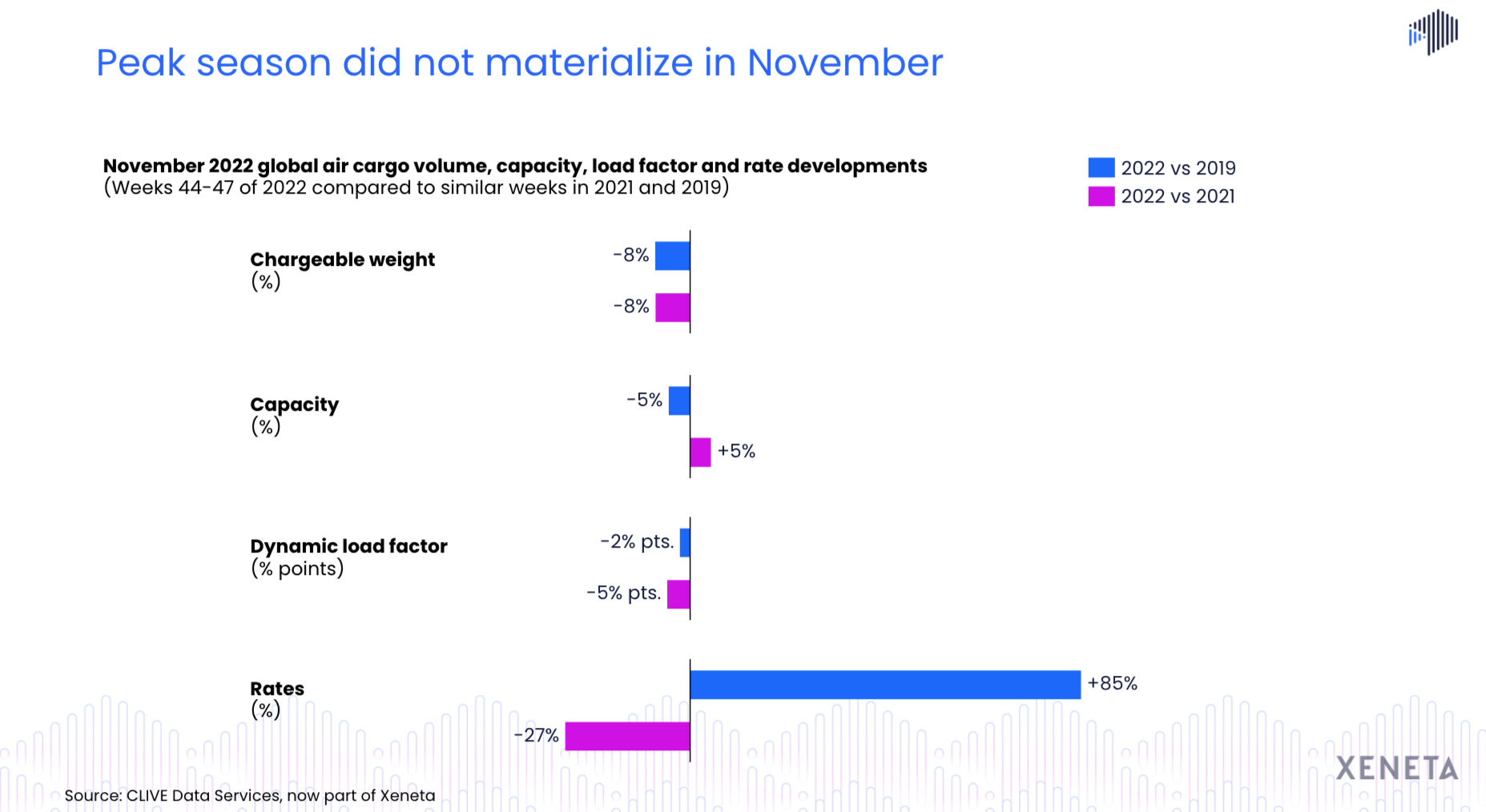

No peak season this year

The air cargo demand, measured in the chargeable weight, is declining. Compared to last year and the pre-pandemic level, it is down by 8%. Also, as the airlines enter the winter season, the capacity has started to decline from October this year. It was on the rise compared to the same month last year, reflecting the continuous positive recovery of the airline industry. However, looking at this comparison with pre-pandemic 2019, we still have a 5% capacity on short, and that is mainly in the Asia-Pacific market.

The air cargo demand, measured in the chargeable weight, is declining. Compared to last year and the pre-pandemic level, it is down by 8%. Also, as the airlines enter the winter season, the capacity has started to decline from October this year. It was on the rise compared to the same month last year, reflecting the continuous positive recovery of the airline industry. However, looking at this comparison with pre-pandemic 2019, we still have a 5% capacity on short, and that is mainly in the Asia-Pacific market.

The dynamic load factor, which takes both the weight and the volume into consideration, was also on down compared to last year as well as 2019 levels. On the global level, we have the air cargo spot rate down by 20% compared to last year. This is the third month this year when the air freight rates are declining compared to last year. However, this year's November air cargo rate level is still closer to the pre-pandemic level.

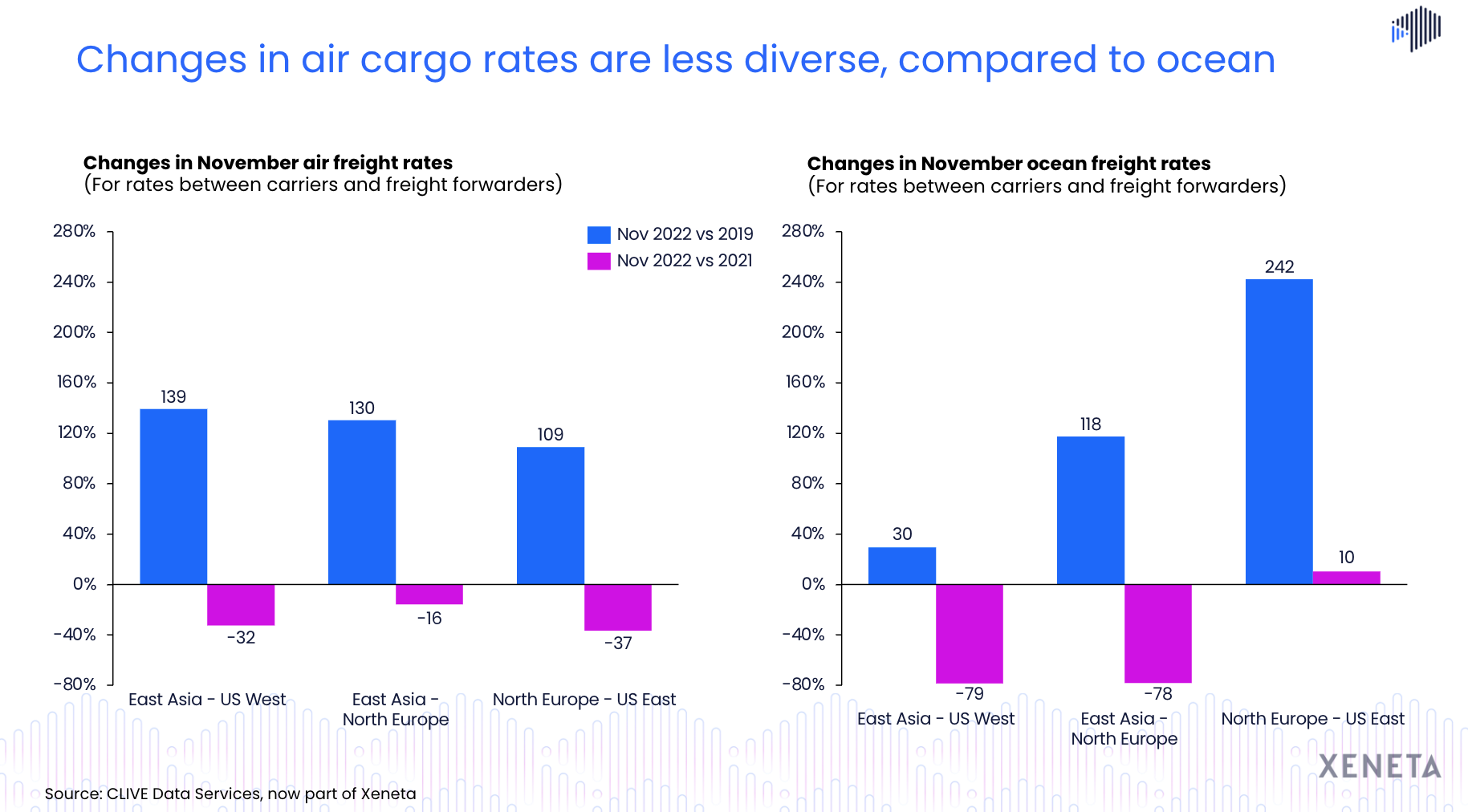

Air vs. ocean freight rates

While talking about the top volume corridors from Asia to the US and Europe, as well as Europe to the US, Wenwen Zhang, Air Freight Analyst at Xeneta, compared the November air freight rate changes to the same months last year and to 2019 levels.

While talking about the top volume corridors from Asia to the US and Europe, as well as Europe to the US, Wenwen Zhang, Air Freight Analyst at Xeneta, compared the November air freight rate changes to the same months last year and to 2019 levels.

Across all these three corridors, the air freight rate is declining. From East Asia to US West, the trade rate are down by 32%, which can be attributed to the easing market demands.

For East Asia to North Europe, we can see that decline was half of the decline to the US. Xeneta experts suggest this is the continued spillover effect of the Russia-Ukraine war, which is still elevating the air freight prices on this corridor.

However, Europe to US trade has benefited from the largely recovered capacity. The air freight rate compared to the same time last year has declined by 37%, the largest among these three corridors, but still higher than the pre-pandemic level.

She also pointed out that the air freight to ocean ratio had hit the lowest for North Europe to the US market, which we haven't witnessed since the pandemic.

Three phases of the air cargo market in 2022

On a global level, the 2022 air freight market can be divided into three different phases from the same time last year. From the peak last year up until February 2022, the market saw an increased air cargo volume. But there was a steep decline in the air cargo volume from March to August, which started to stabilize as we slipped into September.  Even though capacity rose continuously year-on-year until November, it was 5% below the pre-pandemic 2019. With the decrease in volume and increase in capacity, the load factor has declined throughout the past 12 months.

Even though capacity rose continuously year-on-year until November, it was 5% below the pre-pandemic 2019. With the decrease in volume and increase in capacity, the load factor has declined throughout the past 12 months.

The load factor was 61% in November 2022, which is at par with the October level but has been below the 2019 level since April 2022.

Air freight market movements on three top-volume corridors

What to expect in 2023?

Niall van de Wouw, Chief Air Freight Officer at Xeneta, asked to keep an eye out for a few key market trends that will most likely impact air freight rates in 2023.

With reduced consumer spending, we are bound to see dampened air freight growth because of two main factors.

With the increased cost of living, there will be tighter consumer budgets. Also, with more and more services being available now, people will prefer to spend more on services now than they did on goods during the pandemic when most services were unavailable.

Two changing tactics on the ocean freight market side will also have a larger impact on air freight. First is the 'just in case' vs. 'just in time' tactic, which will not make shippers' supply chain leaner but will account for global situations.

Another factor is increasing reliability on the ocean side. During the pandemic, customers were shipping more by air than the ocean due to the unreliability of the ocean carriers and increased blanked sailings. However, that is improving now, which would dampen the need for air freight.

From the demand side, we will likely see less need for general air freight in 2023 than in 2022. Niall added that it is important to monitor ocean freight closely for unknown events, which might boost air freight demand. But overall, he expects muted growth in 2023.

There is still a lot of uncertainty in the market. But if we would look at demand and supply, we will see continued downward pressure on air freight rates in 2023, as we have seen at the end of 2022.

Want to learn more?

Watch the latest 'State of the Market' webinar on-demand and learn how you can take a competitive stance in this weaker market using reliable market insight.

%201.png)