We're here once again presenting the most recent release of the Xeneta and Marine Benchmark Carbon Emission Index (CEI). Our focus is directed towards the trans-Atlantic Fronthaul trade route, spanning from Northern Europe to the Eastern Coast of the United States. Evergreen was the top performer in Q2, scoring 53.8 points 36.5 index points lower than the average trade lane average.

Q2'23 CEI Carrier Ranking

North Europe - US East Coast

|

RANKING |

CARRIER |

CEI SCORE |

| 1 | Evergreen | 53.8 |

| 2 | COSCO | 73.7 |

| 3 | OOCL | 79.0 |

| 8 | MSC | 115.9 |

In the second quarter of 2023, Evergreen emerged as the top performer in the CEI, benefiting from several key factors. Primarily noteworthy was the remarkable size of their fleet, boasting an average capacity exceeding 13,700 TEU per vessel, a substantial 6,000 TEU higher than the average for the trade route.

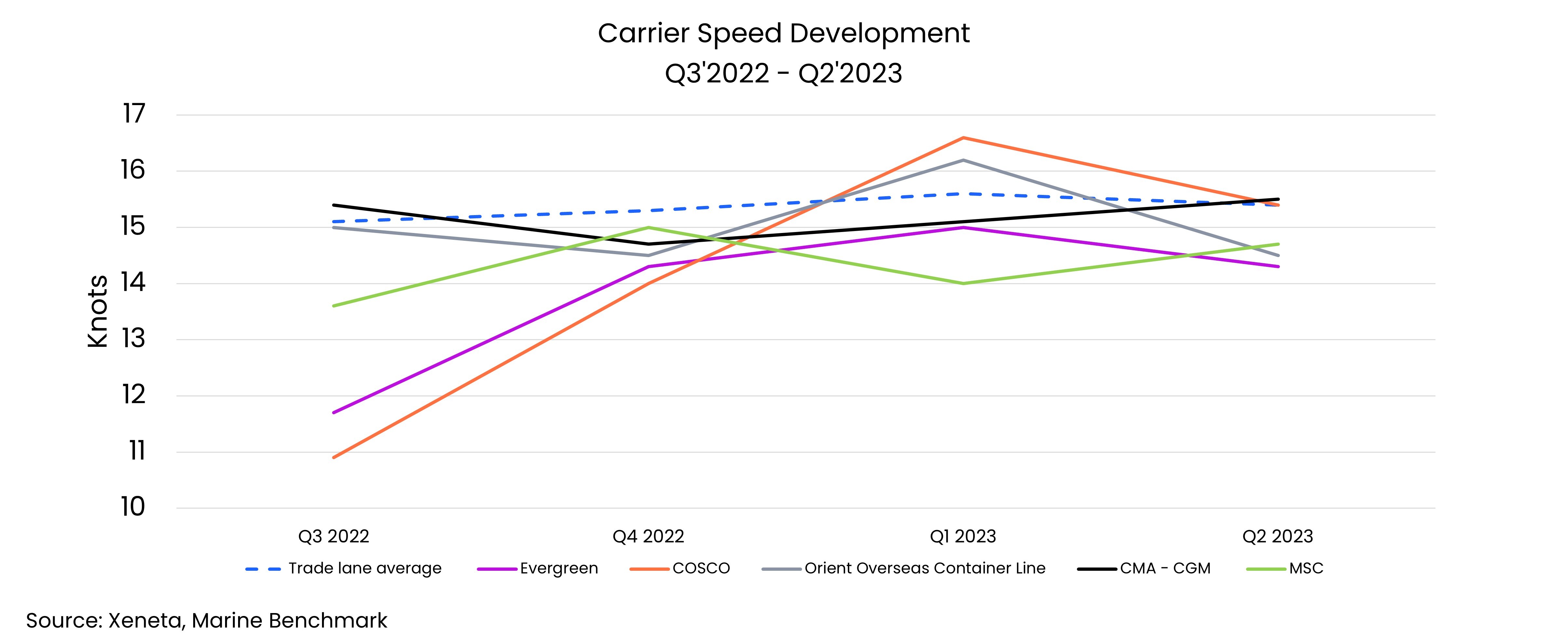

In addition to their considerable size, Evergreen's vessels maintained a lower operating speed compared to other shipping companies. With a speed of 14.3 knots, Evergreen's ships sailed 1.1 knots below the average speed for the trade route. The fleet operated by this carrier also achieved a strong CEI score, attributed to its relatively young average vessel age of 6.2 years.

During the second quarter of 2023, the trade route from North Europe to the US East Coast achieved an average rating of 90.3, marking an improvement of 9.4 points compared to the previous quarter's score of 99.7.

To further understand the trade lane's performance, we assessed the individual scores of other carriers. The OCEAN ALLIANCE carriers, composed of CMA-CGM, COSCO, OOCL, and Evergreen had the Top-4 CEI scores of the past quarter. COSCO and OOCL secured the 2nd and 3rd spots on the CEI-podium, with scores of 73.7 and 79.0 respectively. Both carriers improved their CEI grade significantly from Q1’2023 to Q2’2023, positively impacting the overall trade lane average. These carriers also enhanced their performance by reducing speed, sailing below the 15.5 knots trade lane average.

It's worth highlighting that during the second quarter, among all carriers, only OOCL managed to achieve a utilization rate surpassing 85%. In contrast, the remaining carriers registered figures below 80%. This decline in utilization rates is strongly correlated with the trade lane's low demand and surplus capacity, which has led to reduced freight rates.

During the second quarter, there was a positive shift in the reduction of speed exhibited by the carriers operating within the North Europe to US East Coast trade route. Although the performance during the final two quarters of the preceding year (2022) displayed a substantial acceleration in speed, the most recent quarter has demonstrated a progression in the desired direction, characterized by reduced speed from Evergreen, COSCO and OOCL.

As the industry consistently strives to meet sustainability objectives, it is anticipated that carriers will progressively emphasize carbon footprint reduction through various methods beyond just adjusting speed. Keep on the lookout for improving trade lanes as they lead the global green agenda in the industry.

Get an honest view of carrier emissions

Stay one step ahead of your competitors by making well-informed and sustainable choices when selecting shipping carriers. Xeneta and Marine Benchmark offer an independent and trustworthy Carbon Emissions Index (CEI) data, ensuring accuracy without any guesswork. By utilizing AIS tracking of real-time sailings on 48 major trade routes worldwide, with coverage expanding further in the near future, you can rely on up-to-date information. Don't settle for outdated and unreliable data. Schedule a demo of the CEI today and begin making intelligent shipping decisions.

.png)