A week has passed since TPM. It was one of the largest TPM conferences to date, which gave us the opportunity to meet many industry friendlies, but most importantly our customers. With the market slapping us with continuous decline, shippers were for sure steering that show.

Just before TPM, our CEO and Co-Founder Patrik Berglund and Michael Braun, VP, Customer Success & Solutions sat down to discuss the container shipping market conditions with the Xeneta customer community in the February Ocean Freight Market Pulse webinar. The big focus was on long-term contracts and index-linked contracts. The buzz at TPM echoed the same. Let's dive in.

Key Webinar Takeaways

- The majority of large-volume shippers are opting for predictability in the softened market and are back to annual contracts

- Index-linked contracting is remaining increasingly popular with Shippers/BCO’s to optimize profit and guarantee minimal risk

- The market has returned to 2018/2019 levels, keeping the supply and demand game consistent with pre-COVID conditions and putting a spotlight on capacity

- Two large Asia outbound trades have bottomed out – with no price war, it seems carriers have found a balance between blanking sailings/pulling capacity and spot-market rates

- Current market conditions (chartering rates, increasing energy costs and shippers decrease in volumes) have put carrier’s margins under substantial pressure

Patrik and Michael discussed the shifting market, declining consumer demand and its clear impact on freight rates – putting carriers' under pressure and forcing them to react to an increased number in blanked sailings. But while the market continues to move largely in one downward direction, are shippers overlooking an opportunity? With the trans-Atlantic trade still elevated and trending slower behind the rest, speakers asked customers to take a closer look at the trade.

While long-term contracts are ruling the market and remain crucial for some lanes (i.e China – NEU) perhaps for the trans-Atlantic outlier which hasn’t yet bottomed out, procuring on the spot-market is still advantageous. Peter Sand, Chief Analyst at Xeneta, also spoke about this trade on the TPM panel: Trans-Atlantic Deep Dive. He coined it "the last fortress to fall".

With risk mitigation top of mind for most shippers, the webinar welcomed back special guest and Xeneta resident indexing specialist, Stanley Aizenstark to discuss the importance of indexing in this buyer’s market. Interest from customers and the industry in using index-linked contracts is peaking. Xeneta indexing is unique to others as it hedges on the data provided by the Xeneta customer community, helping shippers avoid basis risk.

Xeneta Customers Say

Xeneta customers are taking a different approach to today’s buyer’s market. When asked about the duration of their contract negotiations for 2023, customers revealed:

- 52% are negotiating for one year, as usual

- 19% are negotiating for one year but with index-based adjustments

- 13% are negotiating for 3-6 months

- 10% are continuing to use only the spot-market

Most customers negotiating their RFQ cycle on an annual basis are doing so likely in the interest of predictability in the softened market. The strategy of longer duration contract negotiations is consistent with the pre-pandemic market levels and communicates a less opportunistic attitude from shippers. The spot market share has been considerably higher in cost early in the tender season, so speakers anticipated that those numbers will decline even further.

Most customers negotiating their RFQ cycle on an annual basis are doing so likely in the interest of predictability in the softened market. The strategy of longer duration contract negotiations is consistent with the pre-pandemic market levels and communicates a less opportunistic attitude from shippers. The spot market share has been considerably higher in cost early in the tender season, so speakers anticipated that those numbers will decline even further.

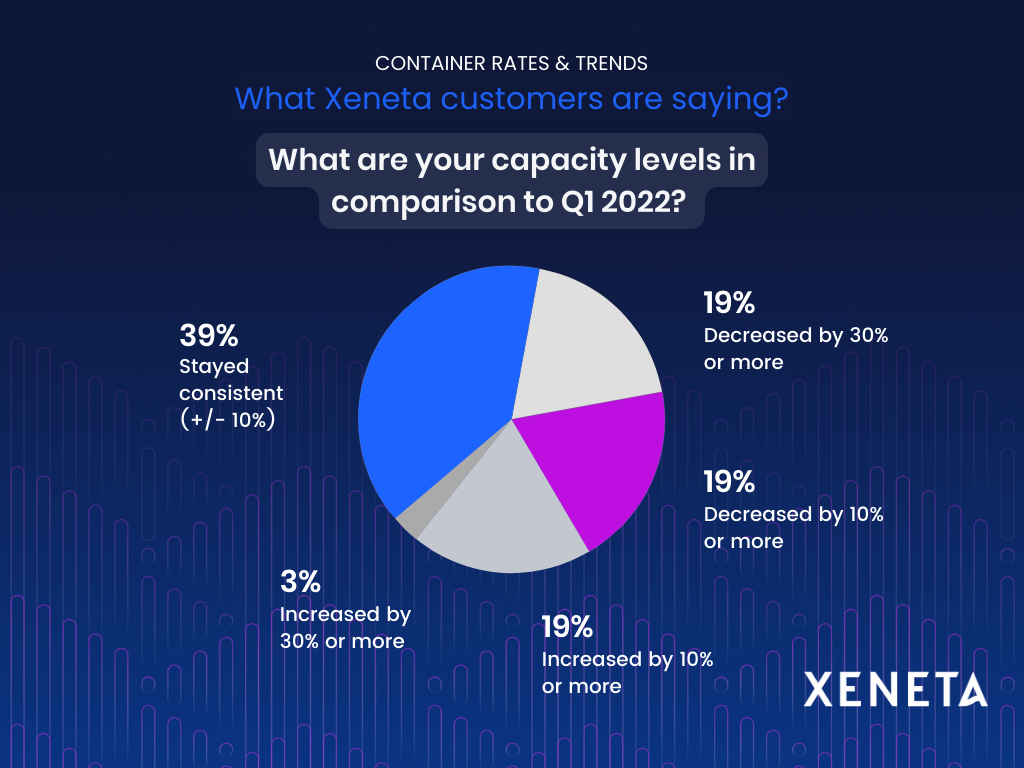

To draw a correlation between decreased capacity and rates, when Xeneta Customers were asked to forecast their volumes for Q1 2023 in comparison to those of 2022:

- 39% stayed consistent (-/+ 10%)

- 19% decreased by 30% or more

- 19% decreased by 10% or more

- 19% increased by 10% or more

- 3% increased by 30% or more

Most shippers and freight forwarders are seeing capacity having varied by only 10%, while 38% of customers expect a decrease in 10% or more in their capacity. With this consensus from large-volume shippers, the outlook painted for carriers remains quite grim. The customer consensus of decreased capacity was reflected directly when evaluating China Main – North Europe Main and North Europe Main – US East Coast Main.

The Xeneta Shipping Index (XSI®) includes 30 high-quality global trade lanes ready to be indexed against, only 1 month lag (as opposed to 6+ months for some comparable legacy indices) for updates with over 36 months of consistent deep, daily data which can be customizable from region to region. For dynamic coverage, the XSI® publishes daily.

Want to learn more?

Xeneta customers get access to exclusive monthly market commentary during the Ocean Freight Market Pulse Webinars. Learn more about the Xeneta platform and how to become a customer now.

Existing customers looking to learn more about the advantages of index-linked contracting and how the Xeneta Shipping Index (XSI®) can support, should reach out to your Customer Success Manager directly.

Not yet a customer and want to learn more about the Xeneta Shipping Index (XSI®) and index-linked contracting?

Contact Us.

.png)