The Ocean Freight Market Pulse is a monthly customer-exclusive webinar series that draws upon Xeneta's ocean freight data to help you plan your next procurement and supply chain move. Every month, our Xeneta industry experts host this customer webinar, where they uncover the stories behind industry headlines. Together with our customers, they discuss the most pressing conundrums and notable market movements.

In the March 2022 edition, we discussed the impact of the ongoing global disruptions on the current state of the market to set reasonable tender targets this season.

Here are a few key insights from our latest 'Ocean Freight Market Pulse' webinar.

The lockdowns, extreme congestion, and sanctions contribute to a disastrous start to the second quarter in ocean shipping.

Earlier this year, we said if the situation remained unchanged - no new bottleneck would turn up in the global supply chain and the situation might calm down. But as we face extraordinary events including oil price hikes and shutdowns in China - these will cause a lot of trouble for the suppliers.

During this recent customer exclusive webinar, 75% of customers said the recent sanctions in Russia have impacted their supply chains. The extended lockdown in Shanghai has also left ports severely disrupted due to strengthened restrictions.

A massive capacity shift to US East Coast has caused major congestion in this area – which is only getting worse with carriers continuing to add vessels and services.

Xeneta experts believe the capacity demands are not expected to ease until 2023. There might even be lower delivered capacity in 2022 Q2/Q3 than we saw in Q1 (which was already low at 200k TEU).

With a decline in priority shipment fees this quarter, we have witnessed a drop in the pure rate and guaranteed shipment fees.

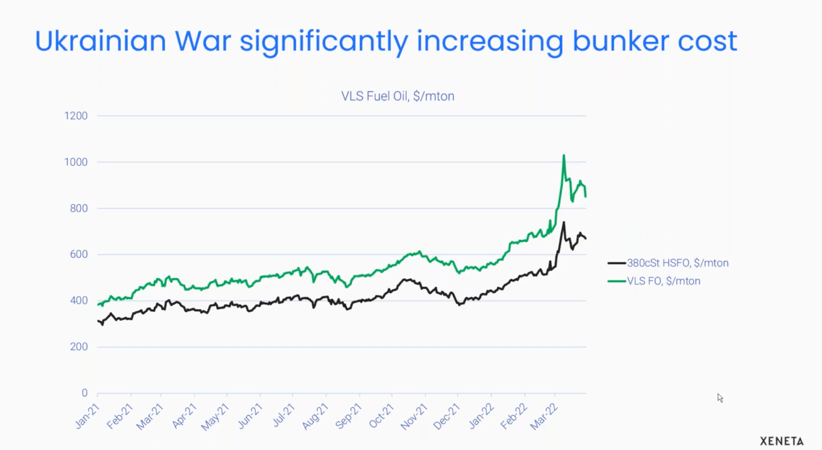

However, there has been constant uptake of quarterly bunker levels.

The last time the cost was approx. $750 - 800 per ton on the IFO bunker was around a time when the freight rates were extremely low - which means each and every increase in the bunker costs had an immediate impact on the P and L of the carriers.

Currently, it is an entirely different scenario. The carriers are earning a fortune even with a higher cost element. They don't need to fight to survive as they have enough profits.

The long-term market rates for main-haul trades – are at record high levels, with a massive gap between the cheapest and highest rates.

But for most outbound Asian trades, we have seen a consolidation of the spot rate levels throughout the last three months, with the prior peaks almost getting over. Currently, we see a downward trend, especially for Europe, Mediterranean and South America markets.

When asked about the possibility of better market conditions, 50% of customers attending the latest Ocean Freight Market Pulse webinar anticipate that the market will not soften until 2023 – while 30% believe it will soften until 2024 and 10% expect it might take even longer.

With COVID-19, US congestion and geopolitical instability continuing to produce more market disruptions and re-shaping popular routes - shippers will need to be flexible with their allocation and networks.

Want to learn more?

Discover our webinars for detailed insights helping you to understand how these global events will impact your tender and procurement strategies.