In a previous blog post, we highlighted the time and cost it takes to manage freight tendering/bidding process. Industry research suggests the effort and the expense for suppliers to answer a tender or bid are estimated at upwards of $15,000 per tender. Because freight contract negotiations can be costly both in terms of time and management, we asked our social media friends how they manage their freight negotiation process.

It has been reported that suppliers are responding to fewer tenders. In fact, based on our experience, carriers respond to as few as 20% of the tenders they are invited to participate. However, as we noted in a recent podcast, the ocean freight market may be heading to longer contracts. Regardless, the need to stay abreast of industry trends is very important in order to decide the best bid.

Related: How To Excel In Your Freight Rate Negotiation

Survey Says ...

Because freight tenders can be costly both in terms of time and management, we asked our social media community how they manage their freight negotiations and here is their response. Over half the responses, 57% indicated they use online platforms to manage freight negotiations while 29% use Excel and 14% use something else.

The complexity involved in managing tenders bodes well for the use of online platforms. According to Chas Deller, of 10XOcean, “the procurement process to purchase transportation services for large global BCOs is time consuming, labor intensive, complex and typically global, fraught with ‘big data’, multiple currencies and changing market landscapes….Decisions are typically conservative yet optimized. Incumbents stand a good chance to retain business.”

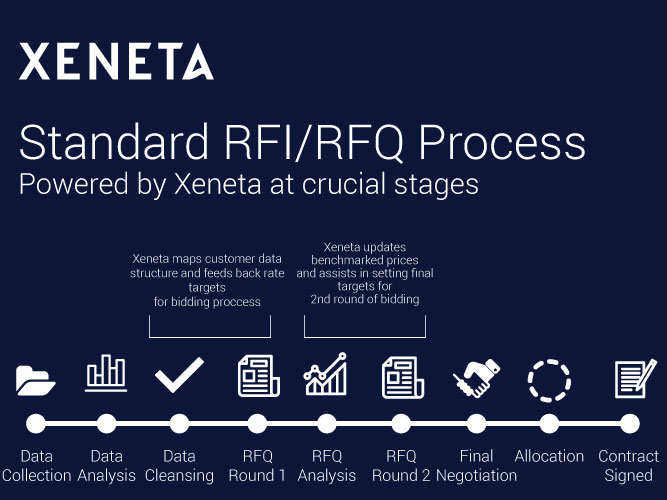

Global Tender Complex Process

Ocean freight negotiations is a cumbersome process, which can take large shippers/BCO's anywhere from 60-90 days from start to finish. While many companies are starting to use online platforms for different stages of the process, as we found out in the survey above, there are still quite many companies working everything in Excel. Talk about tedious and even more time consuming.

Collecting internal rates and cleansing that information to get it ready for the RFQ is nothing short of chaotic. Especially, when there are in many cases, little to no rate structures and information is disparate. I pity the logistics and supply chain professionals during this process. After that data is collected, there has to be an efficient way to compare that data to the current market prices. How else does the company know how the prices they have received from their supplier stacks up against the market? Benchmarking ocean freight prices is the key.

[CLICK TO ENLARGE]

3 Questions to Ask Yourself During Your Freight Negotiations

We put together a simple post with the top 3 questions you need to ask yourself if you are a logistics, procurement and/or supply chain expert responsible or influencing ocean freight rate negotiations. We also added some supporting information to help you through the process. Read 3 Questions to Ask Yourself During Ocean Freight Negotiations.

.png)

-1.jpg)